Despite their reputation as shady operations that want to take advantage of unassuming customers, many pawn shops are reputable businesses with deep roots in the communities they serve.

If you’re in need of quick cash and have jewelry to sell, a local pawn shop can be a solid option to sell jewelry, gold or silver the same day — or secure a loan using your jewelry as collateral.

In our experience, payouts from a reputable pawn shop are in line with what you’d make from a local or online jewelry buyer (keep reading for details).

Before you sell, look for pawn shops in your area with positive reviews on Google, the Better Business Bureau, and Yelp, and seek recommendations from people you know.

In this post, we’ll help you understand:

What pawn shops pay for gold and jewelry

Answers to FAQs about pawning jewelry

- Is it better to pawn or sell gold?

- Do pawn shops pay spot price for gold?

- Are pawn shops a good place to buy jewelry?

- Do pawn shops buy broken jewelry?

If you aren’t in a hurry to be paid, get quotes from multiple pawn shops, jewelry stores and gold buyers, including top-rated online buyers, who offer a more discreet process for selling and highest-price guarantees.

What are pawn shops paying for jewelry?

Pawning jewelry will get you quick cash, but not always the highest payout. Spend just a little more time and get quotes from multiple gold buyers to guarantee you get the most money possible.

We recently sent a North Carolina based writer named Melinda Burris to research different options for selling gold.

Melinda purchased six of the same 7.5-inch Italian 10k gold bracelets from Macy’s, which were on sale for $200 each, plus tax. Her assignment was to sell to several online gold buyers, a local jewelry store, a local cash-for-gold storefront, and a local pawn shop.

She visited two pawn shops near her home in Raleigh, since the first was not currently accepting new items. This was her experience:

Carolina Trade and Loan

I went to a pawn shop called Carolina Trade and Loan to find they were not taking new items at this time. I was told pawn shops do this at times when their inventory or amount owed for loans is too high.

So, a valuable lesson was learned: Call before you go.

National Pawn

When I went to National Pawn on Saturday, March 30, I was greeted and taken to a booth where the bracelet was examined. They used the most recent spot value of $62.86.

The rep did a chemical test on the bracelet because she believed it to be 14K rather than 10K. Her manager came over and did the test again and determined it was indeed 10K.

He asked what I was looking to get out of the piece, and I replied $100, noting once again that the piece was new. He offered $50 cash and would not negotiate further.

However, he and his assistant were very professional and I felt comfortable discussing the piece, its value, and negotiating a price. To complete the transaction, I had to show a photo ID. As I was leaving, the manager called after me and invited me to return at any time.

Final offer: $50

Percentage of spot gold price: 79.5%

This is how National Pawn stacked up against the other gold buyers Melinda sold to:

| Gold buyer | BBB rating | Business type | Final offer | % of spot gold price* |

| CashforGoldUSA | A+ (accredited since 2020 | Online gold buyer | $41.49 | 67% |

| Alloy Market | A- (accredited since 2023) | Online gold buyer | $41.49 | 66% |

| Raleigh Gold Jewelry | A+ (accredited since 2008) | Jewelry store | $40 | 64% |

| National Pawn | A+ (not accredited) | Pawn shop | $50 | 79.5% |

| JewelRecycle | A+ (accredited since 2009) | Local gold buyer | $51 | 80% |

Different pawn shops and gold buyers may offer you more or less money for your jewelry, depending on factors such as:

- Market size/competition

- Current market value of gold

- Demand/saleability of the item you’re selling

At the end of the day, however, a pawn shop and any gold or jewelry buyer is a business, and they will offer you whatever they want to offer you for your jewelry or gold — or they may not be interested in buying it at all. If you have any receipts, certificates, or other paperwork to verify the value of your jewelry, bring them with you when you sell.

Note that some jewelry pieces, like those from luxury brands like Tiffany or Cartier, have value beyond their precious metal content — which means you may have a better shot at selling them to a local jeweler or even an online jewelry marketplace like Worthy or myGemma.

See this Reddit thread:

Before you pawn jewelry, spend some time learning about the market value of your diamond or any gemstone in your jewelry (gemstones and pearls have very little resale value, though the gold in which they are set always does). Since a certified lab report is expensive and time-consuming, a visit to a local jeweler can help you understand the value of your item.

Pawning diamonds, wedding rings, engagement rings

Diamonds in general do not hold their value the same way gold and silver does. In recent years, diamond prices have taken a major hit as the popularity of lab-grown diamonds and other diamond alternatives grows.1

Expect less than 50% of today’s retail value of your diamond at a pawn shop, or other diamond buyer.

This Reddit user detailed a poor experience trying to sell a $2,000 engagement ring to two different pawn shops:

Another also recommended a private sale (via Facebook Marketplace, or ebay, for example) over pawning:

However, several Reddit users recommended selling to a pawn shop over a local jewelry store:

Check out our posts on how to sell diamonds and how to sell engagement rings.

Pawning gold

The price a pawn shop, or any gold buyer, will pay for gold is based on today’s gold price, minus their commission — which could just be whatever they feel like paying you.

The price a pawn shop will pay for scrap gold vs. gold jewelry may be the same if they plan to melt down the jewelry for scrap (such as most gold jewelry, dental gold and gold bullion), or a slightly higher price per gram if the pawnshop plans to resell the gold jewelry as-is.

Broken jewelry is often bought for scrap, but is sometimes repaired and resold.

For example, if a pawnshop owner assesses a broken gold chain at today’s spot price, and believes he can sell it for scrap for $300, he may take a 30% commission — $90 in this case — and offer you $210. You should always negotiate with a pawnshop.

Gold is currently sitting near record prices of $2,400 per ounce, so now is a great time to sell. Learn more about how to sell gold.

However, if you have branded jewelry or a piece that is currently in style, it can be worth more than its precious metal content. Check out our posts on selling luxury jewelry brands:

Pawning pearls

If you want to sell jewelry with pearls, a pawn shop is likely more interested in any gold content of the clasp, chain or setting, as nearly all pearls have zero resale value — no matter where you try to sell.

Learn more about how to sell pearls.

Pawning silver

Like gold, pawn shops are most likely interested in silver jewelry for its precious metal content, unless it is from a sought-after brand. You will likely be paid a percentage of the spot price of silver.

As of , the silver resale value in the United States was at $ per ounce, or $ per gram.

If you have rare silver coins or sterling silverware, a pawn shop is a solid option for immediate cash. You can also sell to an antique dealer, coin dealer, silver exchange, local jeweler, or through an online silver buyer.

Learn more about how to sell silver.

Pawning watches

Before you sell a pawnable watch — like a Movado, Rolex or Tag Heuer — get an appraisal from a jeweler, watch dealer, or antique/estate jewelry dealer or compare prices of similar watches online to understand what your timepiece is worth. Other watches may be valuable for their gold content.

While most pawn shops will buy watches with dead batteries, you should replace them before selling if you can. A pawnbroker will likely want to make sure your watch is not broken before purchasing.

You can find inexpensive battery replacement kits and watch batteries on Amazon.

If you have a luxury watch, you may fetch a higher price selling via an online consigner or jewelry marketplace like Worthy. Learn more about how to sell watches.

How to pawn jewelry

If you want to sell jewelry to a local pawn shop, here are some tips to make sure you get the highest payout:

1. Figure out what your jewelry is worth

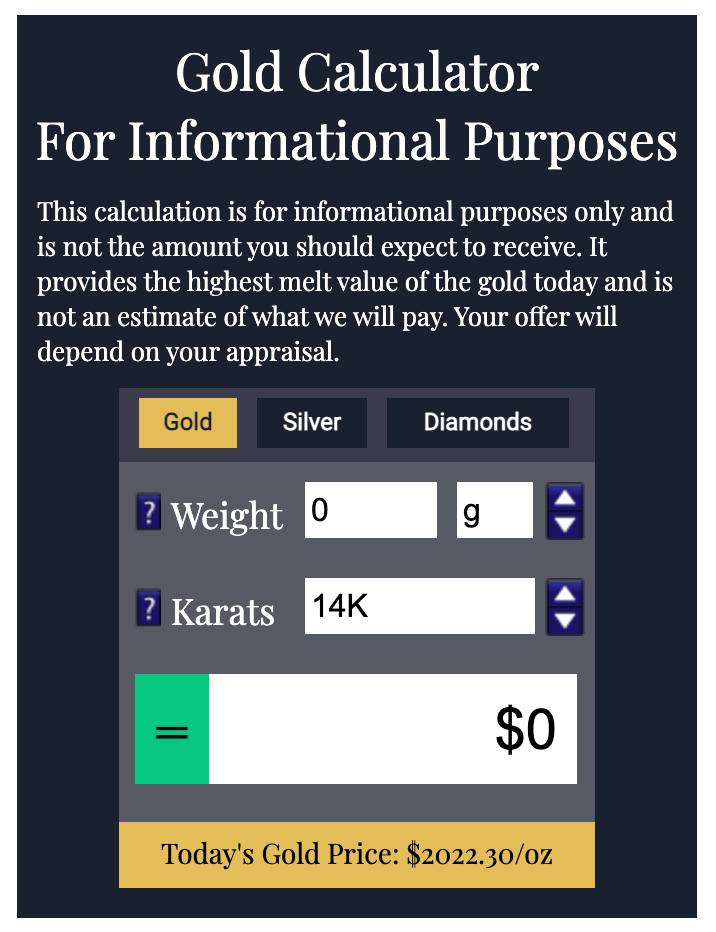

If you have gold or silver jewelry, use a calculator like this one from CashforGoldUSA to estimate how much your jewelry is worth in the current market:

If you aren’t sure whether you have real gold or silver, look for markings that show the type of jewelry you have and how much precious metal it contains.

You can also get a jewelry appraisal though those typically cost $150 or more, so they aren’t worth it unless your jewelry is worth significantly more than that.

2. Find a reputable pawn shop

Ask for recommendations from friends and family and in community Facebook groups. Read Google Business reviews and reviews on third-party sites like the Better Business Bureau, Yelp, and Trustpilot to find a pawn shop that will offer you a fair price and a positive experience.

3. Be prepared to negotiate

Get offers from multiple pawn shops and other jewelry buyers and negotiate a higher payout.

Any receipts, certificates, or paperwork you have on your jewelry can also be used as leverage.

Feeling shy? Try: “Can you do better than that?” when they make the offer. Be prepared to politely pack up your item and walk away — and be prepared for a counter-offer to come at you then.

How to get a pawn loan

If you aren’t ready to part with your jewelry but need immediate cash, some pawn shops offer pawn loans.

Essentially, the pawn shop lends you money, up to a certain percentage of the value of your jewelry, and holds onto your jewelry as collateral.

According to Intuit Credit Karma,2 interest rates on pawn loans range from 5% to 25% and typically have loan terms of 30 to 60 days.

Pawn loans are not based on your credit score and will not hurt your credit score if you are unable to pay them back. However, the pawn shop will keep your jewelry if you don’t.

Online companies like Diamond Banc also offer loans on jewelry.

Answers to FAQs about pawning jewelry

Is it better to pawn or sell gold?

If you need immediate cash, pawning gold to a reputable pawn shop is a solid option. Pawn loans are another option if you need cash but don’t want to part with your gold.

If you aren’t in a hurry to sell, you will get more money for your gold by getting quotes from multiple gold buyers, including local cash for gold storefronts, online gold buyers, and jewelry stores.

Do pawn shops pay spot price for gold?

Pawn shops will not pay you the full spot price for gold, but rather a percentage of the spot price. In our experience, pawn shops typically pay between 25% to 80% of the spot price.

Are pawn shops a good place to buy jewelry?

If you are looking for unique jewelry at a lower cost than retail and you don’t mind paying for something used, pawn shops can be good places to buy jewelry, especially if you like vintage, antique or one-of-a-kind pieces.

Do pawn shops buy broken jewelry?

Some pawn shops may buy broken jewelry if they believe the piece is worth fixing or if it contains precious metals like gold that they can sell to a refiner.

Bottom line: Pawning vs selling: Is it better to sell jewelry online or pawn?

If you need quick cash, pawning jewelry is a solid option, especially if you find a pawn shop in your area with positive customer reviews and a reputation for making fair offers.

However, if you have the time, it’s worth getting quotes from multiple types of businesses — online gold buyers, local jewelry stores, cash-for-gold storefronts, and pawn shops.

If you are thinking about pawning your gold, silver, or diamond jewelry — even broken jewelry — online gold buyers and recyclers offer a discreet process with high payouts.

Our No. 1 recommendation for selling jewelry is CashforGoldUSA, an A+ rated BBB company with decades of experience that offers a highest-price guarantee.

Get started with CashforGoldUSA.com today >>

SOURCES

- “Diamond demand is falling so fast—courtesy lab-grown stones—De Beers is cutting some prices by more than 40%,” by Thomas Biesheuvel and Bloomberg. Fortune. Sept. 3, 2023. https://fortune.com/2023/09/03/diamond-demand-falling-lab-grown-stones-de-beers-cutting-cutting-prices/

- “Is a pawn shop loan a good idea for quick cash?” by Anna Baluch. Intuit Credit Karma. Aug. 31, 2022. https://www.creditkarma.com/personal-loans/i/pawn-shop-loans