If you are struggling to keep up with your monthly car payment, you’re not alone. Credit rating agency Fitch Ratings1 found that 6.1% of subprime borrowers (those with a credit score between 501-600) were late or at least 60 days past due on their auto loan payment as of September 2023 — the highest share recorded since they began tracking in 1994.

If you’re looking for ways to lower your monthly car payment, these are some viable options:

- Refinance to a lower rate

- Extend your loan term

- Negotiate with your lender

- Sell or trade in your car

- Lease a vehicle

- Make extra car payments

Understanding your car payment

When a lender determines your monthly payment, it is calculated based on:

- Principal: The amount you are paying for the car, which decreases over time as you make payments

- Interest: The amount the lender charges you to borrow the money needed to buy the car, which is determined by your credit score (the higher your score, the better your rate)

- Taxes and fees: Any sales tax and fees included in your purchase contract, which vary by dealership and state. Five states don't charge sales tax on auto transactions: Alaska, Delaware, Montana, New Hampshire and Oregon.2

- Length of loan: The longer the loan term, the lower the monthly payments — but the more you will pay over the course of the loan.

Of course, this doesn't account for the many other costs of car ownership: gas, repairs, registration, depreciation — not to mention insurance.

While those costs are mostly fixed, you can usually find ways to lower your car payment:

6 ways to get a lower car payment now

Here are five ways you can lower your car payment:

1. Refinance your vehicle loan to a lower rate

If your credit score has improved since you got your car loan — for instance, if you’ve never made a late payment — you might be able to refinance at a lower interest rate.

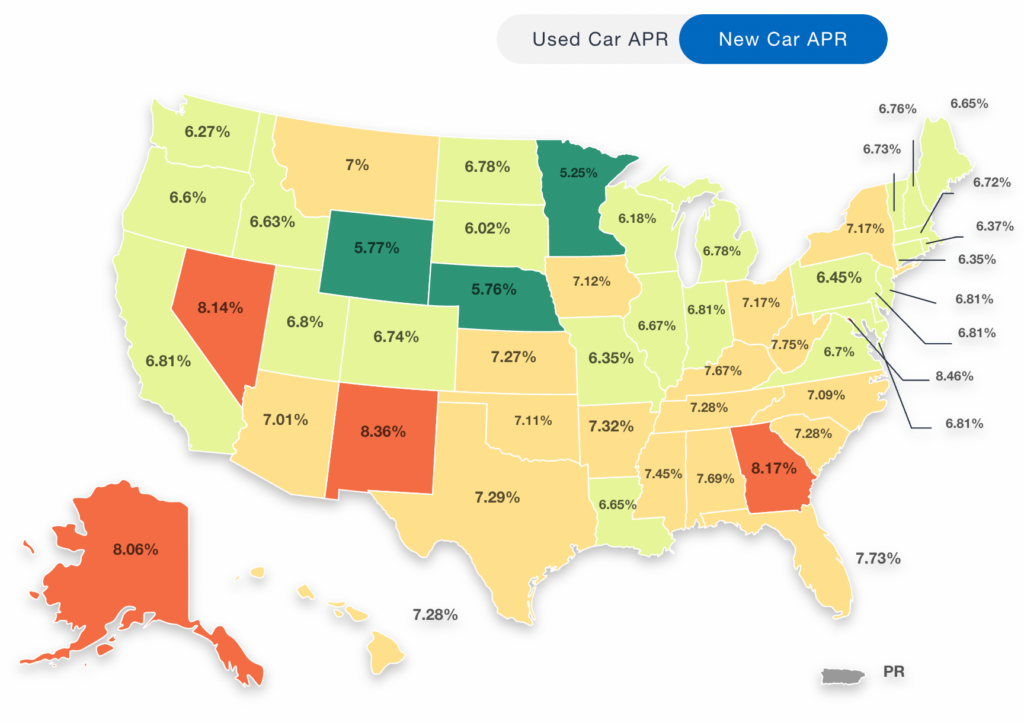

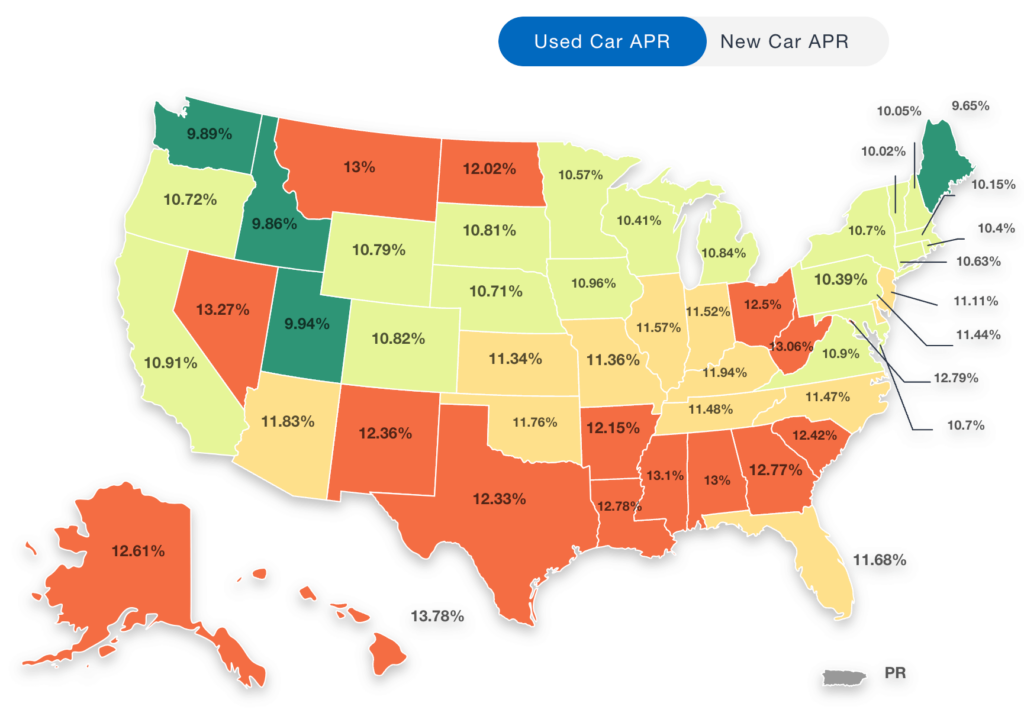

Edmunds4 put together the average car loan rates for new and used cars by state as of January 2024. Used car rates are often similar to refinance rates, though your new rate will depend on several factors, including your credit score and overall debt-to-income ratio:

These are starting rates for some of the top auto refinance companies and their Better Business Bureau ratings as of February 2024:

| Lender | Starting rate | BBB rating |

| Auto Approve | 5.24% | A+ |

| AutoPay | 4.67% | A+ |

| Caribou | 5.99% | A+ |

| Gravity Lending | 5.99% | A+ |

| RefiJet | 5.29% | A+ |

| Upgrade | 3.89% | A+ |

If your credit score isn’t high enough to qualify for refinancing, check out these tips for repairing your credit score and managing your debt.

Can't afford your car payment? See if you qualify to refinance for a lower payment.

Auto Credit Express is A+ rated with the Better Business Bureau:

- Average Saving: $1,700 or $143 per month

- Minimum Credit Score: 525

- APR from 3.99%

- Loan Amounts: $5,000 – $45,000

- Vehicle Criteria: Under 10 Years/150K Miles

Get a refi quote from Auto Credit Express in 30 seconds >>

2. Extend your repayment term

You may also be able to extend your loan to a longer term to lower your monthly payments. If your current loan was for 36 months and you refinance to a 60-month loan, your payments will be stretched out over a longer term, making each monthly payment lower.

However, if you extend the term of your loan, you will end up paying more in interest over the life of the loan.

Before you extend your loan, calculate how much you’ll have to pay over time with the new loan and interest rate vs. the amount you’d pay over the life of your current loan.

For example, this is how much you’d pay for a $30,000 car loan at 10% interest rate over two different loan periods (not including taxes and fees):

| Monthly payment | Paid over life of the loan | |

| 36 months | $968.02 | $34,848.56 |

| 60 months | $637.41 | $38,244.60 |

According to Experian’s third-quarter automotive finance report for 2023,2 the average monthly car payment was $726 for a new car and $533 for a used car, though car prices are currently down 3.5% from January 2023.3

3. Talk to your current loan provider

Rather than refinancing with a completely new auto loan, you may be able to lower your car payments with a loan modification. The first step is to talk with your current lender who does not want to lose you as a customer, should you refinance with another bank.

Cameron Smith, VP of lending at Neighborhood Credit Union in the Dallas-Fort Worth area, says car loan customers can simply call to request a loan modification.

“By telling us the situation, what their goal is, and what would help them the most, we can come up with a solution that helps fit what the member is wanting,” Smith says.

Smith says your lender may suggest one of the following options:

- Refinancing

- Extending your loan repayment period (which will result in more interest payments)

- Trading in for a cheaper vehicle

Another option is to contact the dealership where you bought your car to approach your lender for you, says Scott Kunes, COO of Kunes Auto Group in Delavan, Wis.

“You can approach your lender directly, but your dealer may have a better pathway to the lender and can get you to the right person to speak with,” Kunes says.

He says the dealership may also be able to help you explore options with a different lender.

If you’re in danger of missing a payment, your lender may also be able to offer forbearance, which is an agreement to reduce or skip payments for a set period of time.

One Reddit user was four months behind on car payments and trying to figure out how to get rid of their car. Some other users encouraged them to first call their lender, who set them up on a payment plan they could manage:

Keep in mind that even if your loan is in forbearance, you will still have to pay the full amount eventually, and you may end up paying additional interest over time.

4. Sell or trade in your car

If you absolutely can’t afford the car you’re currently driving, you could trade it in for a less expensive vehicle or look into public transportation options.

Before trading in your car, make sure the dealer will pay enough for your car to pay off your current car loan. Even if you no longer possess the car, you are still responsible for paying off whatever remains of your loan balance.

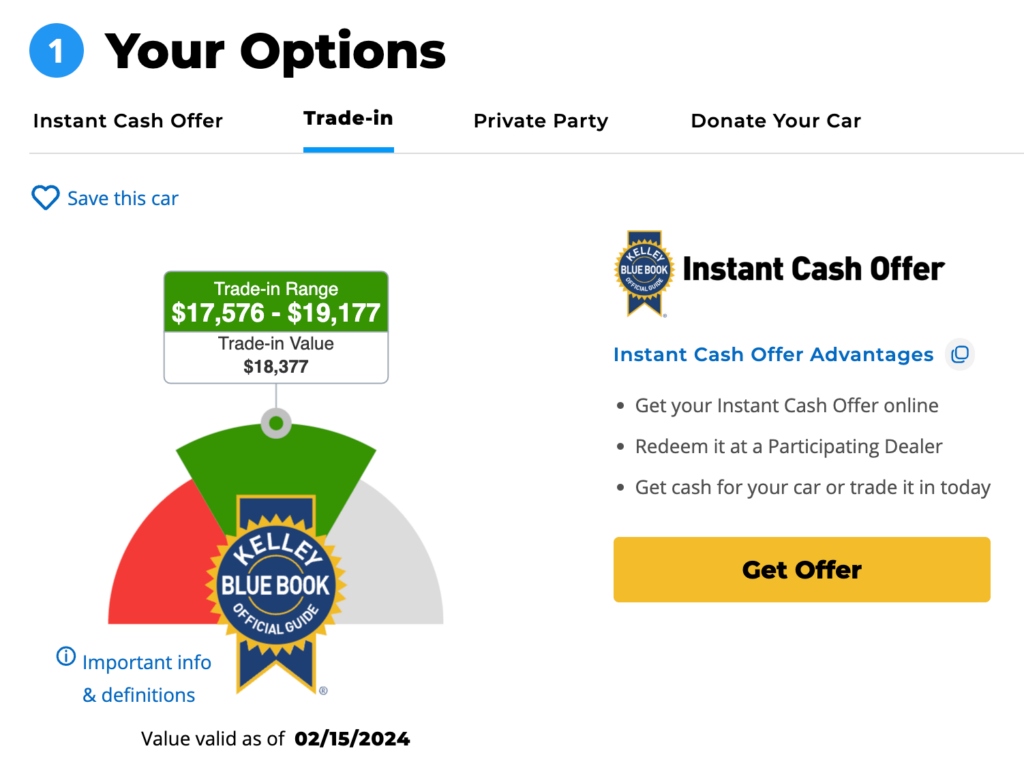

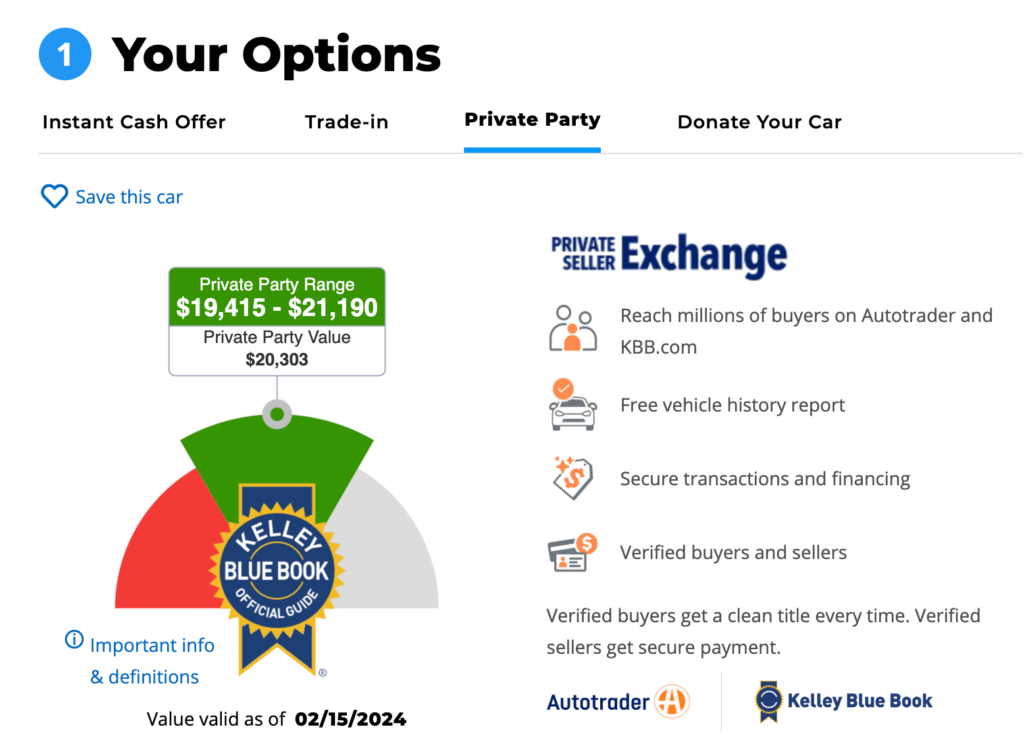

You can research your car’s trade-in value on sites like Edmunds and Kelley Blue Book so you come to the dealership prepared to negotiate your price.

You can often get a higher price by selling your car privately rather than trading it in at a car dealership.

For example, Kelley Blue Book prices a 2020 Honda CR-V’s trade-in value at about $18,377 and its private sale value at $20,303:

However, if you haven’t yet paid off your car loan, selling a car on your own can be tricky. Some loans have strict guidelines about selling the vehicle before the loan has been paid.

Look up the details of your loan, and if you have the right to sell the car on your own, conduct online research to determine the right price.

Call your current lender to find out your payoff amount, and try to sell the vehicle for at least that amount. If you sell your car for less than you owe on your car loan, you’ll be stuck making payments on a car you no longer own.

Check out our tips on how to sell your car for the most money and places to sell junk cars for cash.

After selling or trading in your car, you’ll have to apply for a new vehicle loan to finance a less expensive car, unless you have enough cash to pay for it outright. If you have a low income, you might also qualify for a free car.

If you're ready to buy or refinance a car, but you have low or no credit, Auto Loan Express is a quality lender:

- Better Business Bureau rating of A+

- In business since 1999

- For new or used cars

- Auto loans and refi for buyers who have low or no credit, or who have gone through bankruptcy or had a vehicle repossessed

- Pre-approval within 30 seconds

24 hours to a car loan with Auto Loan Express >

If you decide a new vehicle isn’t financially feasible, look into public transit options in your area. Also, learn if you may qualify for free bus passes.

5. Lease a vehicle

If you sell your current car and opt to lease, rather than buy, another one, you may be able to lower your monthly car payments. That’s because car lease payments are lower than purchase loan payments for the same vehicle.

When you lease, you’re paying for the privilege of driving the car for a specified period of time and then returning it, rather than paying for ownership of the car. Leases typically have limits on the number of miles you can drive per year.

Edmunds offers a calculator5 to determine the cost of buying vs. leasing a vehicle. For a 2024 Toyota Corolla priced at an MSRP of $23,076, you can save nearly $150 per month by leasing, though you will not own the vehicle at the end of the lease term and you will have to lease or purchase a new vehicle when your lease period ends:

| 36-month lease | 60-month loan | |

| Total cost | $11,232 | $24,691 |

| Monthly payment | $312 | $466 |

These calculations are based on a 5% interest rate and no down payment for a purchased vehicle.

While leases are intended for temporary usage of the car, you may have an opportunity to buy your leased car when the lease term has ended, if you choose.

In most cases, leases are for new cars, though some dealerships offer leases for used cars. Some dealers will also let you trade in your current vehicle for a leased vehicle. Take time to learn all the details of the lease agreement and the total costs you will pay before agreeing to lease a car or trade in your car for a leased vehicle.

For example, if you lease a vehicle, you will always have a monthly car payment. If you purchase, you may pay more each month, but once you pay off your vehicle, you will not have a car payment. Plus, you now have an asset you can sell.

6. Make extra car payments

While not a viable option if you are low on cash, paying a little bit extra on your loan each month can help you pay it off more quickly — accelerating your way to the Shangri-La of $0 car payments.

One way to make extra car payments without feeling the pinch is to split the payment in two. If you pay half the monthly payment every two weeks, you’ll end up making an extra payment each year. For a 60-month loan period, you’d pay off your loan five months early.

For example:

- $400 monthly payment over 12 months = $4,800 per year

- $200 biweekly payment over 52 weeks = $5,200 per year

These are some of the best tactics to reduce your car payment if you already have a car loan. However, the best way to secure an affordable car payment is to make wise decisions before you buy the car. Purchase an affordable vehicle and shop around for the lowest interest rates, so you start out with a car payment you can afford long term.

If you're struggling, check out these other resources:

SOURCES

- “Smaller/New Lenders Push Subprime Auto ABS Delinquency Index Higher,” Nov. 2023. Fitch Wire. https://www.fitchratings.com/research/structured-finance/weaker-issuer-volume-growth-affects-subprime-auto-abs-delinquency-index

- “6 Hidden Costs of Getting an Auto Loan,” June 17, 2022. Experian. https://www.experian.com/blogs/ask-experian/hidden-costs-of-auto-loans/

- “Kelley Blue Book Reports New-Vehicle Transaction Prices Continue to Tumble, Down 3.5% Year Over Year in January,” Feb. 13, 2024. Cox Automotive. https://www.coxautoinc.com/market-insights/kbb-atp-january-2024/

- “January Car Loan Rates (APR) in the U.S. for Used and New Cars,” Edmunds. https://www.edmunds.com/car-loan-apr-interest-rate/

- “Lease vs Buy Car Calculator,” Edmunds. https://www.edmunds.com/calculators/lease-vs-buy-calculator/