All life insurance companies start to look alike, and in a lot of ways they are. Bestow stands out in that it is a tech startup that is also backed by a legacy life insurance carrier. Bestow also stands out for its smaller policies that make life insurance affordable — as well as the no-medical exam promise that is attractive to many.

What we found in our review of Bestow: 3 things to know

How much does life insurance from Bestow cost?

What kinds of policies does Bestow offer?

Bestow vs. other insurance companies

Bottom line: Bestow is worth considering if you need to buy life insurance

What we found in our review of Bestow: 3 things to know

Don't have time to read this whole review? Here's what you need to know:

1. Is Bestow a legitimate company? Yes!

Bestow was founded in 2016, and they now issue their own policies. Bestow also has an A+ from the Better Business Bureau, which accredited the insurer in 2017.

2. Pricing

Bestow has some of the lowest rates in the industry, with a rate as low as $10/month and coverage up to $1.5 million

3. Bestow promises no life insurance medical exam ever.

Say what? I said to their product team. Yes, indeed. Bestow guarantees no medical exam, no doctor visit, or blood test. Too busy for that nonsense? No problem.

Get life insurance quotes online now from other top companies >>

Our Bestow ratings:

-

Coverage

-

Price

-

Ease of application

-

Customers' experience

What others say about Bestow

Here's what people have to say about Bestow across the top review sites:

BBB rating and reviews

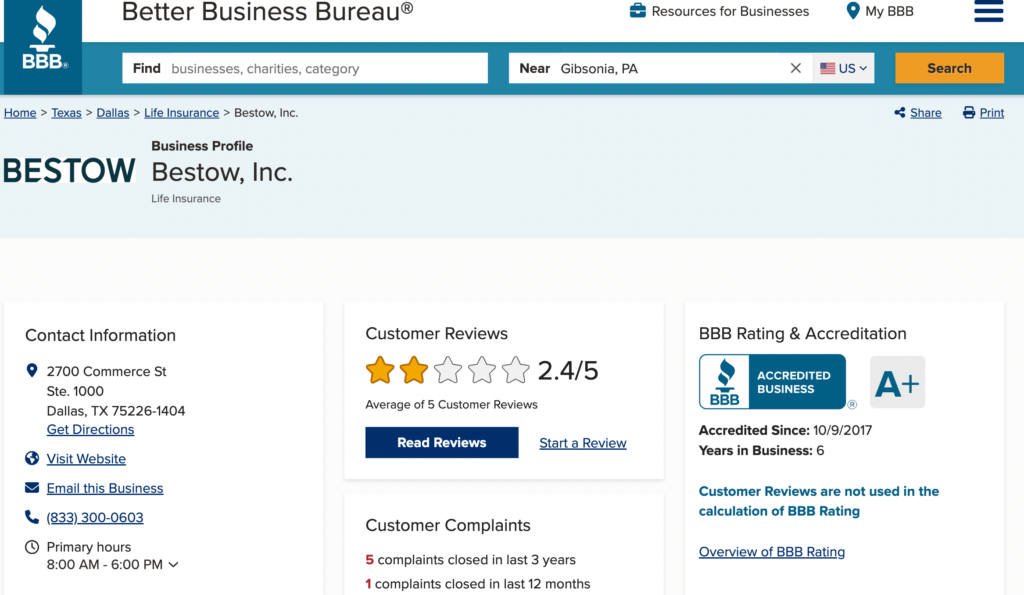

Bestow has an A+ rating with the Better Business Bureau, where it has been accredited since 2017:

Trustpilot rating and reviews

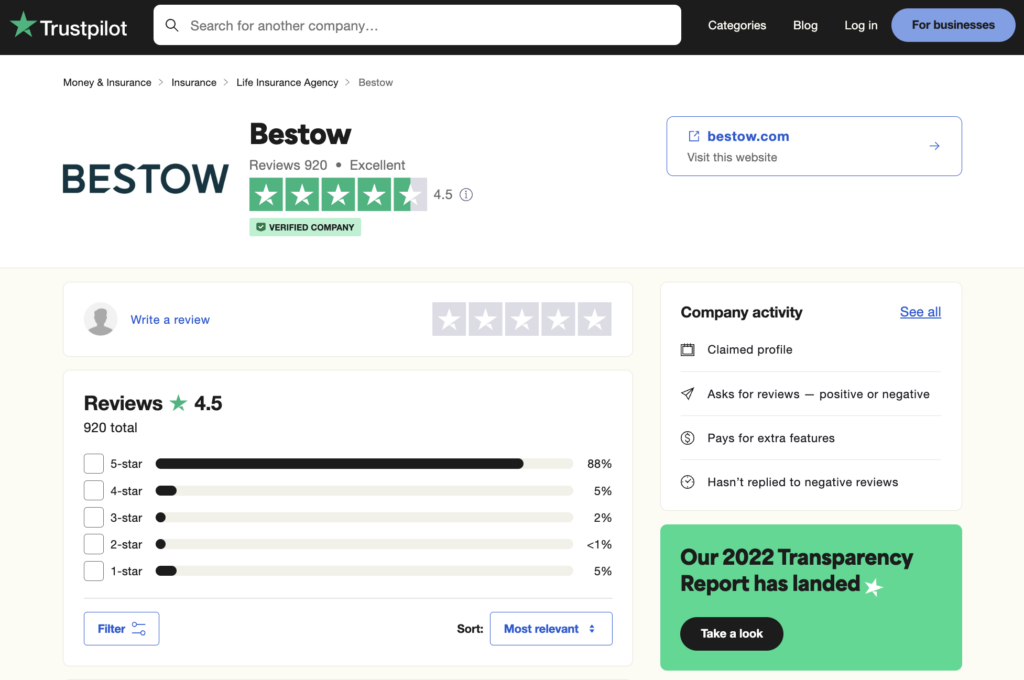

Bestow has a 4.5-star average review based on more than 900 TrustPilot ratings:

What Redditors think about Bestow

There isn't much about Bestow on Reddit, except for one short conversation comparing Bestow to other life insurance companies like HavenLife, though no one weighed in with actual answers:

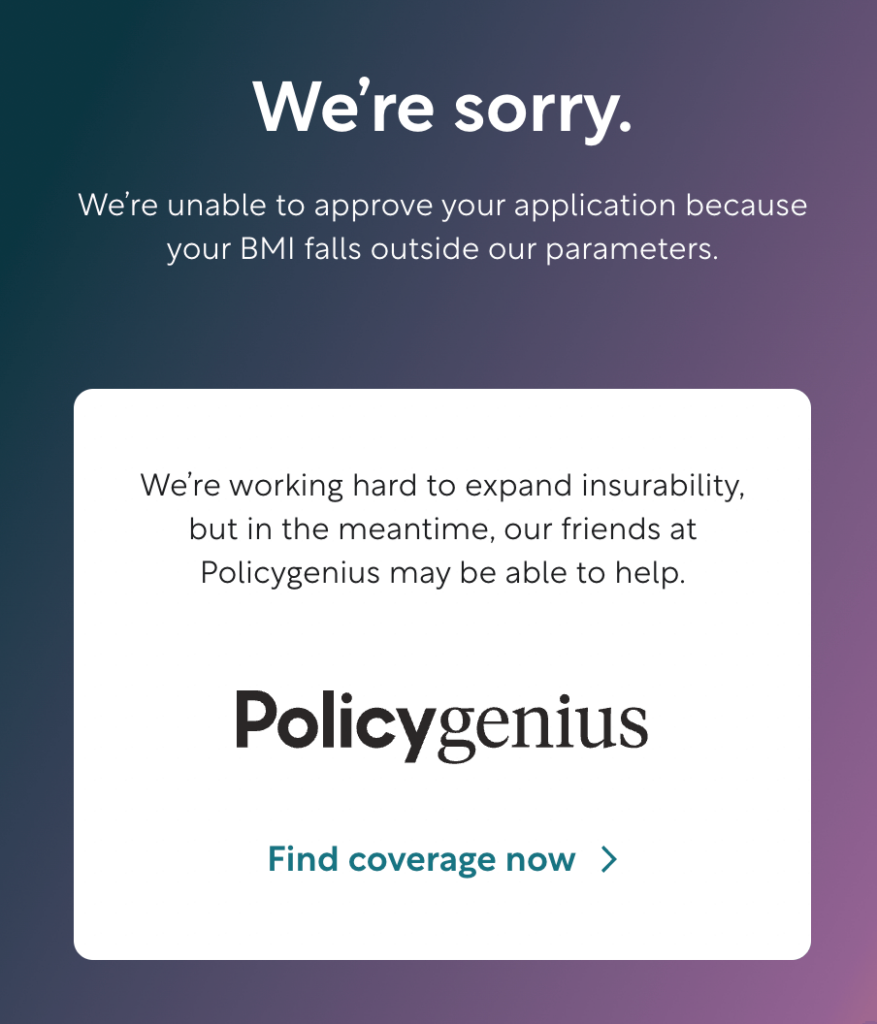

Common complaints

Some reviewers complain they were rejected because of their medical history. Bestow is able to weed out clients who would otherwise require a medical or lab exam, so that only younger and healthier applicants are accepted — and the no-medical-exam promise then holds true.

For instance, if your BMI is over a certain threshold, you may be immediately denied:

How much does life insurance cost when you purchase from Bestow?

Some sample term life insurance quotes from Bestow for healthy, 30-year-old non-smokers: 10, 15, 20, 25 and 30-year products with $100k to $1.5 million of coverage available, at a rate as low as $10/month.

This sort of pricing and terms are excellent for moms who may be in all kinds of transitions:

- Going through a divorce or breakup

- Leaving a job

- Starting a business

- Between jobs

- Relocating

- Kids aging out of the house — you may actually only need life insurance for a few more years

How does Bestow work?

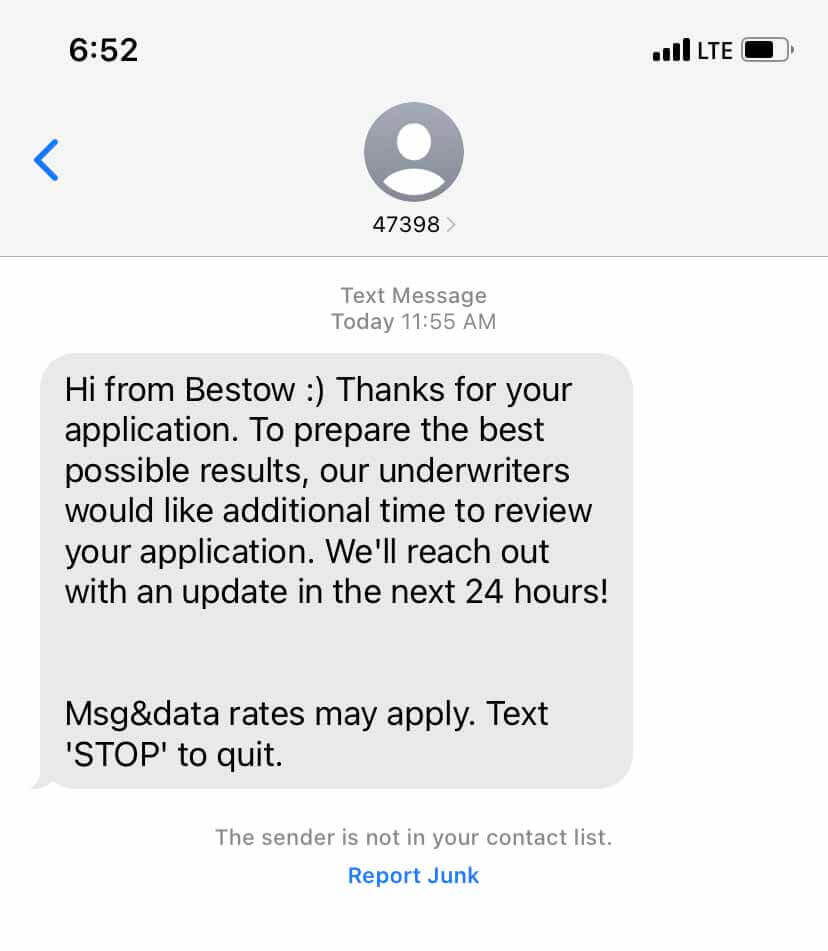

The whole process of applying for and getting life insurance takes less than 20 minutes, unless Bestow determines your application needs more review, for instance if you have a pre-existing condition.

Luckily, there are plenty of quick and easy ways you can get different insurance quotes in a matter of minutes.

Bestow’s life insurance stands out from other life insurance companies in several ways that make it especially appealing to single moms.

Bestow guarantees no medical exam, and prices as low as $10 per month.

Ready to apply for insurance?

- Go to Bestow.com.

- Choose a plan.

- 10, 15 20, 25 and 30 years.

- Coverage from $100,000 to $1 million

- If you’re approved, pay with credit card.

- Sleep great.

No sales calls. No life insurance medical or lab exam. No one visiting your home or work.

Details about Bestow life insurance policies

Here's everything you need to know if you're considering a life insurance policy from Bestow:

What policies does Bestow offer?

Bestow only offers term life insurance policies in 10, 15, 20, 25 and 30-year terms in coverage ranging from $50,000 to $1.5 million.

Term life insurance differs from whole life insurance in that it's only meant to cover you for a specified period of time, for instance, while your children are still living at home/dependent on you.

Who qualifies for one of Bestow’s term life insurance plans?

Bestow requires you be:

- U.S. citizen and resident and green card holders (except those in New York)

- Employed, full-time stay-at-home parent, or student

- Generally healthy

- Between the ages of 21-45 for 20-year term life

Bestow will not cover you if you have one of the following health conditions:

- Heart disease

- Stroke

- Cancer (except basal and squamous cell skin cancer)

- Organ transplant

- Diabetes before 40 (except gestational diabetes)

- Alcohol and drug abuse

- HIV

- Kidney disease requiring dialysis

- Other serious health issues

Does Bestow offer riders?

Bestow does not offer riders at this time.

Pros and cons of Bestow

Based on our review and the reviews of Bestow customers, these are some of its pros and cons:

Pros

- A+ BBB rating

- No medical exam guarantee

- Coverage options starting at just $10/month

- Up to $1.5 million in coverage

Cons

- If you prefer to work with a life insurance agent that lives in your town, who can visit your home or who has an office that you can walk into, Bestow won't work for you.

- If you have a high BMI or have pre-existing conditions, you may not be able to get a Bestow health insurance policy

Bestow vs. other insurance companies

Here is what life insurance companies don’t want you to know: Life insurance is all pretty much the same, but packaged in different boxes.

Bestow and its competitors are all backed by reputable, highly rated older life insurance companies. Each one will give you a slightly different price and terms, and offer different experiences on their website, app or with an agent.

Bestow does stand out for two reasons:

- Bestow guarantees that its life insurance customers never go through a medical exam. This is pretty remarkable, but it is possible because Bestow vets applicants for health concerns that would otherwise warrant a medical exam.

- Bestow starts at $10 per month, making it an affordable option for single parents.

These are some other life insurance companies we reviewed:

- Ethos (check out our Ethos review)

- Ladder (check out our Ladder review)

FAQs about Bestow

What makes Bestow different from other insurance companies?

The in-house underwriting, guarantee of no medical exam, 30-day money-back guarantee and low monthly premiums set Bestow apart from its competitors.

Learn about disability insurance.

Who underwrites Bestow? What is Bestow’s Accelerated Underwriting?

Bestow underwrites its policies in-house, using its own algorithm, making the process very fast and the decision instant in most cases.

Does Bestow life insurance have a waiting period?

In most cases, it takes 10 minutes to get a decision from Bestow. You can get coverage within the same day.

If you are overweight or have a pre-existing condition, Bestow's team may take longer to review your application:

Does Bestow offer coverage for accidental death?

Yes, some policies include an accidental death benefit rider, which pays an additional amount to the beneficiary in the event of a death due to accident only.

Bottom line: Bestow is worth considering if you need to buy life insurance

Because of its low-cost coverage options starting at just $10/month and no medical exam guarantee, Bestow stands out in the life insurance space.

Another great benefit of Bestow is that it's fast and easy to get a quote, so you can always shop around to see if you may qualify for a better deal >>

Policies are issued by Bestow Life Insurance Company, Dallas, TX on policy form series BLI-ITPOL. Bestow Life Insurance products may not be available in all states. Policy limitations or restrictions may apply. Not available in New York. Our application asks lifestyle and health questions to determine eligibility in order to avoid requiring a medical exam. Prices start at $10/month based on a 18-year-old male rated Preferred Plus NT for a $100K policy for a 10-year term. Rates will vary based on underwriting review.

Yes. Bestow was founded in 2016, and policies are issued by North American Company for Life and Health Insurance, a carrier rated A+ (Superior) by A.M. Best that was founded in 1886. It also has an A+ from the Better Business Bureau.

Some sample term life insurance quotes from Bestow for healthy, 30-year-old non-smokers: 10, 15, 20, 25 and 30-year products with $100k to $1.5 million of coverage available, starting at $10/month.

Bestow only offers term life insurance policies in 10, 15, 20, 25 and 30-year terms in coverage ranging from $100,000 to $1.5 million.

The in-house underwriting, guarantee of no medical exam, 30-day money-back guarantee and low monthly premiums set Bestow apart from its competitors.

Bestow underwrites its policies in-house, using its own algorithm, making the process very fast.

It takes 10 minutes to get approved by Bestow. You can get coverage within the same day.

Yes, accidental death is covered by Bestow life insurance.