Whether you need money to buy a home or cover an unexpected medical bill, there are financing options available for single moms, even if your credit is less than stellar.

The catch is deciding whether that is a wise move. In other words, just because you can get a loan, doesn’t necessarily mean you should.

“To put it mildly, the world of loans and financial aid for single mothers can feel like a labyrinth,” says Top Mobile Banks CEO and investment analyst Tim Doman. “But with the right guidance and determination, it’s a maze you can navigate.”

It’s critical to understand exactly what you are taking on — the interest rate, whether the APR is fixed or variable, and whether or not you are actually paying down the principal each month according to the repayment terms.

Bill Ryze, a certified chartered financial consultant warns to note the interest rate on any loan offer. Ryze says you should only get a loan if you are in a financial position to repay it. He says you’re more likely to secure a low interest rate if you have a good credit score — 670 or above. “It is not advisable to get a loan if you have an unstable income, don’t have a solid repayment plan for the loan, or if you already have outstanding loans that you cannot keep up with,” Ryze says.

Learn more about how to improve your credit score.

Here is the run-down on loans for those with low or moderate credit and income.

- FHA loans

- HomeReady Mortgage from Fannie Mae

- FDIC Loans via Operation HOPE Home Buyers Program

- Home Possible Loan from Freddie Mac

- How hard is it for a single mom to buy a house?

- Lending Club

- SoFi

- Universal Credit

- Upgrade

- Upstart

- What disqualifies you from getting a personal loan?

Home loans for single moms

If you want to buy a home, there are home loans for single moms that can help you make that dream a reality. You may also be interested in grants for first-time home buyers, or help with home repairs.

Check the latest mortgage rates.

Some home loans for those with low or moderate incomes:

FHA loans

Federal Housing Administration (FHA) loans offer reduced closing costs and down payment requirements. These fixed-rate loans are available in 15- and 30-year terms.

Details:

- Credit score of 500 to 579 – 10% minimum down payment

- Credit score of 580 or more – 3.5% minimum down payment

- Mortgage insurance required (for life of the loan if you put down less than 10%)

- Property must meet FHA eligibility requirements (maximum purchase price varies from $472,030 to $1,089,300 depending on where you live1)

HomeReady Mortgage from Fannie Mae

The HomeReady Mortgage is designed to help lenders serve credit-worthy borrowers who have a lower income. You must take the Fannie Mae HomeView online course or an approved alternative HUD-approved course to be eligible.

Details:

- Income must be 80% of the area median income2

- No geographic restrictions

- Credit score of 620 or more – 3% minimum down payment

- Funding from relatives, grants, and Fannie Mae Community Seconds is allowed

FDIC Loans via Operation HOPE Home Buyers Program

Operation HOPE Home Buyers Program helps low-income home buyers through FDIC-approved loans, down payment assistance, and first-time buying assistance.

Details:

- Group training and one-on-one coaching for first-time home buyers

- Provides HUD-certified coaches to guide you through the home loan process

Home Possible Loan from Freddie Mac

If you’re looking for low-income home loans for single mothers, a Freddie Mac Home Possible mortgage could be right for you.

Details:

- Your income cannot exceed 80% of the area median income

- As little as 3% down

- No geographic limits on loan amounts

- Can apply with bad credit due to lack of credit history

- Mortgage insurance is required on one-unit properties, but once your loan balance is less than 80% of its value, it is no longer required

How hard is it for a single mom to buy a house?

Because you’re applying for a loan based off of a single income, it can be more difficult to buy a home as a single mom.

However, Doman says home-buyer assistance programs make it easier for single moms to buy a home.

“My sister, for example, got her first home with a USDA loan, which offered her more accessible terms,” he says.

State and local organizations offer a range of assistance options, including home buyer grants. Doman says there are also housing counselors available to help people navigate the process of buying a home.

Car loans

Car loans are available through banks, credit unions, online lenders, and directly through car dealerships. These loans use the vehicle you’re purchasing as collateral, which means if you don’t pay, the lender will repossess your car.

If you need a car loan but have very low — or no — credit, a repossession or bankruptcy, check out Auto Credit Express. A+ Better Business Bureau rating, 30-second pre-approval and cash within 24 hours.

How to get a car loan

Ryze offers this advice to obtain a car loan:

- Access your credit report: Your credit score will have a significant impact on how much interest you pay on your loan (and whether you’ll be approved for a loan at all). If your score is below 660, Ryze says you might want to hold off on getting a car loan and focus on repairing your credit score to secure the best loan rates.

- Identify how much you need: Before applying for a car loan, determine the type of car you would like to buy, how much of a down payment you can afford, and what number of monthly payments work for you. While a longer loan term means smaller payments, you’ll pay more in interest over time.

- Find lenders: Try finding car loan providers — e.g., banks, credit unions, and other institutions — and apply for pre-approvals. Compare pre-approvals before accepting an offer.

- Get your car: After accepting the loan offer, go to the dealership, negotiate your payment, and sign the paperwork once you settle on the price. Your lender will reach out to you with details about your car loan (the amount and mode of payment).

“I recommend automating your payments to stay on top of your debt and enjoy a discount on the interest rate (depending on the lender),” Ryze says.

Auto Credit Express specializes in car loans for those with low or no credit:

- Better Business Bureau rating of A+

- In business since 1999

- For new or used cars

- Auto loans and refi for buyers who have low or no credit, or who have gone through bankruptcy or had a vehicle repossessed

- Pre-approval within 30 seconds

24 hours to a car loan with Auto Loan Express >>

Buy-here, pay-here dealerships

Buy-here, pay-here dealerships are special car dealerships for borrowers who either have bad credit or do not meet traditional lender requirements. These dealerships offer in-house financing, so you will not undergo the same level of scrutiny, though you may have to show proof of income and employment.

Ryze says you typically only need to fill out the required paperwork and demonstrate you can afford the monthly payments toward the loan. Due to the higher lending risk, these dealers often charge higher interest rates.

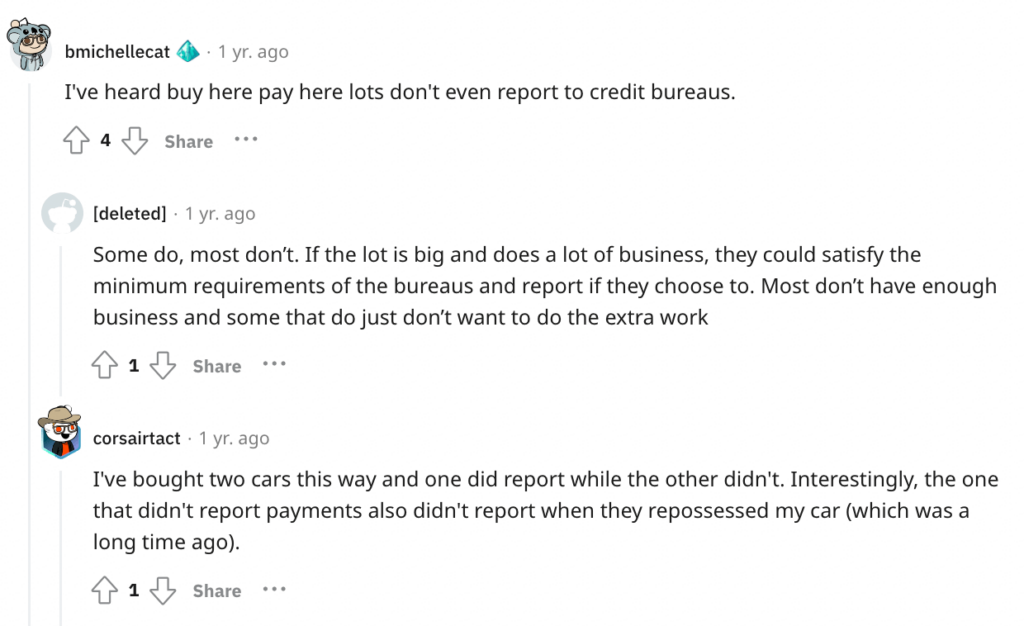

While these types of loans can help people with low credit scores obtain a car loan, Ryze says they do not help build your credit score because most dealerships will not report your payments to a credit bureau.

However, if you do miss a payment, Ryze says some might report it, damaging your credit score even further. Before you buy a car, find out the dealership’s policy on reporting payments.

If you need to work on building your credit before purchasing a car, Ryze says there are steps you can take:

- Watch your credit report and make sure to dispute any errors.

- Try to lower your credit card balances and avoid carrying a month-to-month balance.

- Avoid applying for new credit cards.

- Pay your bills on time so you don’t incur late fees or extra charges.

If you really need help you can seek out sources for a free car, free car repair or free rides.

Personal loans for single mothers

You can get a personal loan to cover any type of expense from an online lender, bank, or credit union:

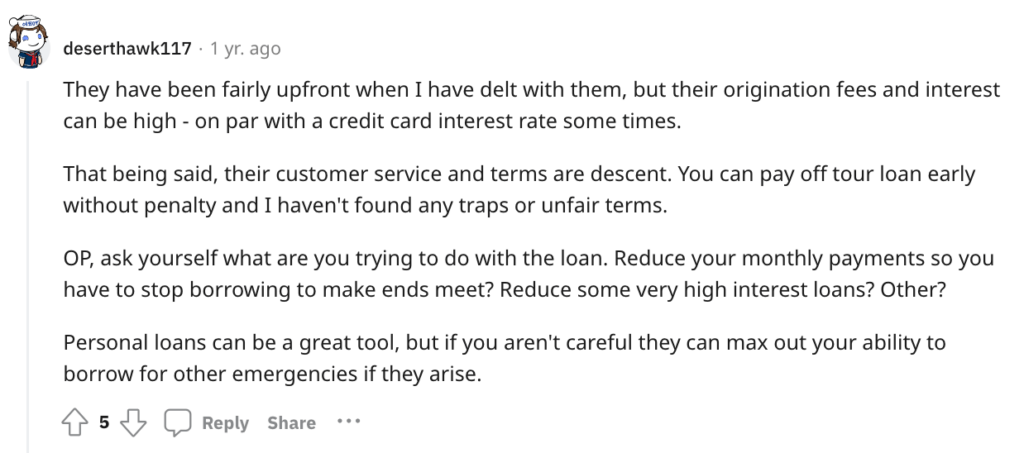

Lending Club

Lending Club offers a quick and easy process to apply online for a personal loan. Money is deposited directly into your bank account or directly to your creditors to pay off debt.

Better Business Bureau rating: A (accredited since 2008)

Loan amounts: $1,000 to $40,000

Interest rates: 9.57% to 35.99% APR

Loan terms: 3 or 5 years

Origination fee: 3% to 6% of loan amount

Minimum credit score: 600

Requirements:

- Maximum debt-to-income ratio of 60% for individual application (40% for joint)

- Minimum 37 months credit history and two accounts

- No minimum income, but must show proof of income

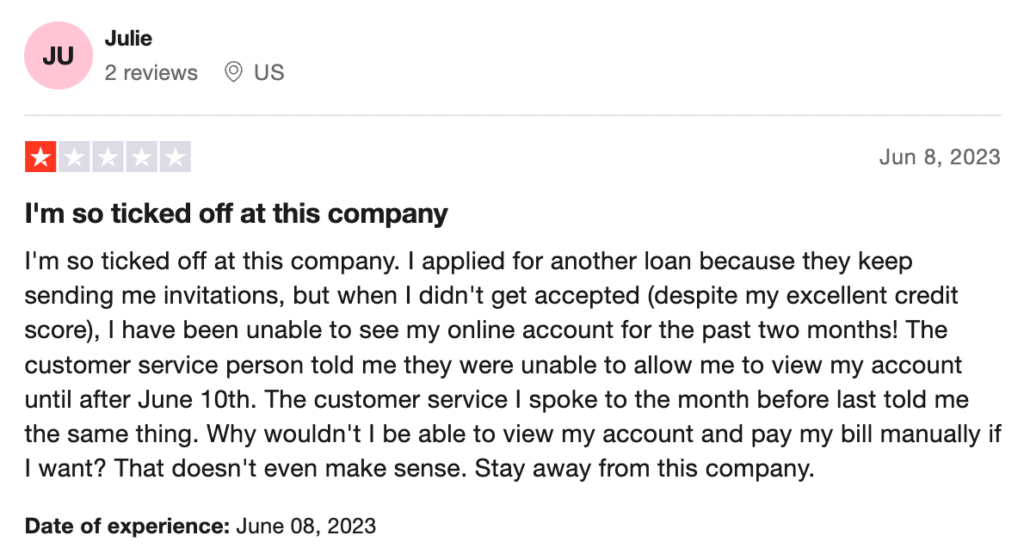

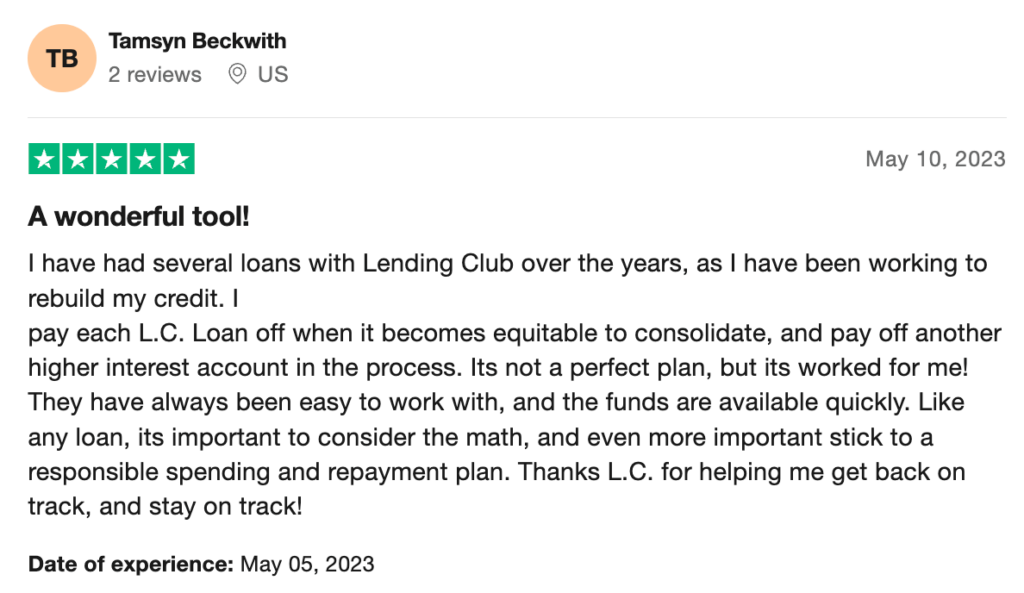

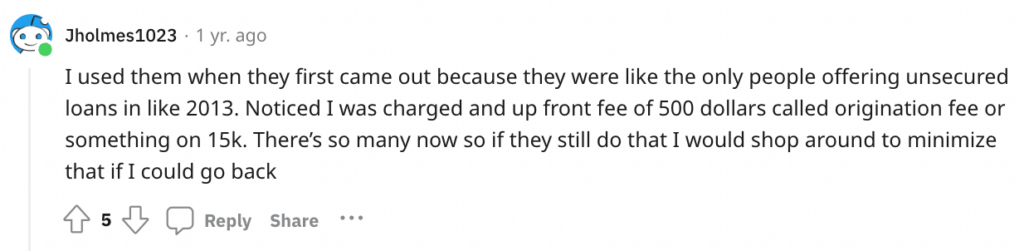

Lending Club reviews:

Trustpilot (4.7/5 stars):

Reddit:

BBB (4.57/5 stars):

SoFi

SoFi offers a hardship loan for people experiencing unexpected financial challenges like unemployment, unexpected medical bills, or caregiver expenses. They also offer a 0.25% interest rate reduction on personal loans for people who set up autopay. SoFi has a mobile app for iOS and Android devices.

Better Business Bureau rating: A+ (not accredited)

Loan amounts: $5,000 to $100,000

Interest rates: 8.99% to 25.81% APR

Loan terms: 2 to 7 years

Origination fee: 0% to 6%

Minimum credit score: 680

Requirements:

If unemployed, it’s necessary to meet one of the two following eligibility criteria:

- Have sufficient income from other sources (varies by the loan amount being sought)

- Have an offer of employment to start within the next 90 days

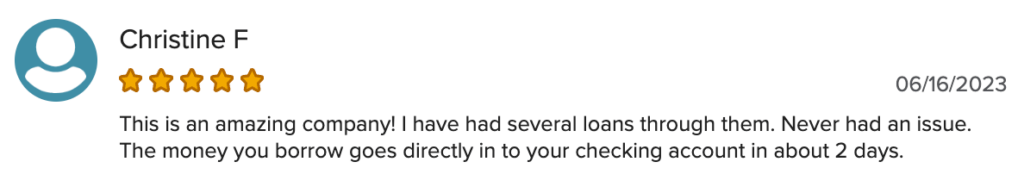

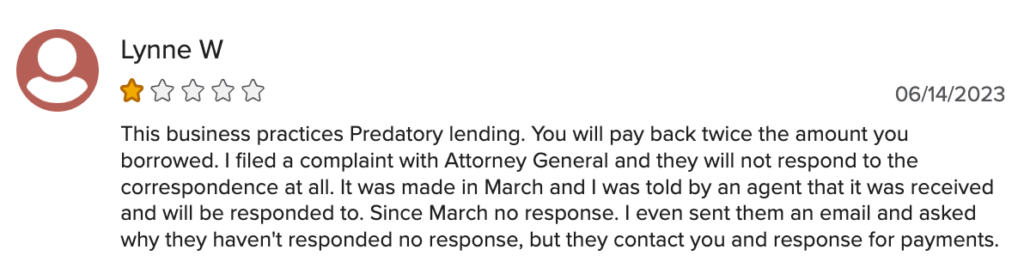

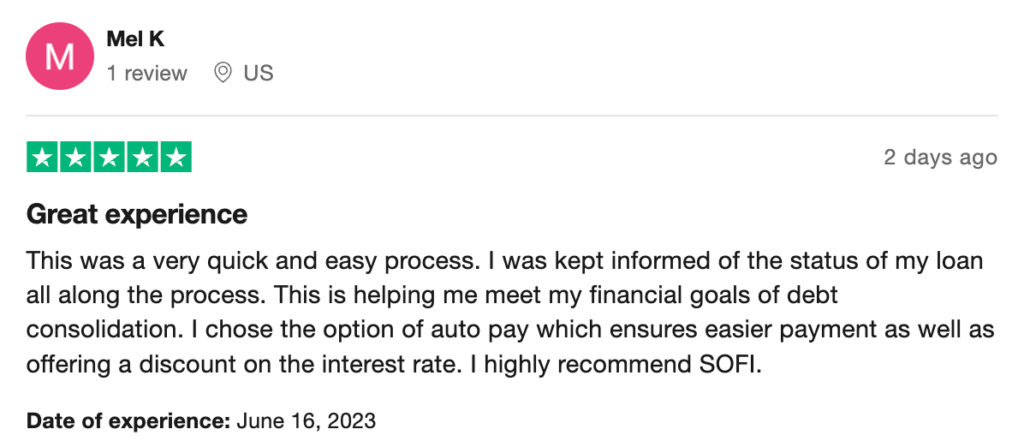

SoFi reviews:

Trustpilot (4.9/5 stars):

Reddit:

How does anyone borrow from SoFi?

byu/StrengthPuzzled9495 insofi

Universal Credit

Universal Credit allows you to answer a few quick questions to see your rate before taking out a personal loan (which won’t impact your credit score). If approved, you can get paid in as little as one day. Universal Credit also offers free credit score reports for borrowers.

BBB rating: A+ (accredited)

Loan amounts: $1,000 to $50,000

Interest rates: 11.69% to 35.99%

Loan terms: 3 to 5 years

Origination fee: 5.25% to 9.99%

Minimum credit score: 560

Requirements:

- Maximum debt-to-income ratio of 75%, including your mortgage and the loan you’re applying for

- No minimum income requirement

- 2-year minimum credit history

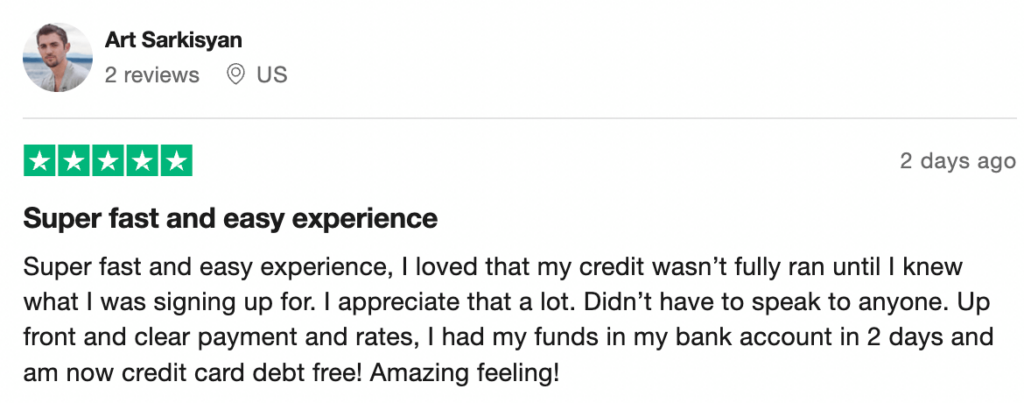

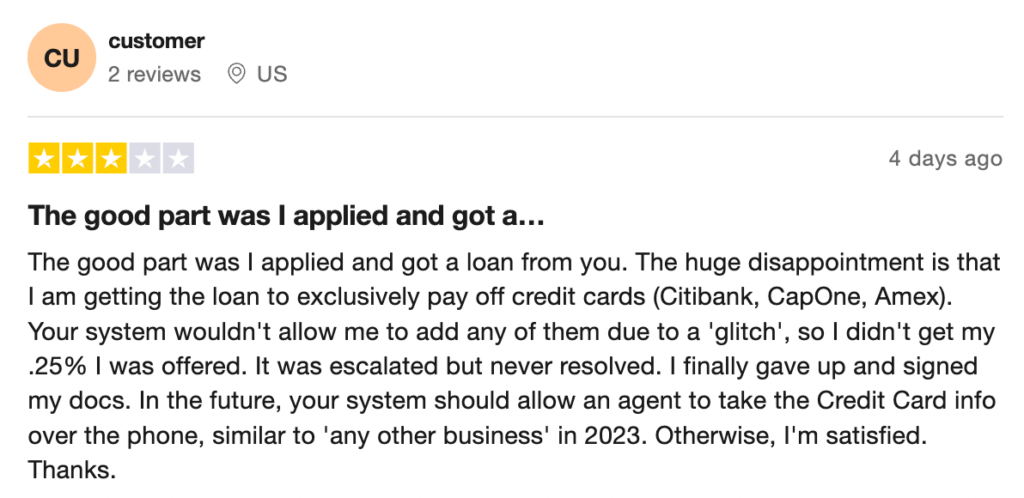

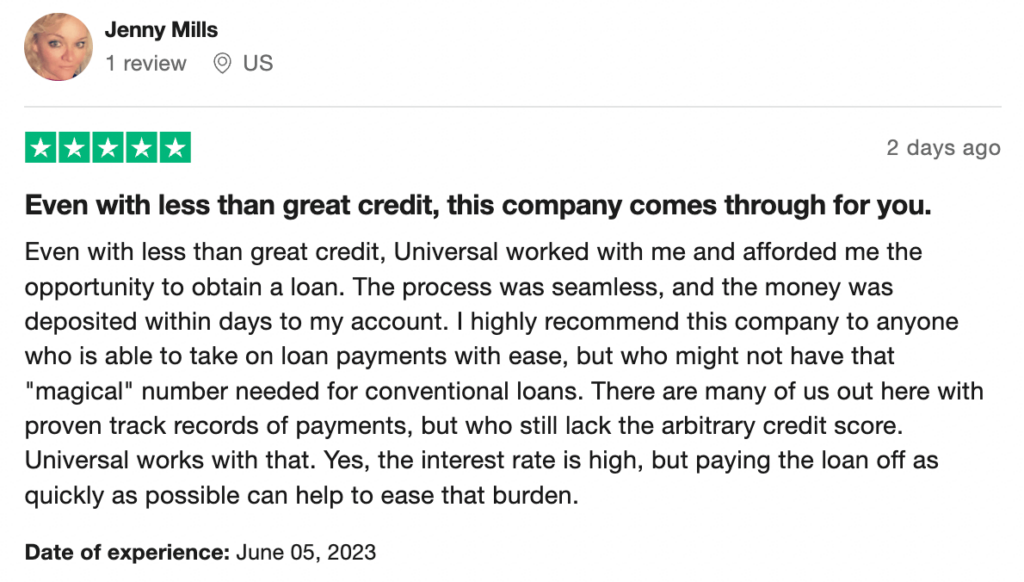

Universal Credit reviews:

Trustpilot (4.8/5 stars):

BBB (4.81/5 stars)

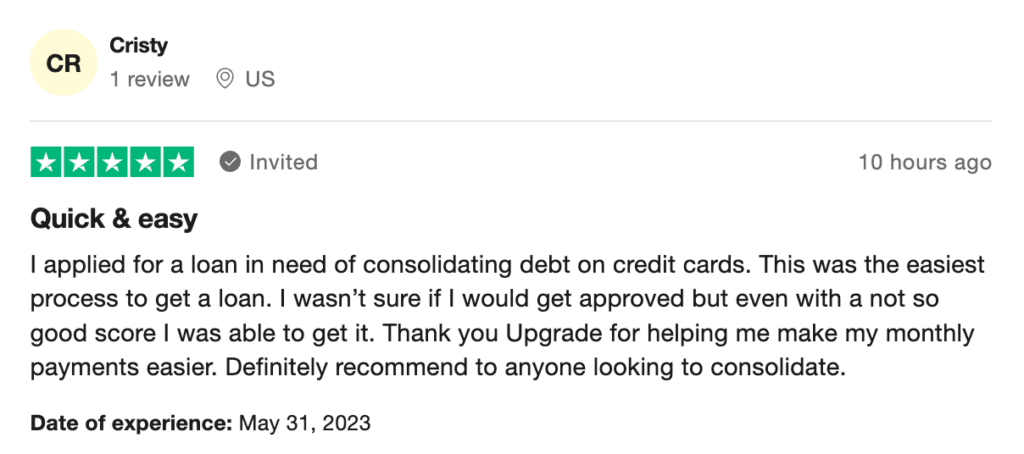

Upgrade

Upgrade offers both secured (meaning your debt is backed by collateral like your house or car) and joint loans (with a cosigner). Acceptable income can come from alimony, retirement, child support, and Social Security funds. Upgrade has a mobile app for iOS and Android devices.

BBB rating: A+ (accredited)

Loan amounts: $1,000 to $50,000

Interest rates: 8.49% to 35.99%

Loan terms: 2 to 7 years

Origination fee: 1.85% to 9.99%

Minimum credit score: 560

Requirements:

- Maximum debt-to-income ratio is 75% or less, including the loan

- 2-year minimum credit history

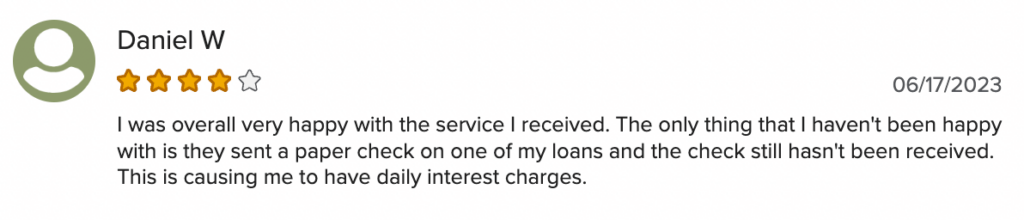

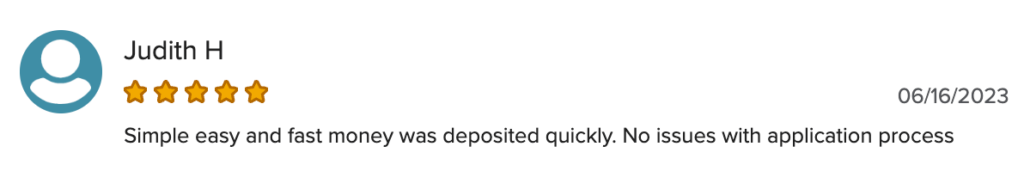

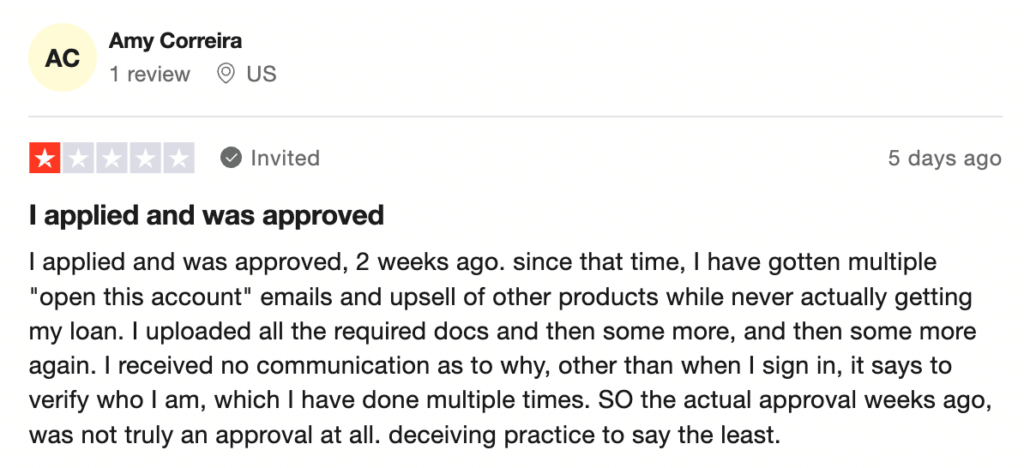

Upgrade reviews:

Trustpilot (4.5/5 stars):

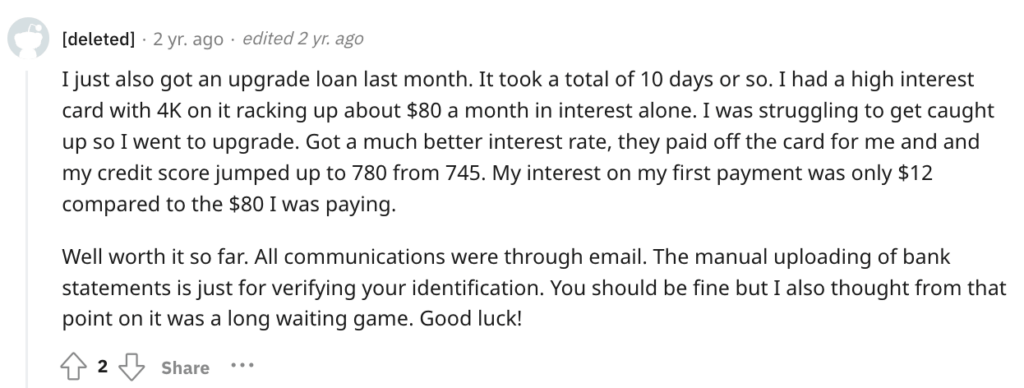

Reddit:

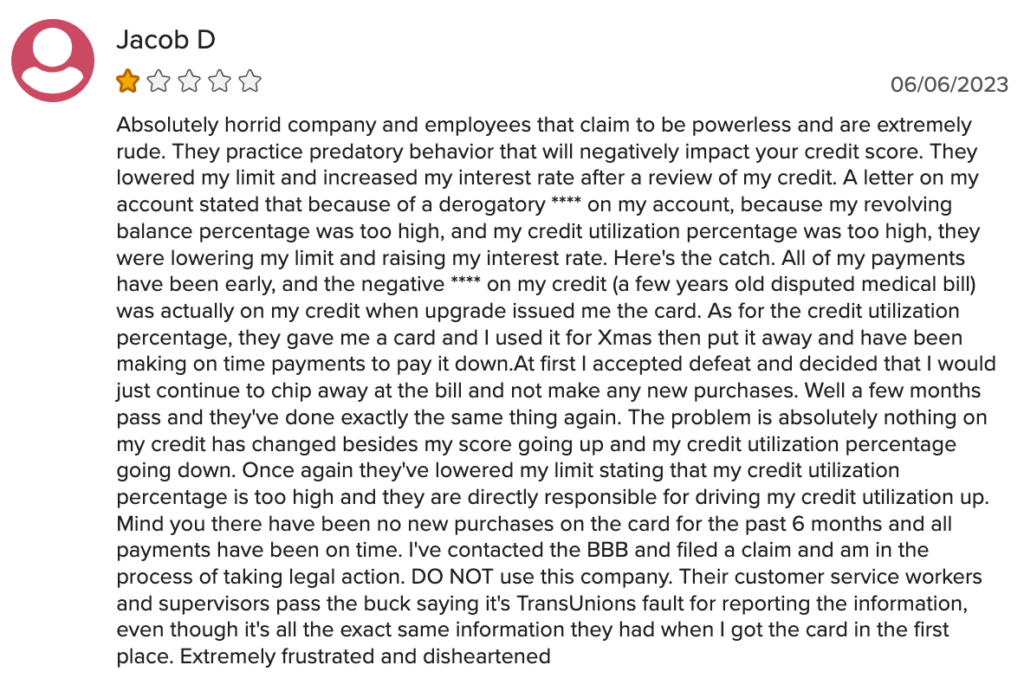

BBB (4.52/5 stars):

Upstart

Upstart offers loans to borrowers with a short credit history, including borrowers who have a combined income from employment, alimony, and child support. Cash payouts are available in as little as one business day. Upstart does not allow joint or co-signers and does not have a mobile app.

BBB rating: A+ (accredited)

Loan amounts: $1,000 to $50,000

Interest rates: 4.6% to 35.99% APR

Loan terms: 3 or 5 years

Origination fee: 0% to 6%

Minimum credit score: 300

Requirements:

- At least $12,000 annual income

- Must have a full-time job or be starting a full-time job within six months

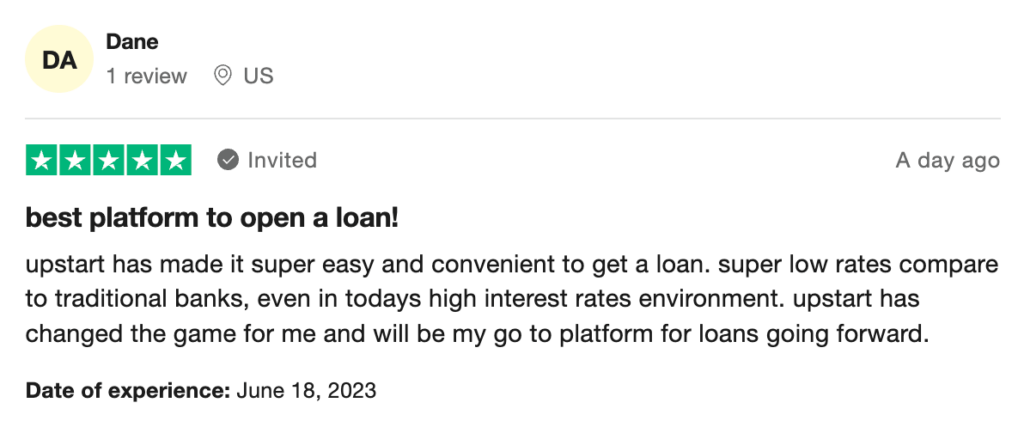

Upstart reviews:

Trustpilot (4.9/5 stars):

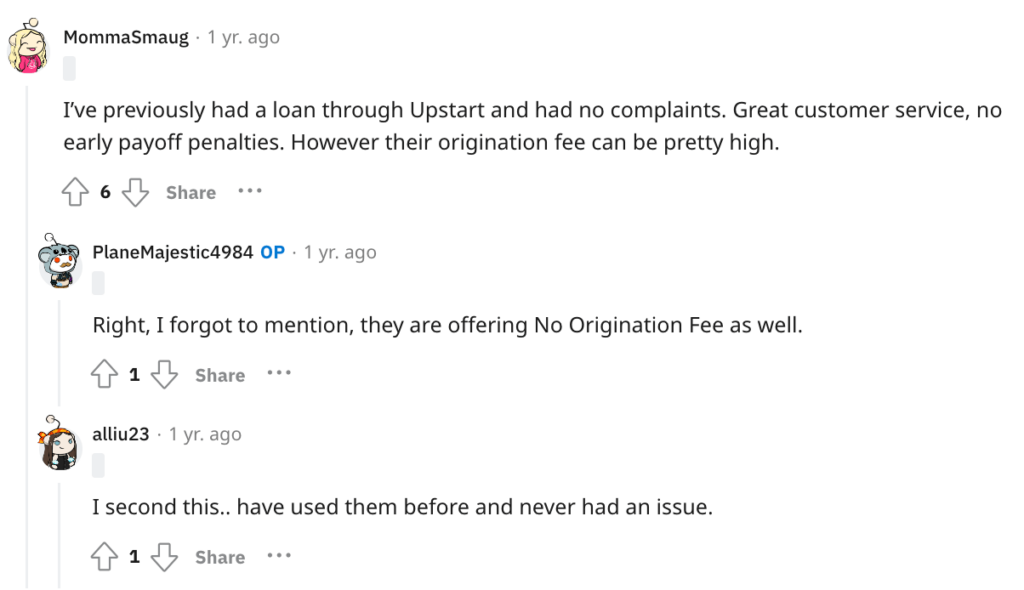

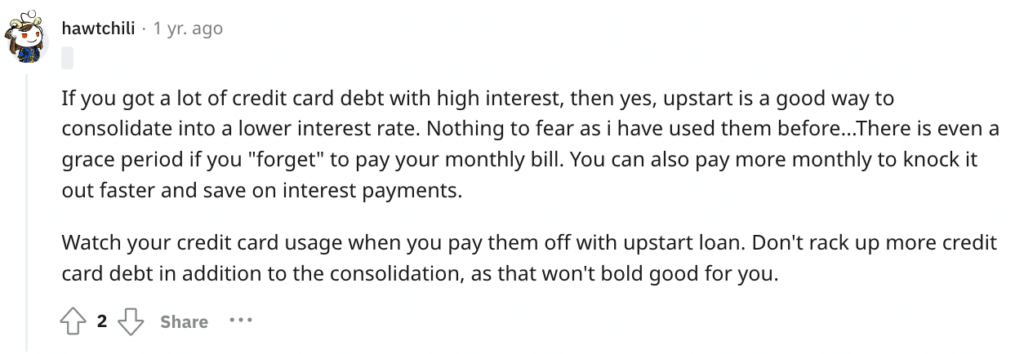

Reddit:

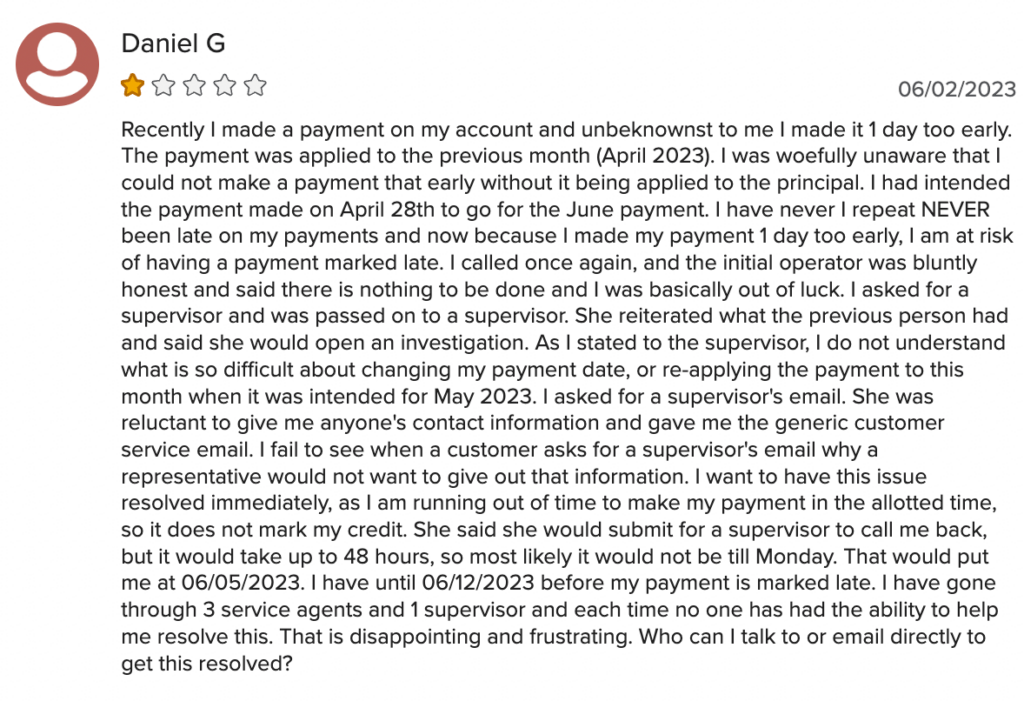

BBB (1.23/5 stars):

What disqualifies you from getting a personal loan?

Ryze, who is board advisor for loan marketplace Fiona Financial, says there are factors that may disqualify you from getting a personal loan:

- Low credit score

- High debt-to-income ratio

- Insufficient income

- Age or residency requirements of individual lender

“One common and often overlooked [issue] is providing inaccurate information or missing information when making your application,” Ryze says.

Emergency loans

Some loans can be paid out quickly to cover emergency expenses:

What are emergency loans used for?

Emergency loans can be used to cover a variety of expenses — car repairs, past-due rent, child care expenses, medical bills, etc.

These are some of the different types of emergency loans:

Payday Loans

- Short-term loan where you borrow money in advance of your next paycheck

- Based on how much you earn

- Not available in every state (16 states and Washington, D.C. don’t allow payday loans)

Cash Advances

- Cash advances from your credit card

- Doesn’t require a credit check

- Interest rates can be high

- How much you borrow is set by a percentage of your card’s limit or a maximum amount set by the credit card company

Title Loans

- Secured loan that uses your car title as collateral

- Car can be repossessed if you fail to pay back the loan at the end of the term

Home Equity Loan/Line of Credit

- Lump-sum funding and a set interest rate

- Repayment of up to 30 years in some cases

- Home equity line of credit means you can borrow for a number of years, with a repayment period of up to 20 years

- Uses your house as collateral, which means if you can’t pay it back, the bank will foreclose on your house

What credit score do you need for an emergency loan?

Ryze says you usually need a credit score of at least 580 to be eligible for an emergency loan, though some companies do not have minimum score requirements.

However, Ryze says that lower scores will result in a higher interest rate (in some cases, upwards of 35%).

Top Mobile Banks CEO and investment analyst Tim Doman says that typically, a score of around 600 and above increases your chances of getting an easy personal loan.

“Don’t lose heart if you’re below that,” says Doman, who notes that some lenders care more about a person’s income and ability to pay back the loan.

When it comes to personal loans, Doman recommends applying through a credit union or online lender.

“They usually have more flexible terms and might be willing to overlook a blemish or two on your credit report,” Doman says.

He recommends shopping around to compare rates and terms before applying for a loan.

“My sister, a single mother herself, has been through this journey, and I can tell you it’s an uphill climb but not an impossible one,” Doman says.

Student loans for single parents

Ryze says private student loans tend to have higher interest than federal student loans. Borrowers of private loans don’t enjoy the same protections as as borrowers with federal student loans, such as fixed interest rates, income-based repayments and low APRs, and may not be the best option for some.

“I would only recommend private student loans for anyone who is not eligible for federal student loans or someone who has exhausted their federal student loans but still needs funds to cover their education expenses,” he says.

Before you apply for student loans, first find out if you qualify for any grants or scholarships, including scholarships for single moms and scholarships for women. You can explore options through the federal government, state governments, specific colleges, and private organizations.

Federal student loans

To qualify for any federal student loans and grants, you have to fill out the Free Application for Federal Student Aid (FAFSA)3.

Your chosen college or university will use this application to determine eligibility for financial aid, which is based upon your expected family contribution, enrollment status (full or part time), and your school’s enrollment costs.

Loan amounts: There are several types of federal student loans, and they all have different loan limits and eligibility4:

| Loan type | Who is eligible | Details | Loan amounts |

| Direct subsidized | Undergraduate students | – Based on financial need – Calculated based on cost of attendance minus expected family contribution and other forms of financial aid – Lowest interest rate of the three – 6-month grace period after you leave school | $3,500 to $5,500 per year (increases for each year you’re in school) |

| Direct Unsubsidized Loan | Undergraduate and graduate students | – Not based on financial need – Calculated based on cost of attendance minus expected family contribution and other forms of financial aid – 6-month grace period after you leave school | $5,500 to $20,500 per year (varies by year in school and dependency status) |

| Direct PLUS Loan | Graduate and professional students | – Not based on financial need- Calculated based on cost of attendance minus expected family contribution and other forms of financial aid – Highest interest rate – 6-month deferment after you leave school | Up to the total cost of enrollment |

How to apply: Fill out the free FAFSA form on studentaid.gov. Applications for the following school year typically open on Oct. 1. For the 2024 school year, however, applications will open in December instead of October because of an overhaul in the application system5.

How much can a single mom get for student loans?

If you apply for a private student loan, the lender will determine your maximum loan amount based on your need and creditworthiness.

Federal student loans have payout limits based on your year in school, dependency status, and how much financial aid you’ve received from other sources (grants, scholarships, work-study programs, etc.).

Undergraduate students can borrow up to $5,500 in subsidized loans and $12,500 in unsubsidized loans, while graduate students can borrow up to the full cost of attendance, minus any other financial aid received.

If you already have student loans, and are struggling to afford them, refinancing your student loan might help lower your payment and shorten the loan term.

If you are wondering how student loan refinancing works, here are the basics to consider:

- Whether the loan will be paid off sooner with refinancing

- How much you could potentially save in interest

- Your employment history and credit score — if they are not strong, you will not qualify for a competitive refinance loan

- Learn how to assess the loan, including fees, forbearance options and customer service

Alternatives to loans

If you do not want to take out a loan, check to see if you qualify for one of many government assistance programs and charities for single moms.

Also, research single-mom programs in your state:

Find single-mom resources in every state:

SOURCES

- “FHA Mortgage Limits,” 2023. U.S. Department of Housing and Urban Development. https://entp.hud.gov/idapp/html/hicostlook.cfm

- “Area Median Income Lookup Tool,” 2023. Fannie Mae. https://ami-lookup-tool.fanniemae.com/amilookuptool/

- “How do I apply for a federal student loan?” U.S. Department of Education. https://studentaid.gov/help-center/answers/article/how-to-apply-for-federal-student-loan

- “The U.S. Department of Education offers low-interest loans to eligible students to help cover the cost of college or career school,” U.S. Department of Education. https://studentaid.gov/understand-aid/types/loans/subsidized-unsubsidized

- “FAFSA launch officially delayed,” March 22, 2023. Inside Higher Ed. https://www.insidehighered.com/news/2023/03/23/new-fafsa-wont-launch-until-december

- “WIC Policy Memorandum #2023-4,” March 31, 2023. United States Department of Agriculture. chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://fns-prod.azureedge.us/sites/default/files/resource-files/wic-ieg-2023-24-memo.pdf

- “Find out if you can still get health coverage,” 2023. HealthCare.gov. https://www.healthcare.gov/screener/

- Single Parent Project. https://www.singleparentproject.org/