If you have a diamond ring or other diamond jewelry you no longer want, you might be surprised to learn that the resale value of a diamond is typically much lower than its retail price (what it initially cost in a store) and even its wholesale price (what jewelry stores pay for diamonds in bulk).

In fact, because diamond prices are so depressed thanks to the lab-grown diamond market and a struggling economy, you may get as little as 10% to 50% of the retail value of your diamond.

I recently met a woman named Phyllis who shared the gemological report for a 2.65 carat solitaire ring in 18-carat white gold that her ex-husband paid $15,000 for in 2017. The report from that year gave an insurance value of more than $26,312, and Phyllis told me she expected to get $6,500 in resale value.

We emailed the report to a local jeweler that specialized in buying diamonds, who replied that because the ring is color-enhanced, she could not buy it because there was no market for it.

While this may be disappointing, many people are selling their diamonds today before prices go lower.

Learn more about where and how to best sell your diamond.

In this post, we’ll explain:

What affects diamond resale value

Diamond resale value in today’s market

How to determine the resale value of diamonds

Bottom line: Know the resale value of your diamond before you sell

What affects the resale value of a diamond?

If you’re looking to sell a diamond engagement ring or other diamond jewelry, there are several factors that may affect its resale price:

1. Quality of the diamond

The quality of a diamond is determined by four characteristics that all begin with the letter C:

- Cut – The shape the diamond is cut into (some cuts are more in demand/valuable than others, and trends are always changing)

- Clarity – The fewer visible flaws and inclusions (non-diamond materials that get encapsulated in the diamond), the more valuable

- Color – Colorless diamonds typically command a higher price

- Carat – The higher the carat weight, the more a diamond is worth

A diamond grading report from the Gemological Institute of America1 or an appraisal from a GIA-certified gemologist can inform you about all of these qualities in your diamond jewelry.

2. Demand for diamonds

The demand for diamonds fluctuates over time. Right now, in February 2024, the demand for diamonds isn’t very high. According to Rapaport News,2 a leading outlet for diamond market information, sales have slowed in the U.S. in part because mined diamonds are facing strong competition from lab diamonds and fake diamonds like moissanite.

However, if you’re holding out on selling your diamonds hoping to get a much larger price in the future, you might want to reconsider.

“I tell people that if you put that diamond back in your closet and you wait a year or you wait two years, you are not going to hit the jackpot,” says Jonny Ritz, owner of the boutique jewelry shop Jonny Ritz & Co in Los Angeles.

In other words, consider selling now before prices go even lower. Or, at least get what the diamond is worth now and invest that cash.

Ritz advises customers not to treat diamonds like an investment that might appreciate over time — in contrast to common investment vehicles like gold or silver.

3. Economic factors

The state of the economy has a large influence on the price you can get for a diamond, and right now, the economy is pushing the price of diamonds down.

More on that below.

Diamond resale value in today’s market

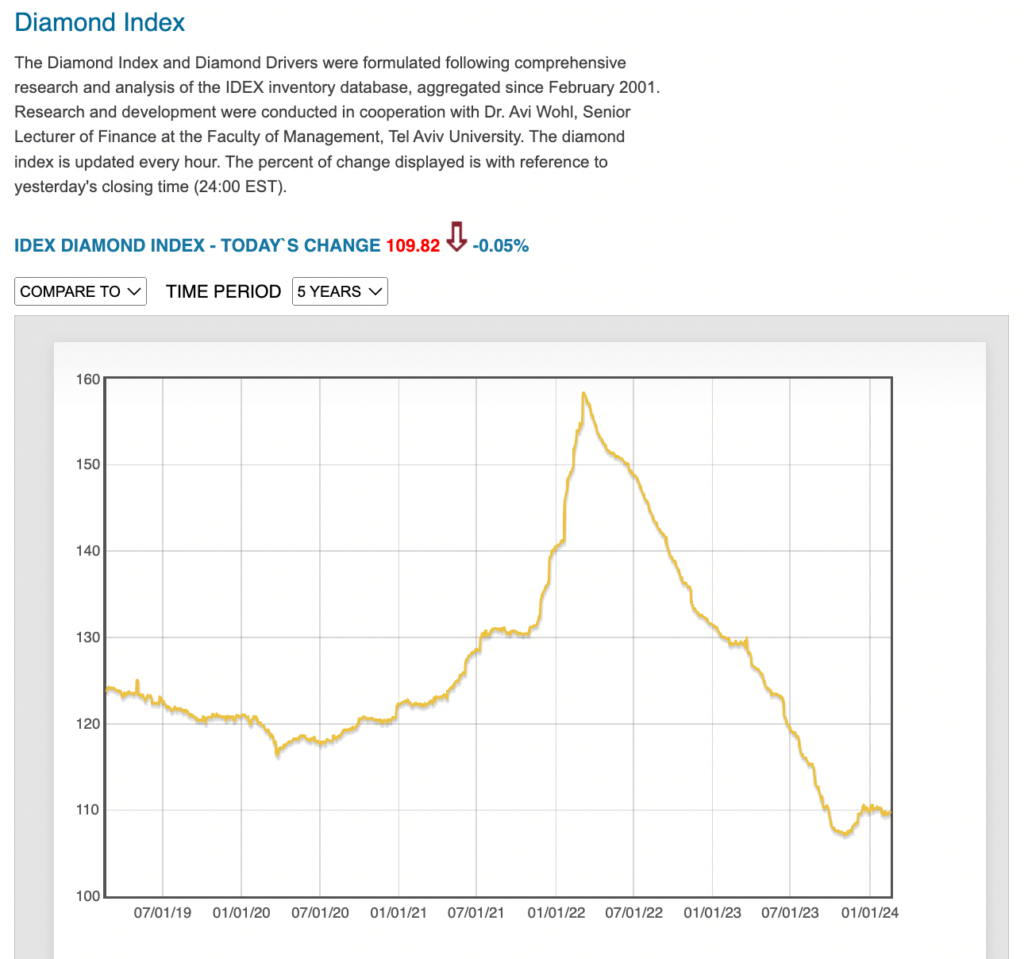

Diamond resale prices have been on a roller coaster over the past few years. Prices jumped 31% during the pandemic and peaked in April 2022 but have since fallen more than 30%, according to IDEX, which tracks global diamond trends.3

While the diamond market isn’t very strong right now, that isn’t the case for gold, which may make up the band or setting of your diamond jewelry.

When looking at the resale value of diamond versus gold, gold is performing much better in 2024, sitting near its record high set in December 2023.5

As of , the spot gold value in the United States was trading at $ per ounce, or $ per gram.

How much do you lose selling a diamond?

Expect to lose between 50% and 90% of what you paid for your diamond at resale. The reasons include:

- Diamond buyers are really only interested in the center stone, which they can repurpose into other, more contemporary pieces of jewelry or custom items for their clients. The retail price you paid includes the design, smaller side stones, labor, and the retail experience. A diamond wholesale buyer or diamond exchange will melt the metal down to scrap.

- The retail price of a diamond is marked up from what the jeweler initially paid for it, sometimes more than 300% of its wholesale cost.6 Diamond buyers aren't going to pay you what you paid because they need to make a profit when they turn around and resell your diamond.

- There is often confusion about the total carat weight of a diamond ring or other jewelry. A common misunderstanding is that the jewelry owner believes that, for example, she has a 1-carat diamond ring, when in reality, the center stone is .5 carats, and the surrounding smaller stones total .5 carats. Most jewelers or jewelry buyers value the smaller stones very little — perhaps less than $100 total in this case — and are only interested in the center stone.

One of the reasons many women choose not to sell their diamonds or diamond ring is that the price they are quoted from a jeweler or auction site is much lower than they believe their rings to be worth.

That said, diamonds do have a vibrant resale market, and old jewelry, a ring from a divorced marriage, or inherited estate jewelry can bring much-needed cash when you need it.

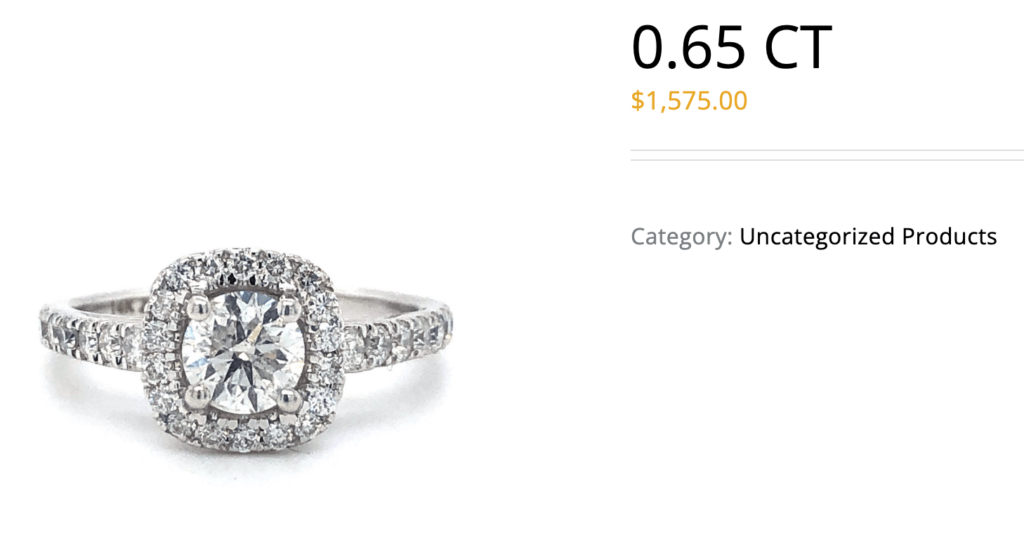

We pulled some recent jewelry sales from February 2024 on Diamonds USA and compared them to a similar piece's estimated retail value:

0.65 carat halo diamond ring with I colored diamond

Estimated retail value: $2,800-$3,700

(Price varies depending on the clarity and cut of the diamond, metal purity, and retailer markup)

Resale: $1,575

2.7 total ct weight gold bracelet

Estimated retail value: $2,800-$6,000 (varies by retailer and style)

Resale: $1,200

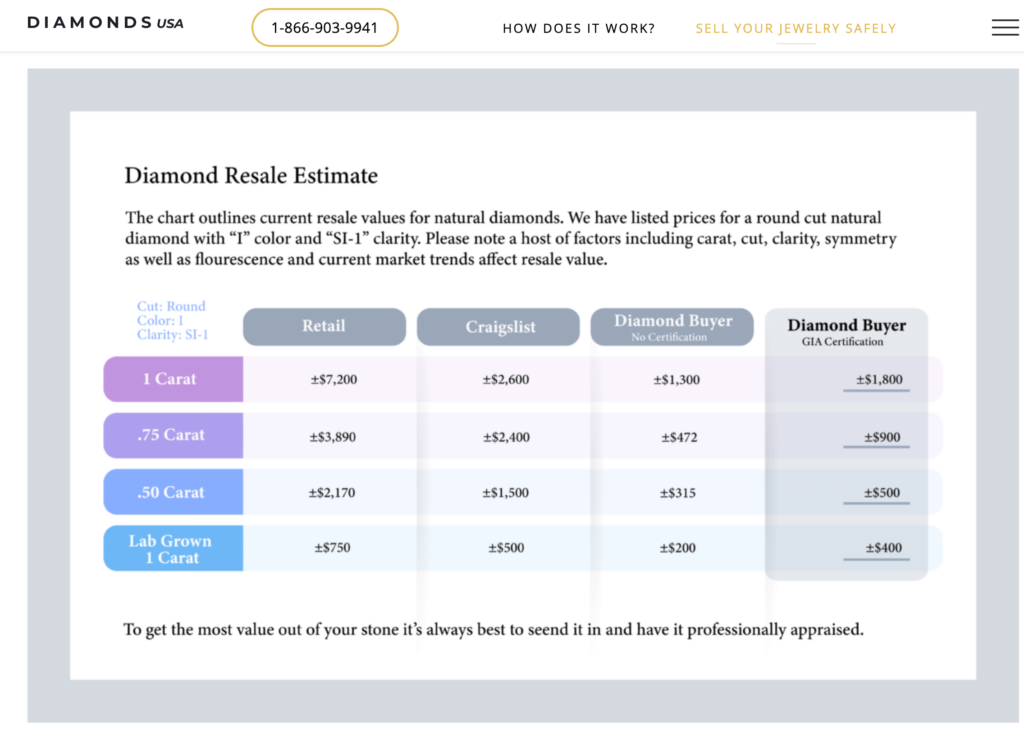

Diamonds USA also offers this chart to help sellers understand what they can expect to make on both lab and mined diamonds:

How do you determine the resale value of diamonds?

At the end of the day, your diamond is worth what someone is willing to pay you for it at that moment.

You can always walk into your local jeweler and see if they will buy your jewelry or loose diamond for cash — and take the offer on the spot.

However, it can be more profitable to sell a diamond ring or other diamond jewelry online from one of the top diamond buyers, who will send a FedEx or USPS mailer to your door for free and overnight your item to their offices for evaluation, appraisal and quick payment.

Before you sell, there are a few ways to determine how much your diamonds might be worth in the current market:

A certified diamond grading report

A diamond grading report is also known as a diamond certification or a lab report. It’s not the same as an appraisal, which we detail directly below.

A grading report is a document that states the technical specifications of a diamond. It’s produced by a small handful of independent, internationally-known labs, such as GIA.

These labs are independent entities, so reports are useful if you’re looking for unbiased information. To create the report, lab technicians take the diamond out of its setting and examine it with specialized equipment.

You should get a diamond grading report if you want to be confident in the exact specifications of your diamond. Some diamond buyers require that the stone be certified before purchase.

Reports are also useful if you want to insure jewelry or get a loan on jewelry. If you are looking to sell a higher-value diamond in particular, a diamond grading report may be worth it to give you more specific information about the value of the stone.

However, it’s important to note that a grading report won’t provide you with a retail or resale price.

A diamond appraisal

In contrast to a diamond grading report, which is detailed above, a diamond appraisal will list the replacement value for the jewelry, or the retail price you’d pay today.

So if you purchased a diamond princess-cut ring for $4,000, for example, the appraisal should state a value around $4,000.

It’s important to note that an appraisal won’t list the resale value, which is typically between 10% to 50% of the retail value.

During an appraisal, the jewelry will be examined, but the stone won’t be taken out of its setting. You’ll also receive the technical details of your jewelry.

Since the price of an appraisal can sometimes cost $150 or more, they aren’t necessarily advisable unless your diamond is worth more than $1,000.

A diamond resale value calculator

While there are accurate calculators available online for commodities like gold and silver, there is no such public tool for the precise value of a diamond. There are sites that can give you an estimate, but the value you may be able to receive for a particular diamond can vary considerably.

That’s because there is no public exchange for diamonds like there is for gold or silver. Those within the industry have access to more information about current diamond values, but again, the price of a diamond is contextual.

That’s why it’s best to shop around for the best resale price if you have the time, getting quotes from online diamond buyers and at trusted local pawn shops or jewelry stores.

Diamond resale value FAQs

If you want to sell diamonds, here are some things you should know:

Do diamonds lose value after purchase?

Yes, in the vast majority of cases, diamonds lose value after purchase.

“It’s like when you buy a car,” says Karen Taub, who founded Madison 501, a private-label jewelry manufacturer in New York. “Unfortunately, there’s a loss of value as soon as it changes hands.”

There are a number of reasons why they lose value immediately. Wholesale sellers add some markup to the price after they receive it from a manufacturer. On top of that, retail sellers may add their own significant markup.

Retailers are able to do that because when people buy diamond jewelry, it’s often for a personal or emotional occasion, such as an engagement, wedding, or anniversary. This drives people to buy brand-new jewelry that’s special and unique — which depresses the market for second-hand diamond pieces.

Taub says that whenever a diamond ring is sold back to a jeweler, it’s often taken apart and melted down to make a brand new piece of jewelry. This adds additional costs for the jeweler and is another reason why the resale price isn’t as high as the retail price.

Do lab-created diamonds have any resale value?

Right now, lab-created diamonds have very little resale value, despite their growing popularity as a mined diamond alternative.

Very few online diamond buyers will pay you for your lab diamonds.

How do you determine the resale value of a diamond ring?

If you have diamond ring in-hand and you’d like to figure out its value, you have several options:

- Have the diamond ring certified by getting a grading report from a reputable organization like GIA. This report won’t come with an estimate of its dollar value, but you can use the report to help get an accurate dollar value during an appraisal with a jeweler or other buyer.

- Send your diamond ring to an online diamond buyer that will provide you a free, insured mailer. We recommend A+ rated Diamonds USA, which pays within 24 hours of accepted offer.

- Take your jewelry to local jewelry stores and pawn shops to get a range of quotes.

In general, expect to receive anywhere between 10% to 50% of the original retail price you paid.

Do used diamonds lose value?

Diamonds generally lose value immediately after purchase. The only exceptions are very rare or unique diamonds that are quite high in price.

The value of a diamond over time will depend on the market conditions for diamond resale. While you’ll typically always lose value in reselling a diamond, there are better times and worse times to sell. This often changes with the state of the economy, as the price of luxury items like jewelry tend to decrease in economic downturns.

Diamond value is also based on the supply of diamonds from the major diamond companies. The success of lab-created diamonds in the past few years has added another wrinkle to the market. Lab-created diamonds are generally driving down the price of diamonds, since they’re so much cheaper to produce.

Is there a diamond value calculator?

While there are accurate online calculators for gold, silver and other precious metals, a diamond value calculator is only available to members of the trade because there is no standard diamond exchange (or central location where diamonds are bought and sold) accessible to the general public.

If you are interested in selling a diamond, the price of diamonds is best understood through the quality as determined by the 4 C’s, and by being evaluated by a respected laboratory, such as GIA, which uses industry-specific equipment.

Armed with the lab report, bring it to a GIA-certified jeweler who can inspect, evaluate, and offer a price.

However, if you want to sell diamond jewelry set in gold or another precious metal, you can use a calculator like the one on CashforGoldUSA's website to determine how much the precious metal content is worth:

Bottom line: Know the resale value of your diamond before you sell

Diamond prices have been steadily falling since they peaked in April 2022 and are expected to continue falling as lab-grown diamonds increase in popularity and drop prices.

If you’re looking to sell diamond jewelry, you have several options. If you’d like to sell your diamond in person, we recommend checking Yelp and the Better Business Bureau for reputable pawn shops and jewelry stores in your area. Make sure to get quotes from several businesses, as what they offer you may vary.

If you’d like to get a competitive offer without leaving your home, you can mail your jewelry to a number of online companies. Compared to brick and mortar stores, they have less overhead and more competition, both of which increase the prices they offer sellers.

We recommend the family-owned Diamonds USA in particular among online companies for a number of reasons. Diamonds USA:

- Has an A+ rating from the Better Business Bureau

- Sends you a free mailer insured to $100,000 to send in your jewelry

- Pays within 24 hours

- Offers a 10% bonus if you accept the sale within a week

That said, there are other sites and buyers you can look into in addition to Diamonds USA, especially if you have estate jewelry, a higher-end piece, or additional metals you would like to sell.

To learn about other buyers, marketplaces, and recyclers, check out 16 best diamond buyers “near me” and online.

SOURCES

- “Analysis and Grading,” GIA. https://www.gia.edu/gem-lab

- “Why retail jewelers aren’t buying,” Sept. 26, 2023. Rapaport. https://rapaport.com/analysis/why-retail-jewelers-arent-buying/

- IDEX Diamond Index. http://www.idexonline.com/diamond_prices_index

- “Treasury targets price cap violation network and implements G7 ban on Russian diamonds,” Feb. 8, 2024. U.S. Department of Treasury. https://home.treasury.gov/news/press-releases/jy2085

- “Why gold prices are hitting records,” Dec. 5, 2023. Wall Street Journal. https://www.wsj.com/finance/commodities-futures/why-gold-prices-are-hitting-records-5772ec5f

- “Hidden camera video reveals just how high diamond markups can be,” March 30, 2017. Yahoo News.