Diamond Banc is a jewelry buyer and equity lender — meaning they provide loans on jewelry — that does business online and in 11 U.S. retail locations.

We reviewed the process to sell jewelry and secure a jewelry loan from Diamond Banc. Here’s what we found:

Is Diamond Banc legitimate?

Yes. Diamond Banc is a legitimate jewelry buyer and lender founded in 2007 by a third-generation jeweler. The company boasts an A+ Better Business Bureau rating (accredited since 2014) and 4.3 out of 5 stars on Trustpilot.

Items sent to Diamond Banc are insured in transit and while held by Jewelers Mutual for their full wholesale value (for jewelry loans) or full offer amount (for jewelry sales).

All collateral items are stored in serialized tamper-proof bank packaging with the client's name and loan number:

Who owns Diamond Banc?

Diamond Banc is owned by Mills Menser, whose family has operated Buchroeders Jewelers in Columbia, Mo., since 1896. Buchroeders also has an A+ BBB rating.

What does Diamond Banc do?

Diamond Banc offers two separate services, similar to what a pawn shop offers in person: buys jewelry and offers loans on jewelry.

Diamond Banc buys jewelry

Diamond Banc buys fine jewelry and watches, including designer jewelry brands like:

They also purchase:

- Loose diamonds of any size and shape

- Gold jewelry in any condition, including worn, broken, and damaged items

- Gold, silver, and platinum bars and bullion

- Gold coins

- Scrap gold

- Dental gold

For online jewelry sales, your item must be worth at least $500. There is no minimum for in-store jewelry sales.

Diamond Banc offers loans on jewelry

If you have fine jewelry, watches, or designer assets worth more than $500, Diamond Banc can extend a loan using your jewelry as collateral in as little as 24 hours.

Diamond Banc offers jewelry collateral loans from $500 to $500,000. Here’s how Diamond Banc jewelry loans work:

- Diamond Banc holds onto your jewelry as collateral for a personal loan, up to 80% of the estimated liquid wholesale value* of your jewelry (though 65% to 75% is typical). This maximum percentage is determined by how desirable and stable the asset is. In most cases, you can borrow up to 80% on gold and above-average color and clarity grade round brilliant-cut diamonds over 1 carat. Diamond Banc does not require credit checks for jewelry worth less than $30,000.

- Over the lending period — a minimum of 61 days up to 5 years — you must pay a minimum fee every 30 days to cover the interest on your loan, which starts at 2.5% of the loan amount when you borrow 30% to 50% of your jewelry’s liquid wholesale value, up to 10%. This percentage is determined by where you are located in the country, your desired loan period, and the item(s) you’re using as collateral. You can pay over the minimum each month to pay down the principal balance on your loan and reduce your interest payment, or you can pay it off all at once. As long as you pay the interest every month, you can keep extending your loan for up to 5 years.

- Once your loan is repaid, your items are returned to you via insured Fedex overnight shipping. You will still have to pay the full interest amount for the month you pay off your loan, whether you pay it off on day 2 or day 29.

- If you miss three payments (which don’t need to be consecutive), your loan is considered in default, and Diamond Banc becomes the owner of your jewelry. Diamond Banc says that 85% of its loans are successfully repaid.

Diamond Banc will accept the following as loan collateral (as long as their combined loan value is between $500 to $500,000, you can submit multiple pieces for one loan):

- Loose diamonds of 0.50 ct or larger of any shape

- Extremely fine precious gemstones

- Gold jewelry in any condition, including worn, broken, and damaged items

- Designer jewelry

- Gold, silver, and platinum bars and bullion

- Gold coins

- Scrap gold

- Dental gold

- Diamond Banc may also accept other assets, like designer handbags, as collateral

*The liquid wholesale value is the price a wholesaler would pay for your jewelry in the current market. For example, if you purchased a diamond for a retail price of $6,000, its wholesale value would likely be about $4,500. Diamond Banc would loan up to 80% of that price, approximately $3,600.

This video offers an overview of the buying and lending process:

Work with Diamond Banc online

If you do not live near a Diamond Banc location, you can work with Diamond Banc online to sell your jewelry or get a jewelry loan. Here’s how the process works for both options:

Jewelry loans

- Go to DiamondBanc.com and click “Get a loan.”

- Fill out the submission form,

describing your item and indicating your desired loan amount. You should also upload photos of your jewelry if you have them. - Expect an initial offer via text, email, or phone call within 24 hours, though most people get a reply within two hours if it’s during Diamond Banc’s business hours of 9 a.m. and 5 p.m. CST Monday through Friday.

- At this point, there is room for negotiation on loan terms if you choose a lower loan-to-value ratio, which will result in a lower interest rate.

- At the time your offer is sent, Diamond Banc provides you with a fully-insured, trackable overnight FedEx shipping label to mail in your items. Items sent to Diamond Banc are insured in transit.

- Upon arrival at Diamond Banc’s headquarters in Columbia, Mo., your jewelry will remain on continuous video surveillance until the package is opened and your items are verified, typically the same day they are received. All diamond assessments are handled by GIA-certified Diamond Banc staff.

- As long as your items are as described, the amount of your initial loan offer will not change.

- If you accept Diamond Banc’s loan offer, your money will be issued immediately via wire transfer or overnighted check if you prefer. If you decline their loan offer, your items will be shipped back to you via fully-insured, trackable overnight FedEx shipping.

- Diamond Banc will draft the terms of your loan and email you the documents to digitally sign.

- You’ll have to make an interest-only payment for every 30 days Diamond Banc retains possession of your collateral, with a minimum loan period of 61 days up to 5 years. Your loan rate remains the same throughout the life of your loan. You can pay down the principal balance on your loan over time or all at once. Any payments toward your loan balance will reduce the amount of your minimum monthly interest payment. Three missed payments results in a default on your loan, and Diamond Banc will claim ownership of your collateral.

- All collateral items are stored in serialized tamper-proof bank packaging with the client's name and loan number.

- Once you’ve repaid your loan, your items will be immediately returned to you via fully-insured, trackable overnight FedEx shipping. You will still have to pay your minimum monthly interest payment for the month you pay off your loan.

Selling jewelry

1. Go to DiamondBanc.com and click “Sell my jewelry.”

2. Fill out the submission form,

describing your item and indicating your desired price. You should also upload photos of your jewelry if you have them.

3. Expect an initial offer via text, email, or phone call within 24 hours, though most people get a reply within two hours if it’s during Diamond Banc’s business hours of 9 a.m. and 5 p.m. CST Monday through Friday.

4. At the time your offer is sent, Diamond Banc provides you with a fully-insured, trackable overnight FedEx shipping label to mail in your items. Items sent to Diamond Banc are insured in transit.

5. Upon arrival at Diamond Banc’s headquarters in Columbia, Mo., your jewelry will remain on continuous video surveillance until the package is opened and your items are verified, typically the same day they are received. All diamond assessments are handled by GIA-certified Diamond Banc staff.

6. As long as your items are as described, the amount of your offer will not change.

7. If you accept Diamond Banc’s offer, payment will be issued immediately via wire transfer or overnighted check if you prefer. If you decline their offer, your items will be shipped back to you via fully-insured, trackable overnight FedEx shipping.

Working with Diamond Banc in person

When you schedule an appointment at a Diamond Banc location (which you can do on their website or by calling), Diamond Banc will appraise your jewelry in person to determine how much they can offer to buy your jewelry or how much you can borrow as a jewelry loan. All diamond assessments are handled by GIA-certified Diamond Banc staff. Store hours vary by location.

If you accept Diamond Banc’s offer, payment will be issued on the spot via check or wire transfer.

If you take out a loan, documents will be drafted that detail the terms of your loan, and your loan period will begin immediately upon possession of your jewelry. The in-store process takes about 40 minutes.

Diamond Banc has 11 locations across the east coast and midwest:

- Tampa

- Boca Raton

- Miami (two locations)

- Orlando

- Nashville

- Atlanta

- Charlotte

- Kansas City

- Columbia

- Rochester

Is it better to sell or get a loan for my jewelry from Diamond Banc?

That depends on whether you want to retain possession of your jewelry or you no longer want or need your jewelry.

If you take out a loan using your jewelry as collateral, you’ll have to pay between 2.5% and 10% in interest every 30 days until your loan is repaid.

There are no fees involved with selling your jewelry to Diamond Banc.

What kind of jewelry does Diamond Banc buy or offer a jewelry equity loan?

Jewelry used to obtain a loan from Diamond Banc must equate to a loan amount of $500 to $500,000. There is no minimum for in-person jewelry sales and a $500 minimum for online jewelry sales.

The following items are accepted for sale and as collateral:

| Jewelry sales | Jewelry loans |

| – Loose diamonds of any size and shape – Gold jewelry in any condition, including worn, broken, and damaged items – Designer jewelry – Gold, silver, and platinum bars and bullion – Gold coins – Scrap gold – Dental gold | – Loose diamonds of 0.50 ct or larger of any shape – Extremely fine precious gemstones – Gold jewelry in any condition, including worn, broken, and damaged items – Designer jewelry – Gold, silver, and platinum bars and bullion – Gold coins – Scrap gold – Dental gold – Diamond Banc may also accept other assets, like designer handbags |

What is Diamond Banc’s interest rate?

Diamond Banc’s interest rates start at 2.5% if you are taking out a loan for 30% to 50% of your jewelry’s liquid wholesale value. Rates can be as high as 10% for higher percentage loans on some items that have more volatile pricing.

If I get a jewelry equity loan, how do I redeem my loan?

Diamond Banc pays you the amount of your loan via wire transfer or overnighted check immediately upon receipt of your jewelry and acceptance of the loan terms.

From the time you submit the form on Diamond Banc’s website, the process to get paid can take less than 24 hours if you ship your jewelry the same day you receive your initial offer using Diamond Banc’s prepaid overnight FedEx shipping label.

Diamond Banc pros

- A+ BBB rating

- Full process from submission to payment can take less than 24 hours

- Offers jewelry sales and equity loans

- Low interest rates on jewelry loans starting at 2.5%

- No fees for jewelry sales

- Insured by Jewelers Mutual insurance for their full wholesale value (for jewelry loans) or full offer amount (for jewelry sales).

- For 6-figure items, Diamond Banc uses Brinks’ armed guard service. Clients consults with Diamond Banc on how to package and hand deliver their items to their nearest Brinks location. Brinks attaches the coordinating air bill shipping label and signs a manifest document stating that the package is shipping from that specific address to Diamond Bank. Packages shipped this way usually arrive in 48 to 72 hours.

- Responsive customer service that will work with you outside of business hours as needed

- Worth with Diamond Banc online or visit one of their 11 physical locations

- Tampa

- Boca Raton

- Miami (two locations)

- Orlando

- Nashville

- Atlanta

- Charlotte

- Kansas City

- Columbia

- Rochester

Diamond Banc cons

- Insurance is only for wholesale value (for loans) and offer amount (for sales)

- Only accepts diamonds larger than 0.5 carats for jewelry loans (though it accepts all diamonds for sales)

- Value of your jewelry must equal a loan amount of at least $500 for jewelry loans

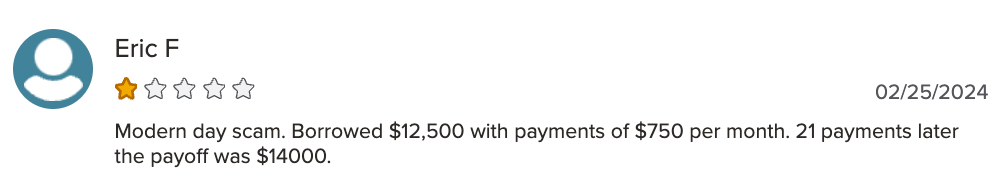

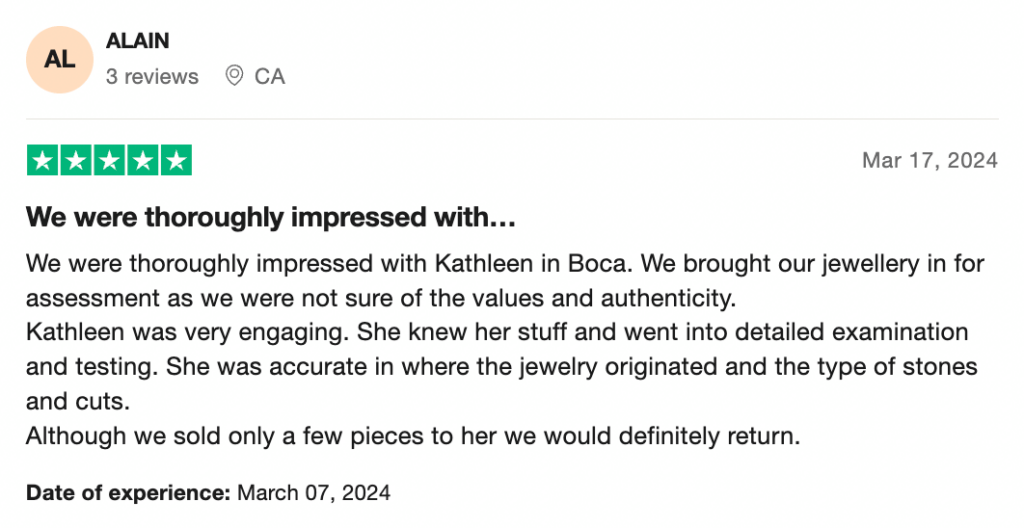

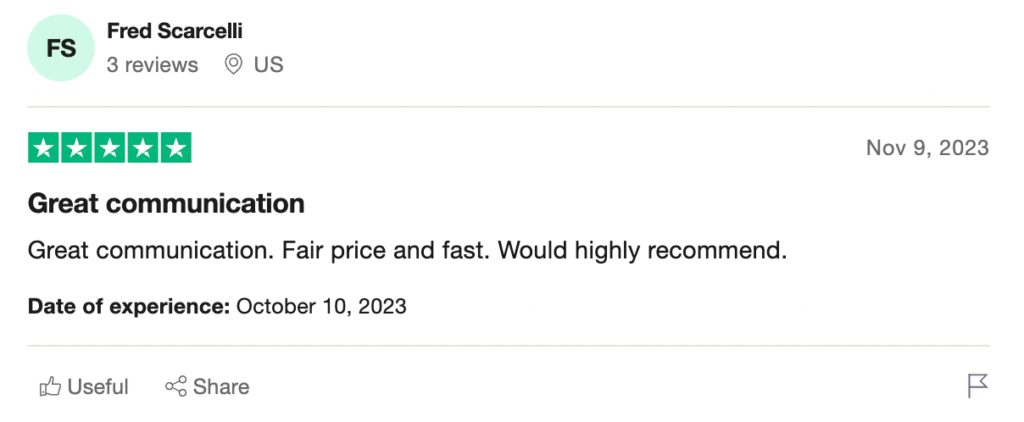

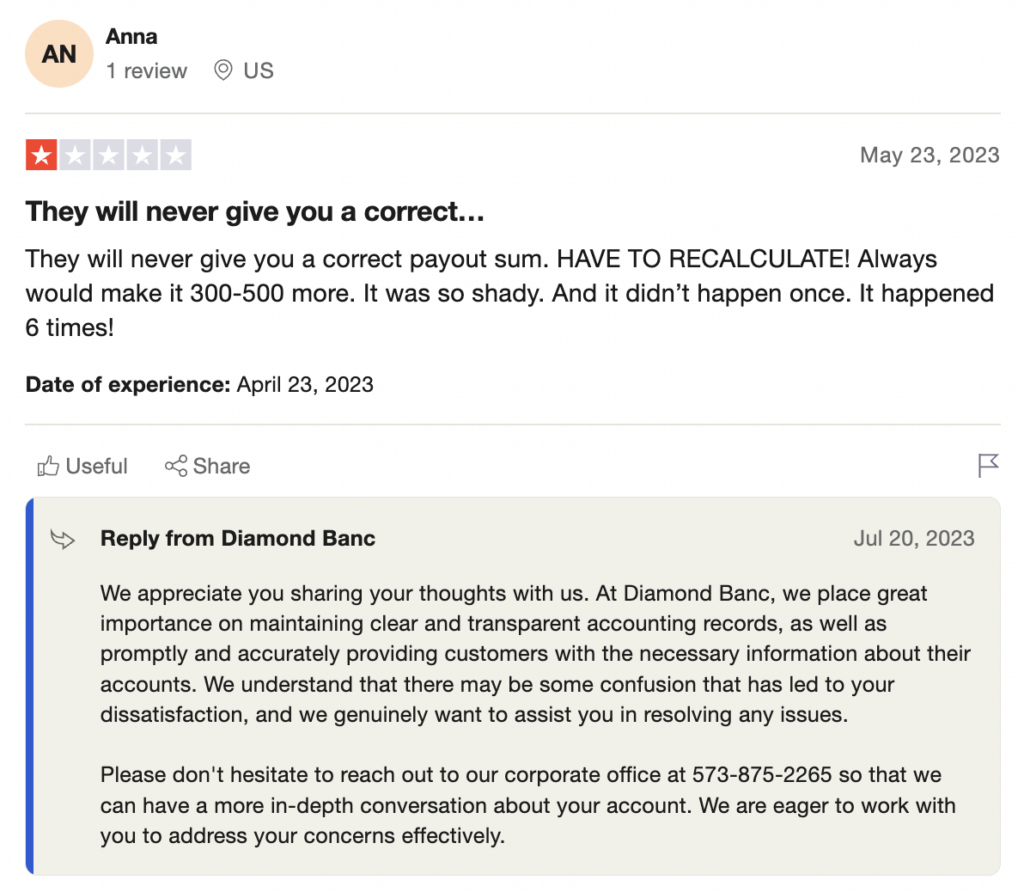

Diamond Banc reviews and ratings

Diamond Banc’s reviews are overwhelmingly positive:

Better Business Bureau

Diamond Banc has an A+ rating from the Better Business Bureau and has been accredited since 2014, though it only has one, 1-star customer review:

Trustpilot

Diamond Banc has 4.3 out of 5 stars on Trustpilot based on more than 530 customer reviews.

Diamond Banc also has 4.7 stars on its Facebook business profile, though there are no legit reviews more recent than 2021:

Bottom line: Diamond Banc is a reputable and legit way to sell jewelry or get a loan on jewelry

Whether you want to sell your jewelry or use your jewelry as collateral to obtain a personal loan, Diamond Banc is a reputable company that offers a secure process to get paid in as little as 24 hours.

Based on my personal experience interacting with Diamond Banc’s National Director of Funding Jordan Isaacs, Diamond Banc’s process is transparent, and it’s easy to get in touch if you have any questions about selling or obtaining a loan.

Secure a low-interest loan or sell your jewelry to Diamond Banc today >>

Yes. Diamond Banc is a legitimate jewelry buyer and lender founded in 2007 by a third-generation jeweler. The company boasts an A+ Better Business Bureau rating (accredited since 2014) and 4.3 out of 5 stars on Trustpilot.

Diamond Banc offers two separate services, similar to what a pawn shop offers in person: buys jewelry and offers loans on jewelry.