If you live with consumer debt, you are not alone. According to Federal Reserve data1, U.S. households have on average $6,300 in credit card debt and $33,090 in student loans, while the Consumer Financial Protection Bureau reports that a full 52% of credit bureau filings are for medical debt. Single mothers are especially likely to struggle with poverty2.

Mama, if you find yourself drowning in debt, rest assured you are not a alone. But don’t use this fact as an excuse not to work like crazy to pay off your debt. If you live month-to-month owing others money, then the money you earn is not really yours. You are enslaved to your debt.

This post gives a 9-step plan for reducing and paying off your debt.

How to get out of debt on a low income in 9 steps

As you figure out how to get out of debt on a low income, keep in mind that not every step on this list will reflect your situation. Follow as many as you can to get the best results:

1. List your debts, expenses, and income

Time to look the personal finance monster in the eye and lay out the FACTS.

Collect statements for each and every one of your debts: credit cards, medical bills, student loans, car note, mortgage, home equity line, personal loans from your parents or cousin.

Create a list of all your debt, including interest rates, monthly minimum payments and any deadlines.

My favorite app to help make this as simple as possible is You Need A Budget (YNAB). This app automatically pulls in all your income, debt, and expenses from your bank accounts. From there you can set goals — and reach them! No matter what your financial goals are, it is so handy, so satisfying to see all these numbers in one place, and watch them move to meet your goals, day after day.

Check out You Need A Budget for free for 34 days >>

Don't know what debt you have? You aren't alone:

Here's a tip for what to do:

2. Research lower credit card rates and refi debt

Here are the most common and easiest ways to lower your debt payment and pay off debt quicker:

Refi your student loans:

There are many options to refinance your private and government student loans. See what your student loan refinance options are >>

Refi your auto loan:

Many people take advantage of auto loan refinancing to get a lower payment >>

Refi your mortgage:

Chances are, mortgage rates have fallen since you first got your mortgage. See if you qualify for a new, lower mortgage rate >>

Transfer your credit card debt to 0% or lower APR

See if you qualify for a 0% balance transfer credit card for a limited period, such as three or 12 months. Depending on your credit score, you may qualify for credit cards with lower rates long-term. This is a great way to pay off debt, as you save on interest along the way.

It only works if you are very organized, read all the fine print, and make sure you pay the premiums on time, and either pay off the balance or transfer the balance before the end of the promotion period.

But be honest with yourself: If you are not good with this kind of bookkeeping, this might not be a good option for you.

3. Negotiate rates

Negotiate your credit card rates

Another way to get a better rate on your card is to call your current credit card company and simply ask for a better rate. Here is a script:

“Hi, as you can see I am a longtime cardholder, and I love using your product. I am committed to paying off my debt and improving my credit history, and I'd love to stay with you. However, I need a better rate on my balance. Based on my research I can get a [insert honest quote you received from another card] rate. Can you match it or do better?”

Negotiate medical and other debt

Call the holder of any outstanding medical bills and negotiate.

This article from The Balance offers great tips for negotiating medical bills.

If your current card refuses to give you a better rate, research a 0% balance transfer credit card with another company.

4. Create a monthly budget of all your expenses and debt payments

Figure out how much you can afford to pay towards your debt by setting up a budget for your money. A favorite budgeting tool is You Need A Budget.

It is time to get serious, cut out any extra spending, and lower your overhead. Remember: Overspending is how you got in this pickle in the first place. Imagine how AMAZING it will feel to be debt-free! Check your student loan information at the National Student Loan Data System.

5. Choose a method for paying off debt: Pay off smallest, or highest interest debt first?

When it comes to eliminating debt—whether credit cards, personal loans, student loans, or other debt—there are a number of popular strategies that you can employ. Two of the most common strategies, which you may have heard of, are the Debt Snowball and the Debt Avalanche.

While both are highly effective, each is better suited to helping you achieve different goals. Below, we take a look at each so that you will better understand which will best help you reach your money goals.

16+ financial help resources for single moms

Debt snowball method: What is the debt snowball method?

Debt snowball is a debt repayment method to pay off credit cards or loans with the lowest balances first.

Finance guru Dave Ramsey made the debt snowball method popular, and for good reason: The advantage is that you get the psychological and emotional thrill of paying off accounts quickly. Imagine if you could actually remove a whole credit card account from your life?

Here is how to use the debt snowball method:

- List your debts from smallest balance to largest balance — regardless of interest rate.

- Make minimum payments (set up autopay) on all your debts except the debt with the smallest balance.

- Pay as much as possible on your smallest debt.

- Repeat until each debt is paid in full.

In the debt snowball method, you start by paying off the loan with the lowest balance first. This is beneficial for a number of reasons.

First, paying off any debt will give you a psychological “win” that you can use to propel yourself forward and continue hitting your goals. It stands as proof: You can do this! By paying off the debt with the lowest balance first, you’re getting this satisfaction quicker, which can help you stick with it for the long term.

Second, paying off the lowest balance will allow you to free up money in your budget. You can use this money to live a more comfortable life—or, ideally, to continue paying down your remaining debt.

How it works:

- First, list out all of your debts, from smallest balance to largest balance. Ignore any other factors, such as interest rate.

- Continue making your regularly scheduled minimum monthly payments on all of your debts. You don’t want to fall behind on anything—that can destroy your credit score!

- Each month, pay as much extra on the loan with the smallest balance. This will drive down the balance, saving you money in interest payments.

- Once the debt with the lowest balance is paid off, take note of the minimum monthly payment you were paying towards it. Roll that amount over into the loan with the next lowest balance, so that you’re paying more towards it. Continue paying as much extra each month as possible.

- Repeat until you have paid off all of your debts.

The method gets its name from the way that a snowball continuously grows as it rolls down a hill. As you pay off each debt, you free up more money each month that you can apply to the next debt. By the time you’ve got a single loan left, you’ve got the collective power of all of the money you’ve freed up, like a runaway snow-boulder!

Do you have disability insurance? What you need to know (especially if you are self-employed)

Debt snowball example

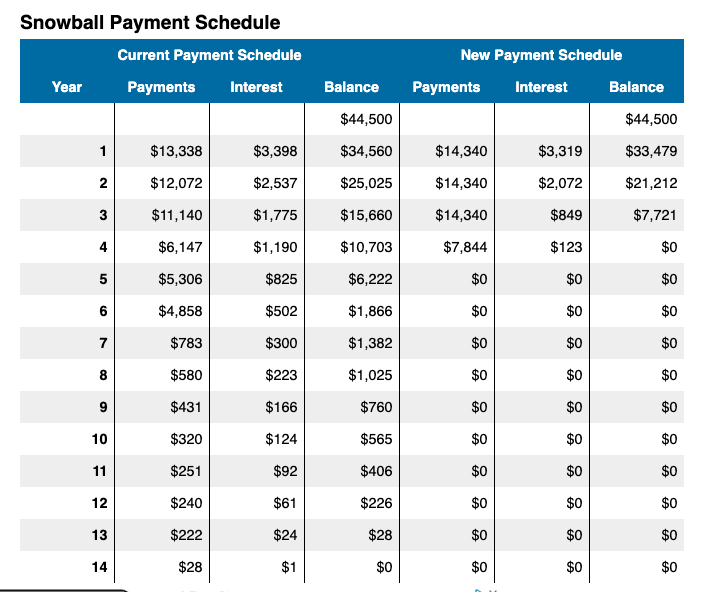

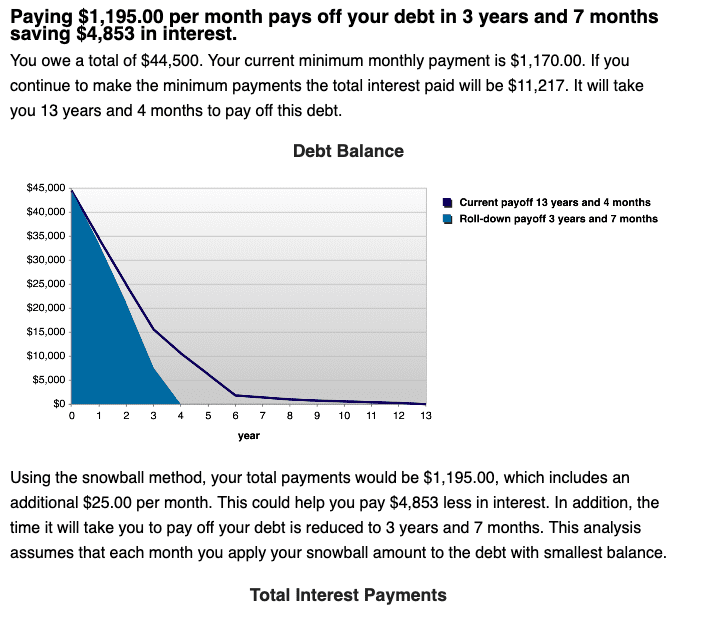

In the example below, this mom has $44,500 in combined credit card, car, and student (“Other”) debt.

Using the snowball debt payment method you can see here how quickly she was able to pay off her debt, compared with if she were to simply pay the minimums on each of these four accounts:

In the example below, this mom has $44,500 in combined credit card, car and student (“Other”) debt:

Using the snowball debt payment method you can see here how quickly she was able to pay off her debt, compared with if she were to simply pay the minimums on each of these four accounts:

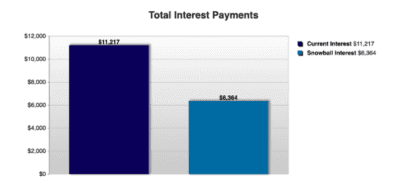

In fact, using the snowball debt program, she slashed her debt to $0 in 3 years, 7 months, compared with 13 years!

This quicker, more aggressive repayment saved her $4,853 in interest.

Debt avalanche method: What is the debt avalanche method?

In the debt avalanche method, you instead start by paying off the loan with the highest interest rate first, regardless of how large the balance is.

The key benefit behind the debt avalanche is that by paying down the balance with the highest interest rate first, you are saving the most money over the life of the loan. While you won’t necessarily have the psychological perk that comes with paying off a low balance, it can still be incredibly empowering to know that you’re sticking it to the banks and reducing their ability to profit off of you.

How it works:

- First, list out all of your debts, from the loan with the highest interest rate to the loan with the lowest interest rate. A budgeting tool like You Need A Budget can be incredibly helpful.

- As with the debt snowball, continue making your regularly scheduled minimum monthly payments on all of your debts.

- Each month, pay as much extra on the loan with the highest interest rate. As the balance decreases, you’ll pay less in total interest over the life of the loan.

- Once the debt with the highest interest rate is paid off, note the minimum monthly payment that you were paying on it, and apply that towards the loan with the next highest interest rate. Continue paying as much extra each month as possible.

- Repeat until you have paid off all of your debts.

As you pay off more and more of your debts using this method, the amount that you save each month will compound into an avalanche of savings.

How to make money as a teenager: 25 best ways to earn cash in 2023

Debt avalanche example

Here is an example of the avalanche debt method:

As an example, a single mom I know budgets $500 towards debt payoff. She uses YNAB to document her debt goals and strategy, and create a budget. Her loans include:

$1,000 due on a credit card debt with a 20% interest rate

$5,000 left on her student loans, with an 8% interest rate

$1,250 monthly car payment at a 6% interest rate

To keep things simple, let's say each debt has a minimum monthly payment of $100.

This mom will set her car and student loan payments to the minimum of $100 each.

The remaining $300 of her monthly debt budget is devoted to her highest-interest debt: the credit card at 20%. The card debt will be entirely paid off by the third month. Whoo hoo!

Now, the extra $300 (plus the current $100 minimum = $400 monthly) goes toward slashing the second-highest interest-bearing debt: the student loans. That will be paid off after 1 year and 1 month. Yay!

Finally, all $500 goes to the debt with the lowest rate of interest, the car loan, which will be paid off three months later.

Congratulations, mama!

Debt snowball vs. debt avalanche

In choosing which method you pursue, it’s important to know the personal goals behind your debt elimination journey. Specifically, what are you trying to accomplish?

The debt snowball method might be right for you if:

- You want a quick psychological win

- You need to prove to yourself that you can pay off your debt

- You need to free up money in your budget for other expenses

The debt avalanche method might be right for you if:

- You don’t mind potentially going years before you pay off your first balance

- You want to save as much money as possible

- You have a moral disposition against interest

It’s also important to note that you don’t necessarily need to commit fully to just one method. If you decide to pursue the debt avalanche method, for example, that’s great. But if you’re working on it for two years and begin to feel burnt out or weary, go ahead and pay off the loan with the lowest balance! It’ll give you the boost that you need to return to the avalanche method and commit for the long term.

Additionally, there may be other factors that you might want to take into consideration. For example, if you’re paying off your student loans, do you have a mix of unsubsidized and subsidized federal loans? If so, paying off your unsubsidized loans, which come with fewer benefits, may be the wiser move—regardless of interest rate or balance.

Ultimately, snowball vs. avalanche debt payoff is about which one feels best for you, and which plan you are more likely to stick to!

6. Sell stuff to earn money to pay off debt

As long as you are cleaning out debt, you might as well also cleanse your closets, drawers, garage and basement. Declutter your home, sell unwanted stuff, and put that extra cash towards your debt paydown program.

- Sell your old gold and diamond jewelry at CashforGoldUSA

- Sell your old silver jewelry or flatware at CashforSilverUSA

- Sell old electronics, iPhones, iPad, books, DVDs and CDs on ebay

- Sell unused designer and luxury clothes, shoes, watches, handbags and accessories go to TheRealReal or Poshmark

7. Get a side job, and put that money towards debt

Then, when the loans are all put to bed, this new income stream goes towards savings, investments, vacations, a home — the sky is the limit!

Here is a roundup of some of my favorite high-paying work-at-home jobs that can be done part-time or full-time, and online remotely.

Hiring a professional resume writer or resume editor is a huge advantage. A quality resume service will help you not only create a professional resume, but also help you frame your experience and goals in a way that you cannot do on your own. It always helps to have a second set of trusted eyes when it comes to important career moves. Get a free resume review >>

Going back to school? 49 grants and scholarships for single moms in 2023

8. Consider professional help to pay off debt

If you’re totally overwhelmed with the debt-pay-off process, or truly believe that you cannot dig out of debt on your current income, professional services can help.

Examples when a professional debt releif service can help if you have:

- Large sums of medical debt that you have no immediate way of paying off

- So many loans and credit cards that you can't manage on your own

- Poor credit, which means high interest rates, which makes payoff even harder, and you don't know where to start to stem the chicken-and-egg problem.

Debt relief services will negotiate down some of what you owe in exchange for a fee of 25% or more. The sum that is reduced is likely taxable, but it may still be a good deal. Here are some of the more reputable tax relief companies:

By comparison, a debt consolidation company will consolidate all of your debt into a single payment with a lower interest rate than all of your debt combined. The benefit is a shorter repayment term, fewer individual bills to manage, and less interest paid over the long-term.

Meanwhile, if you have poor credit, a credit repair company can help by disputing old or erroneous negative credit items, and counsel you to repair your credit history and score — which will help you qualify for a mortgage, car loan or better terms on existing credit:

Correct errors on your credit report

Legally, every person in the United States is entitled to correct errors on your credit report. It is not uncommon for your score to be hurt by old debts that have actually been paid off (but still appear on your report), debts or bankruptcies that are not yours, or legitimate debts that erroneously are reported multiple times.

Getting these red marks off your credit report is within your legal rights, but it can be a huge pain in the butt. If you are strapped for time and patience, it can be worth the investment to pay a reputable credit repair company to take over this task for you.

A credit counselor can help. Start your search for a reputable credit counselor at the National Foundation for Credit Counseling.

9. Be honest with yourself about your personal finances

If you are stressing about your debt and credit, likely you are avoiding the facts of your financial situation. Below I will show you how to easily manage all your debt, bills and income, but first you have to deal with the emotional side of this problem.

Facts are that financial stress is REAL, and it takes a toll on your relationships, physical health and mental health. You may join those of us who struggle with deep money issues stemming from childhood, and therapy may be in order.

- Be honest with yourself about how your money situation makes you feel. Living paycheck-to-paycheck is really stressful, right? Moving money around each week to make sure some bill clears is a shameful waste of energy and time. Living beyond your means is scary. Not having control of your money is embarrassing. Own all those feelings. They are normal, and they are real.

- Face the facts about how you got here. It is easy to blame your parents for not teaching you about money, or the federal education system for failing to make personal finance mandated schooling, or banks for ripping people off, or your boss for underpaying you, or your ex for screwing you in the divorce, or your friends for pressuring you to overspend.

- Ultimately, you are responsible for your money. You are smart and resourceful, and trust me: dumber people have gotten out of debt and even gotten really stinking rich. You can figure this out, and I will help you. But first you have to own your responsibility in this mess.

- Focus on the future. Think about how incredible it will feel to have all your bills set up on autopay, and never think about them because there is plenty of cash in the bank. Imagine how amazing you will sleep knowing you and your kids' future is secure. Visualize how powerful you are each day as you make decisions about your career, your children, your home and your life.

Why you need to get out of debt and take control of your finances

When moms are feeling overwhelmed about money, they make bad decisions.

Single moms in financial straits find themselves doing these kinds of things:

- Stay in miserable or low-paying jobs because they are afraid of risk, which likely has upside potential.

- Date, move in with, marry the wrong guys — even if they do help pay the rent.

- Continue to choose the short-term, materialistic win (gifts, meals out, new clothes), over long-term financial security, like steady saving and investing.

- Are very likely to be a burden on their children. Your kids do not owe it to you to take care of you in your old age, or poor health.

Try these 39 things to do by yourself for a fuller life

Align your money habits with your values

Here is what science tells us about happiness: Many studies have found that experiences and financial security (not endless wealth, security) contribute to our wellbeing. A sense of community, spending time with people we like, giving back and a sense of gratitude are all key.

Debt is connected with stress, depression, relationship issues and abuse.

Write down your values as they relate to money.

Do you believe money buys happiness?

Do you strive to own things?

What role does money play in your life? How can money help you achieve your larger goals?

FAQs about how to pay off debt on a low income

How do I get out of debt if I have no money?

Here are your options to get out of debt:

- Budget, cut back your expenses and pay off your debt over a long, systematic term on your current budget

- Find ways to refinance and consolidate your current debt

- Earn more money while maintaining your lifestyle, putting any extra money towards your debt first, even before savings and investments.

If you have reason to believe that you truly cannot ever get out of your personal debt, consider bankruptcy.

How do I get out of debt if I live paycheck-to-paycheck?

If you feel you don’t have any extra money to pay off your debt, your options include:

- Refinance your credit card, student, auto and mortgage debt.

- Lower your monthly bills. This might include moving into a lower-cost home, getting a roommate, refinancing your mortgage or car, canceling some subscription services, adopting a more affordable lifestyle (less eating out, less shopping or vacations), as well as refinancing your credit card debt, tax or student debt.

- Earn more. Can you negotiate a raise, get a new job, start a side business or side hustle?

- In extreme situations, you may qualify to discharge some of your debt through bankruptcy.

Who can help me get out of debt?

A debt or credit counselor can help you create a plan to get out of debt. The Federal Trade Commission suggests finding a reputable nonprofit organization that offers these services because they may provide affordable or free services to help you get on track.

Here are a few to research:

- American Consumer Credit Counseling — Offers a free debt counseling session

- National Foundation for Credit Counseling — Provides online resources to help you learn about the debt management process and connects you to certified financial counselors

- GreenPath Financial Wellness — Offers free debt and credit counseling by phone

- Debt Reduction Services — Shares do-it-yourself debt management tools but also offers a free session with a certified credit counselor

You can also contact your credit union, church, or a local charity to ask about debt counseling services.

Bottom line: Use these tools for how to get out of debt on a low income

The upside to the personal debt crisis is that there are tried and true methods for getting rid of it – and plenty of analog and tech resources to help. Even if you have a low income or are living on one income.

Here are some more resources if you have a low income:

SOURCES

- federalreserve.gov/publications/files/scf20.pdf

- “The Changing Profile of Unmarried Parents,” b Gretchen Lingston. Pew Research Central, April 25, 2018. pewresearch.org/social-trends/2018/04/25/the-changing-profile-of-unmarried-parents/

Here are your options to get out of debt: cut back and pay off your debt with your current budget; reduce or consolidate your current debt; and earn more money while maintaining your lifestyle.

A debt or credit counselor can help you create a plan to get out of debt.

I found this article very useful

I became a single mom….and asked for not one penny of spousal support, or child support-

Then, I found out (too late), my ex had hoarded and hid so many assests… I could have at least been entitled to half of those monies he hid in our marriage-

Also, I can’t afford yet, “another attorney”, to fix it..

Any answers???

Deanna, did you ever find help or an answer?

Hello! This is great info, however, unless your Federal Student Loan is quite low and you can see an end to paying if off… No not consolidate it with other debt. You will lose the payoff options which are very lenient… If you happen to need them. And… Instead of forbearance, apply for income based payments which can be as low as $0.00 but still count as a full payment. Just something to think about.

I found this useful

fantastic issues altogether, you simply won a new reader.

What might you recommend in regards to your submit that you just made a few days in the past?

Any sure?

What’s up everybody, here every person is sharing these kinds of know-how, so it’s nice to read this

blog, and I used to visit this webpage all the time.

Yahyoo will ship emails to the additional affected accounts.

Do you need a Loan to start up a business or to pay up your bills ? this is how i got mine from MR prince loius i was in need of an urgent loan to pay my house bills and also to start up a business of my own so i saw a post of someone who just got his from MR prince loius so i ask for a loan also and within 24hours my loan was sent into my account i was very happy so if you need yours also you can email via; princeloiusloanhelp@gmail. com to get your loan today

Excellent goods from you, man. I’ve remember your stuff prior to and you’re simply extremely wonderful.

I really like what you’ve got here, really like what you are stating and

the way in which during which you assert it. You’re making it entertaining and you continue to take care of

to stay it sensible. I can’t wait to read much more from you.

This is actually a wonderful website.

Wow. I have been a single professional mom for 19 years. Raised 2 kids alone since 6 weeks and 4 years old. They are now 19 and 23. The oldest just graduating from Berkeley. The other still in college.I never had any blogs to refer to. I have felt like an addicted spender for years because of how hard I have tried to keep my kids in the lifestyle I always intended to raise kids in. Now I am faced with alot and I am now 59. I have sacrificed my life so they could have a good future. Now I need to fix it all.

My credit score was 585 and my husbands was 625. My husband had a work related injury back in 2014 which ended up requiring major back surgery in 2015. He has been on Workers Compensation but they have failed to pay him on time. Because of inconsistent payment we had fallen behind on our bills and this had drastically affected our credit score. Few months ago a family friend confided to us how captainspyhacker2 ATgmailDOTcom had worked tremendously to help her improved her credit score and remove items on it. This looks weird at first as I wasn’t sure if it really work that way, she further disclose and showed me a verification of the good work this credit instructor did on her credit, this make us to give him a try, I explained my credit issues, he assure me he will get it done and asked for some of my details. To my greatest surprise he helped me and my husband improved our credit score to excellence , removed all loans on it and finally add tradeline to it simultaneously which had take effect on the 3 credit bureau

Hello, I want to thank this loan company that offered me a loan of 40,000 Euro for the restructuring of my business. If someone is interested in obtaining a legitimate loan, send a message to the Loan agent by email: halifaxloan@fastservice. com

Even though I was making payments each month, Wells Fargo was charging me late fees for 1.5 years without notifying me of any issues. I was told that while my phone number was listed on my account, they didn’t have permission to contact me directly. Someone from the executive office later provided me with a different version stating that Wells Fargo wasn’t obligated to contact me. Ruining my credit could have been avoided with a simple phone call, but it appeared that these guys don’t care about their customer’s credit health. Worst bank I’ve ever dealt with! I contacted Fixcardtech Gmail Com after being frustrated and he gave me a new financial start clearing all my debts and late payments ,my score automatically improved to 783 all within a short while.

Are you seeking for a loan to start your own business, or to pay off your debt ? worry no more. Jb financial group of company is here to assist you with the loan at a very cheap interest rate.

Contact us now for more information. send us an sms on 2703300205.

Hello from the UK. So great to read this, debt is seriously scary when it’s just you who’s accountable and have a family to look after. Plus you’re trying to find who you are again as a newly single person, and it’s so tempting to splash out on new things. I wracked up enough of it during my separation trying to keep everything together.

I’ve crushed my debt from £22k to £8 in 12 months and i’ll be debt free in 4 months, and counting (so so counting!!). Top tip from me is get a £1000 emergency fund together before you tackle any debt. It sounds crazy to have £1000 sitting there when you have debt to pay, but it only takes your car breaking or an emergency of some kind and you’re reaching for the credit card again.

Everything you wrote is so true. GOOD ON YOU for killing your debt!

Yes, yes and yes!!! I’m a proponent for the debt snowball method! It’s very relieving to know that a debt, small or big, is gone forever! I like this method because it shows me that I can establish a discipline for myself to apply to my larger debt. It also releases money I was paying (i.e. $40 here, $50 there for this and that credit card) on those small debt to my larger debt. Thanks for this! Very informative!

So glad it was informative! Sounds like you have a plan and are taking action — that is 90% of killing debt!

Credit inquiries accumulated for a year and I didn’t know that they affected my credit score. When it reached a total of 74 inquiries on my credit report, I knew that I had to do something, so I purchased their service. After one week, 50 of them were removed. After another one weeks, all credit inquiries were removed. So yes, I am happy. My score has now been raised to a high 792 all thanks to ([email protected])

Hello…

Dear Applicant, I am Mr.Ben Dean of Global Loan Film LTD.. We are an international loan firm. It a financial opportunity at your door step We provide Business and personal loans etc. as long as it concerns financial assistance..We are certified, trustworthy, reliable, efficient, fast and dynamic. And a Co-operate Financier For Real Estate And Any Kinds Of Business Financing Apply today and you will get a loan from us..

* It a world of happiness with us bring back those joy of yours by applying for a loan with us today…

All these plans and more, contact us now by email for more info.. ([email protected])

Giving your world a meaning.