Ethos offers term and guaranteed whole life insurance policies with no medical exams ever for people ages 20 to 85.

Like other online insurance providers, Ethos uses a detailed questionnaire to ask questions about your health, finances, and lifestyle to determine whether or not they can offer you coverage.

I was ultimately not offered an insurance policy based on my BMI and health conditions, though I should note that I also haven’t been approved for any other online provider to date.

Ethos claims to approve 95% of applicants for policies, which means if you are generally healthy, you should be able to obtain an affordable life insurance policy through Ethos.

- Yes, it’s real. Ethos is a legit life insurance company.

- Ethos is not for everyone.

- Ethos has no medical exams ever.

Details about Ethos life insurance policies

- What policies does Ethos offer?

- Who underwrites Ethos insurance?

- Does Ethos offer riders?

- Does Ethos pay out?

Ethos vs. other life insurance companies

Bottom line: Ethos is worth considering if you need to buy life insurance

What we found in our review of Ethos: 3 things to know

1. Yes, it’s real. Ethos is a legit life insurance company.

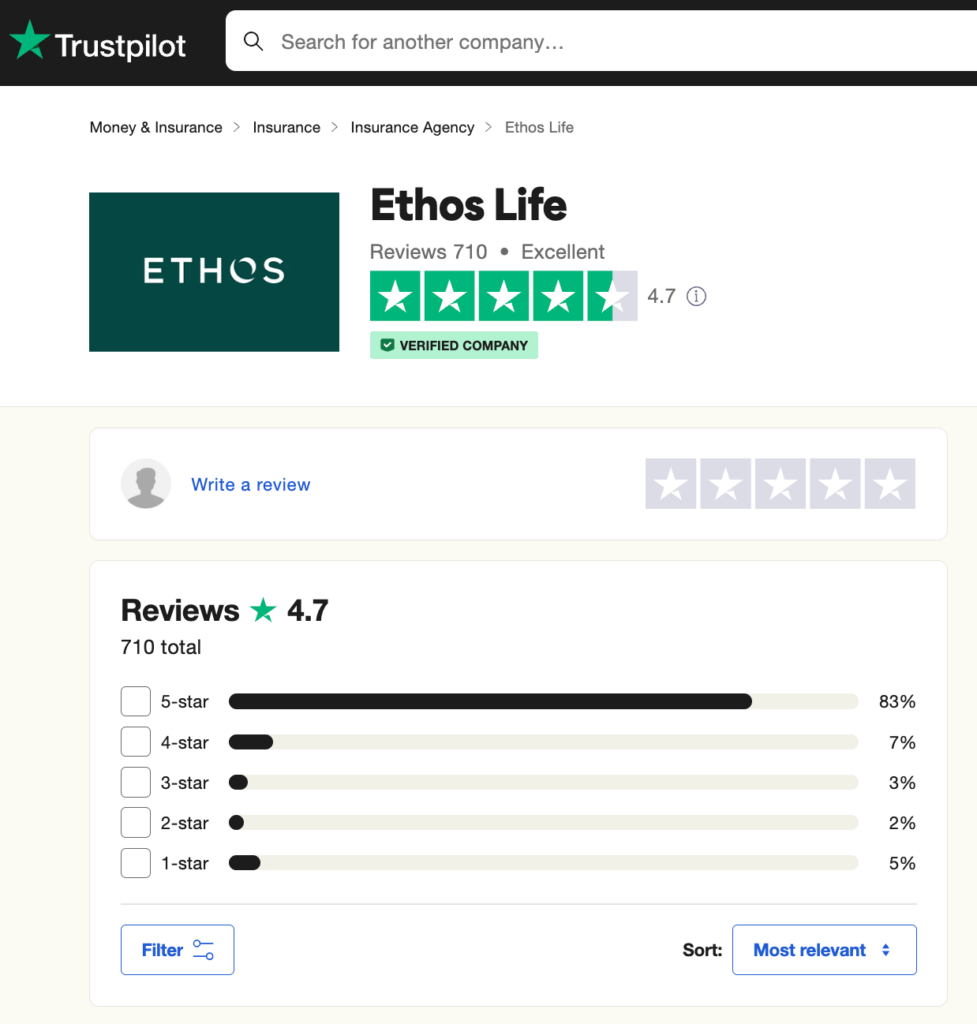

Although it was only founded in 2016, Ethos is a legit life insurance company with an A+ rating from the Better Business Bureau and 4.7/5 stars on Trustpilot. Ethos administers policies from established insurance carriers, including:

- Legal & General America (est. 1981)

- Ameritas Life Insurance Corp. (est. 1887)

- TruStage Financial Group, Inc. (underwriter CMFG Life est. 1935)

- Senior Life Insurance Company (est. 1970)

- Mutual of Omaha (est. 1909)

Ethos policies are also reinsured by Munich Rea, which holds an A+ BBB rating.

2. Ethos is not for everyone.

Ethos is licensed in every state except New York, plus the District of Columbia. They offer two types of policies:

Term life insurance:

- For people aged 20 to 65

- Policies can cover you until the age of 80

- $20,000 to $2 million in coverage

- 10-, 15-, 20- and 30-year terms

- Approval is based on your answers to questions about your medical history, finances, and lifestyle (where you work, whether you smoke, if you have kids, etc.)

Ethos claims to have life insurance policies that cover all health conditions and BMIs, but based on my experience, this isn’t true.

For reference, I am a 32-year-old woman with two children ages 4 and 9. I want term life insurance to be able to replace my income and support my family in the event that I die before my kids are financially independent.

However, because of my high BMI and health conditions — asthma, PCOS, anxiety, and IIH — I have been unsuccessful in obtaining life insurance coverage, both from Ethos and other providers like Ladder Life Insurance.

After being rejected, Ethos did suggest I call an agent to talk about other policy options, and an agent named Damon recommended I apply for an accidental death policy from Mutual of Omaha for $500,000, which would cost me $36/month.

While this coverage doesn’t offer everything I’m looking for in a life insurance policy, it is something I may purchase in the meantime while I work to improve my health until I can be covered.

Guaranteed issue whole life insurance:

- For people aged 66 to 85

- Policies cover you for life, with no payments after you turn 100

- $1,000 to $30,000 in coverage

- Guaranteed approval after you answer health questions to determine your rate

- Secure rate that never increases

While Ethos does guarantee approval for its whole life insurance policies, depending on your answers to its health questionnaire, you may not qualify for the full $30,000 in coverage.

3. Ethos has no medical exams ever.

Sounds too good to be true, right?

Well, it is true that Ethos will never require a medical exam, but that doesn’t mean everyone will be automatically approved for term life coverage. Ethos’ whole life policies, on the other hand, have guaranteed approval.

Ethos use an online questionnaire to weed out people who wouldn’t otherwise qualify for term life coverage — for example, if you have a high BMI, serious health conditions, or you work in a risky career.

For whole life insurance coverage, a set of health-related questions determine how much coverage you can receive and at what rate.

We evaluated Ethos in comparison to other online life insurance companies based on:

- Coverage – Amount of coverage available, variety of coverage options

- Ease of application – Online questionnaire, medical exams, overall user experience

- Price – Cost of coverage

- Customer service – BBB reviews/my personal experience with customer service

- Customer reviews – Customer ratings across major review sites

Our Ethos Life ratings:

-

Coverage

-

Ease of application

-

Price

-

Customer service

-

Customer reviews

What kind of insurance is Ethos?

Ethos offers term life insurance and guaranteed issue whole life insurance coverage.

Term life insurance provides coverage for a set period of time at a fixed rate, with a specific sum paid to your beneficiaries at the time of your death.

Whole life insurance provides permanent coverage with a guaranteed payout that builds cash value over time.

What others say about Ethos

Reviews for Ethos life insurance are overwhelmingly positive:

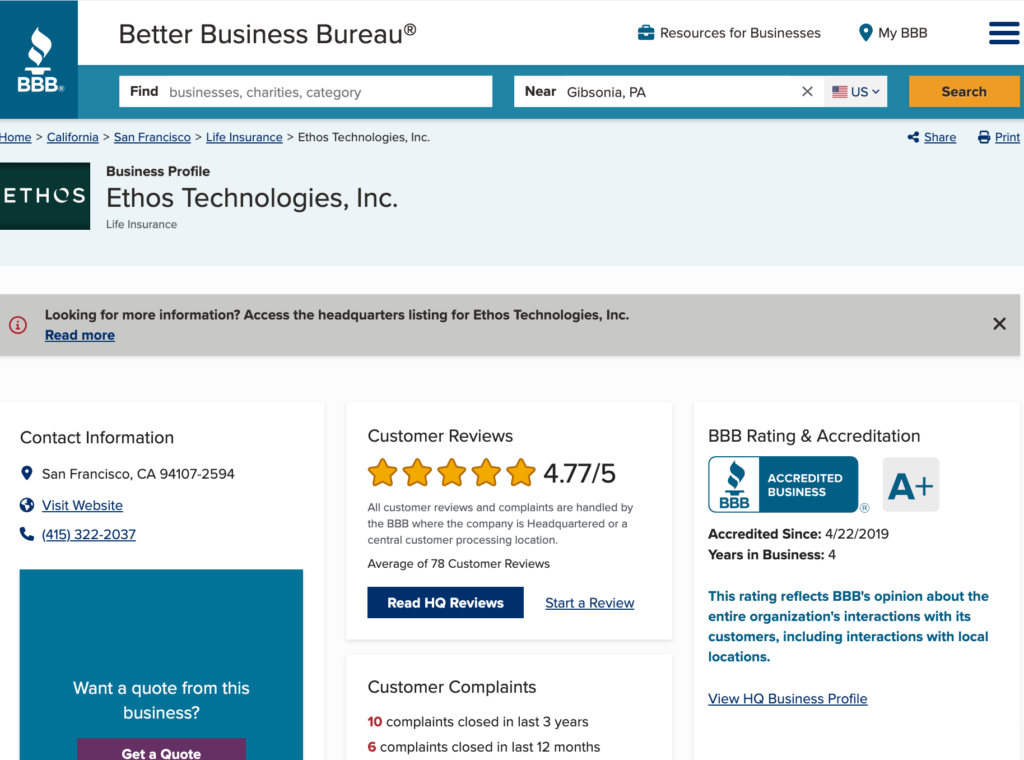

BBB rating and reviews

Ethos Technologies, Inc., has an A+ rating with the Better Business Bureau and 4.77/5 stars based on more than 75 customer reviews.

Trustpilot rating and reviews

Ethos has 4.7/5 stars based on 740+ reviews on Trustpilot.

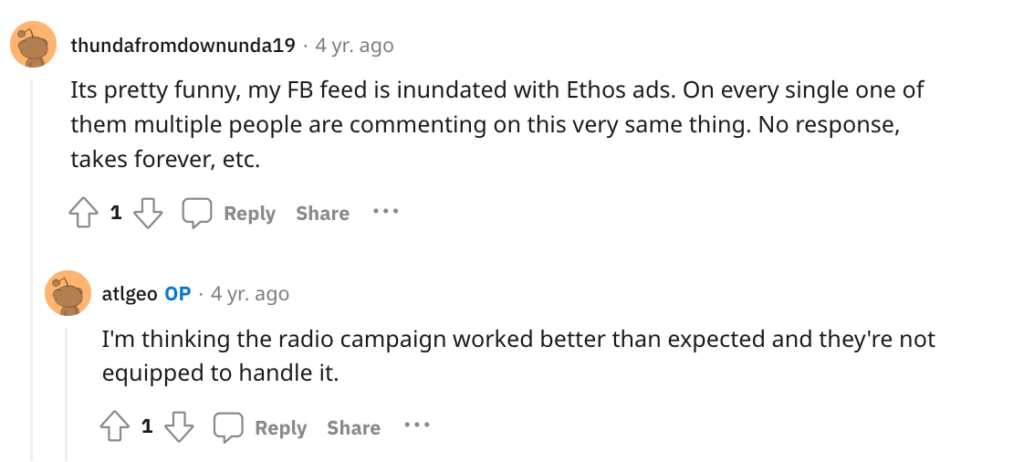

What Redditors think about Ethos

The only posts about Ethos on Reddit are from people thinking about applying for coverage. Responses are limited and are from people who have applied but are still waiting to hear if they’ve been approved for a policy:

Experience with ethos?

byu/atlgeo inLifeInsurance

Does anyone have any experience with Ethos life insurance?

byu/anonymous-2356 inInsurance

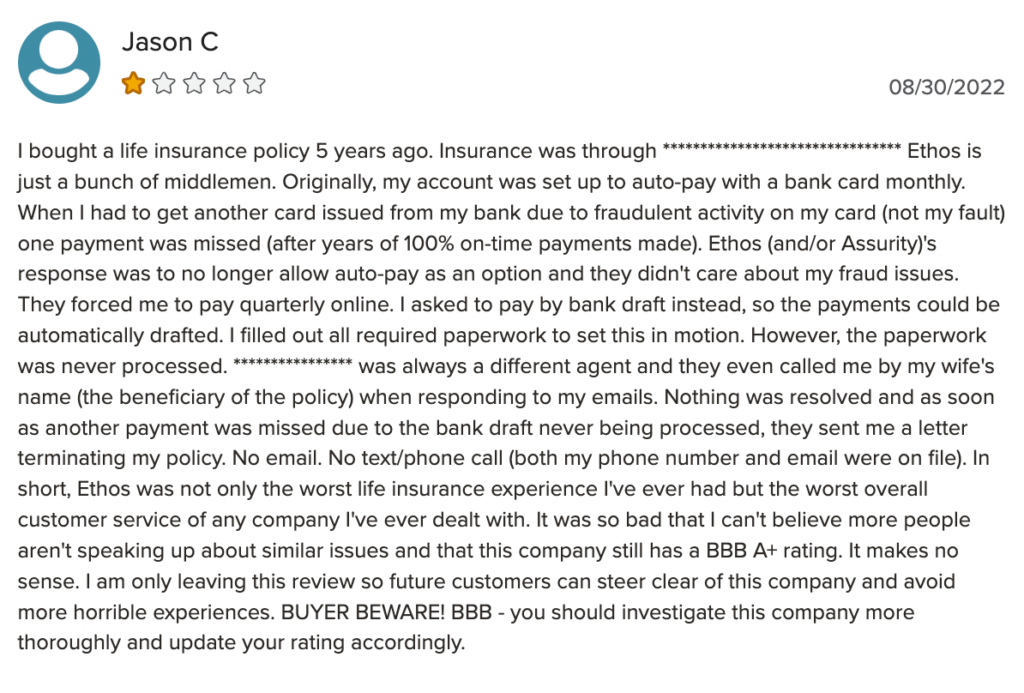

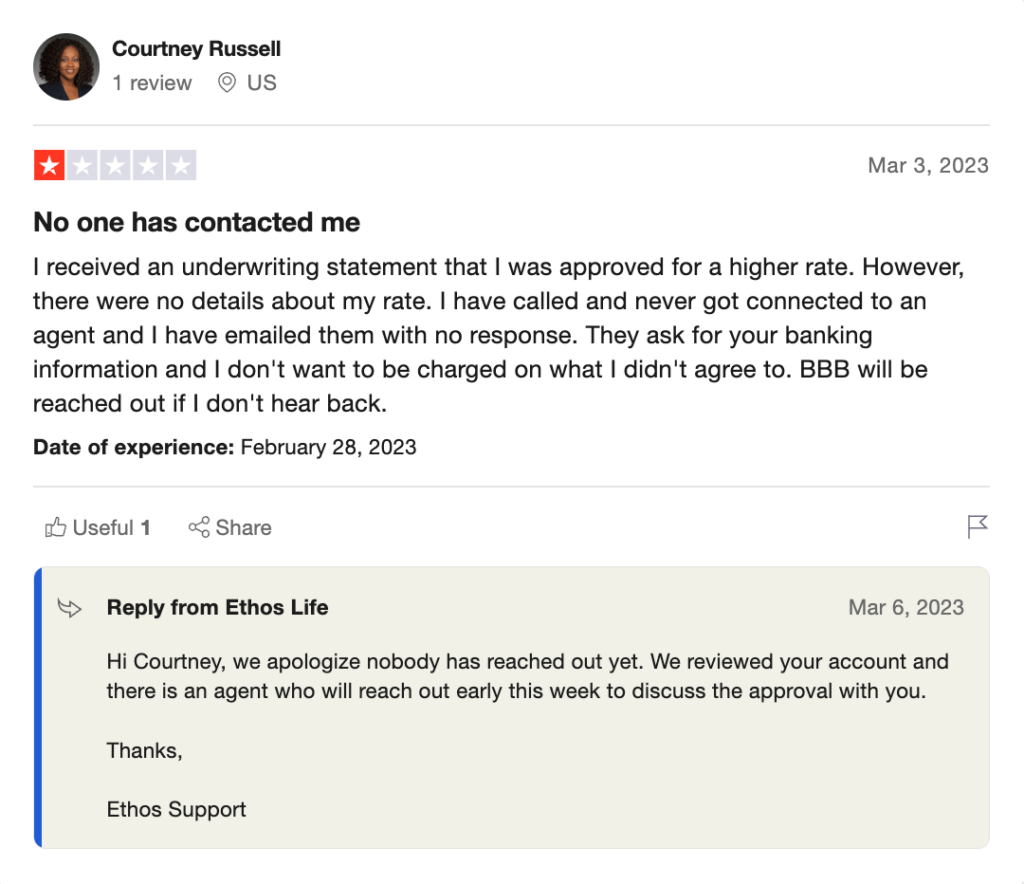

Common complaints

Common Ethos complaints are from people frustrated with the long underwriting process and those who have been unable to reach customer service:

From my own experience, it was difficult to find Ethos’ contact information on their website. The “Email us” button is at the very bottom of their home page, and there is no publicly listed phone number that I could find. I was only shown a phone number to call once I was rejected for a policy.

For reference, the number they listed was 415-322-1828. I was connected with an agent immediately after selecting the appropriate menu options.

On the other hand, I emailed [email protected] (which comes up when you click the “Email us button”) with a list of questions and have not gotten a response nearly three weeks later.

How much does life insurance from Ethos cost?

Ethos term life insurance coverage starts at $7 per month, with policies ranging from $20,000 to $2 million. This rate is based on a 20-year old healthy, non-smoking female for a 10-year term and $100,000 policy.

Whole life insurance policies are for $1,000 to $30,000 in coverage. A 66-year-old healthy, non-smoking female can expect to pay about $27 per month for $5,000 in whole life coverage.

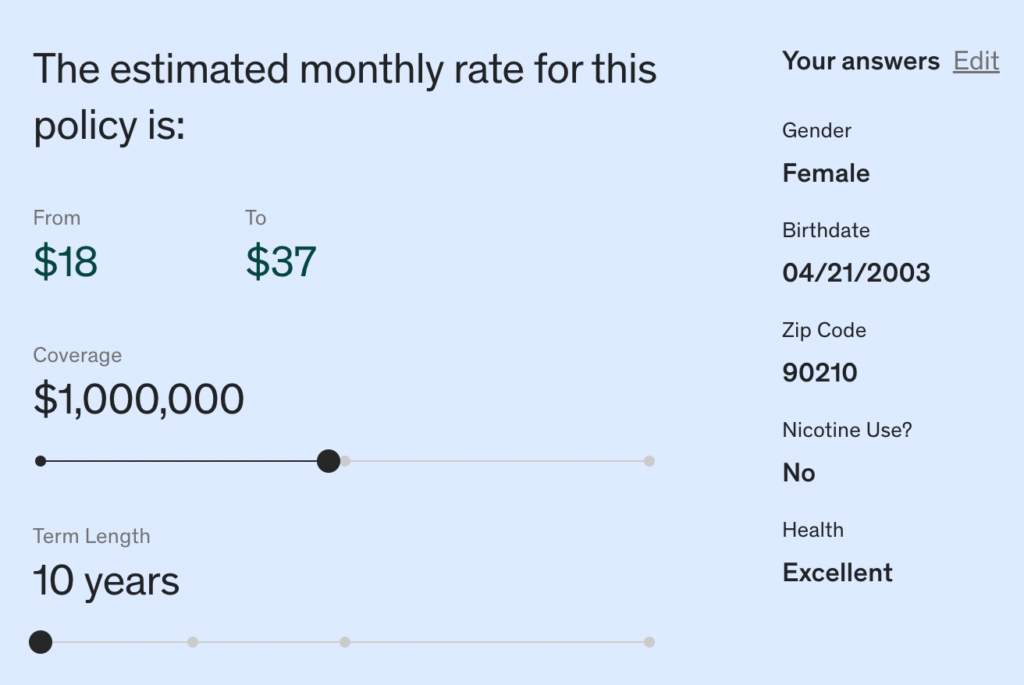

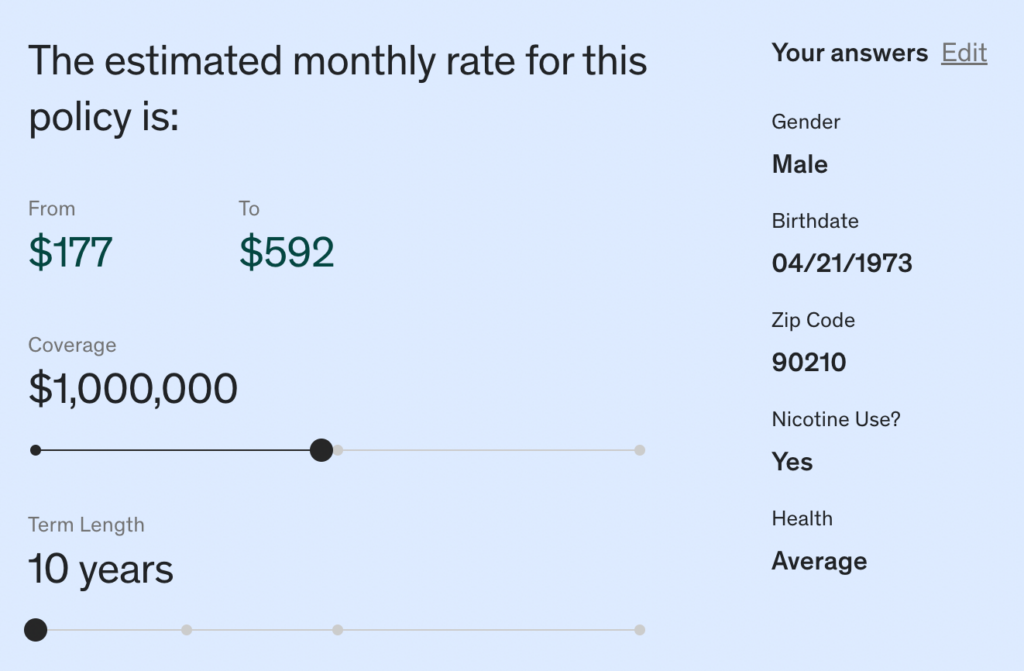

Ethos offers a life insurance calculator to give you a general idea of what you can expect to pay for life insurance coverage from Ethos. This does not take into account your specific answers to its more detailed application questionnaire.

According to Ethos’ calculator, a 20-year-old female with excellent health who doesn’t use nicotine products can expect to pay between $18 and $37 per month for a 10-year policy with $1,000,000 in term life coverage:

A 50-year-old male with average health who uses nicotine products can expect to pay between $177 and $592 per month for the same policy length and coverage amount:

Note that this calculator does not tell you whether or not you’d be approved for an Ethos policy but just gives you an estimate of what you can expect to pay if you were.

How does Ethos life insurance work?

Ethos uses a simple online application process to determine eligibility for term life insurance coverage. Based on your answers to their questionnaire, you’ll either be:

- Instantly denied or approved

- Notified via email if you qualify after an underwriting process, which may take anywhere from a few days to several weeks; you may be called to answer more questions about your health and eligibility

For whole life insurance policies, you are guaranteed approval, but a health questionnaire will determine how much coverage you can receive and how much you’ll pay.

Ethos’ questionnaire requires you to provide your:

- Name

- Contact info

- Medical history

- Employment and salary info

- Mortgage/total debt

- Beneficiaries

- Last four digits of your social security number

If you are approved for a policy, Ethos will pay out your coverage amount — known as a death benefit — to your beneficiaries in the event you die while covered.

Can’t afford health insurance? 5 health insurance options for single moms

Details about Ethos life insurance policies

If you’re considering an Ethos life insurance policy, here’s what you need to know:

What policies does Ethos offer?

Ethos’ term life insurance policies are for people ages 20 to 65, with coverage ranging from $20,000 to $2 million. Policies can cover you for 10, 15, 20, or 30 years, though you can’t get a policy that covers you past the age of 80. That means someone who is 65 would only be approved for a maximum 15-year policy.

Ethos’ whole life insurance policies are for people ages 66 through 85, with coverage that lasts until the end of your life. After you turn 100, your coverage remains in place but you no longer have to pay a monthly premium.

Who underwrites Ethos insurance?

Ethos administers policies underwritten by major insurance providers:

- Legal & General America (est. 1981)

- Ameritas Life Insurance Corp. (est. 1887)

- TruStage Financial Group, Inc. (underwriter CMFG Life est. 1935)

- Senior Life Insurance Company (est. 1970)

- Mutual of Omaha (est. 1909)

Does Ethos offer riders?

Ethos policies currently only include one rider at no additional cost — an accelerated death benefit, which allows the insured to withdraw a portion of their death benefit upon diagnosis of a terminal illness.

Does Ethos pay out?

Yes. At the time of your passing, your beneficiary will file a claim with your insurance carrier to receive payment in one lump sum, unless Ethos discovers you:

- Committed insurance fraud

- Answered questions within the application dishonestly

- Died by suicide during the first two years of the policy

Pros and cons of Ethos

These are some of the pros and cons of an Ethos insurance policy:

Pros

- A+ BBB rating and 4.7 stars on Trustpilot

- No medical exams ever

- Offers both term and whole life insurance

- Coverage options available for ages 20 to 85

- Policies underwritten by established insurance providers

- Life insurance calculator to give you an idea what you might pay before you apply

- 30-day money-back guarantee.

- No cancellation fees or penalties

Cons

- Difficult to reach customer service — no phone number listed on home page/slow email response time

- May deny coverage based on your answers to questions about your health, salary, mortgage/debt, and career/lifestyle

- Underwriting process may take several weeks if you are not instantly approved or denied

Can’t afford health insurance? 5 health insurance options for single moms

Ethos vs. other life insurance companies

Among other online life insurance providers, Ethos stands out because of its:

- High customer ratings

- Term and whole life insurance options

- Number of available carriers

I compared the estimated cost of an Ethos term life insurance policy for a healthy 20-year-old for a 10-year term at $500,000 in coverage vs. the same policy from competitors Ladder Life and Bestow.

Note that each of these calculators did not have the exact same criteria for coverage estimates. For example, Ethos didn’t ask for height/weight like the other calculators, so I chose “excellent” for health status and inputted a weight/height of 5’5” and 110 pounds with no health issues for the other two calculators:

- Ethos: $11 to $22 per month

- Ladder: $33 per month

- Bestow: $43 per month

Bottom line: Ethos is worth considering if you need to buy life insurance

If you are a relatively healthy adult between the ages of 20 and 65 or you are 66 to 85 and want to purchase a whole life insurance policy, Ethos is a reputable insurance provider with affordable coverage options and an easy application process.

Apply for a term or whole life insurance policy with Ethos life >>