Ladder Life insurance promotes its low premiums with an easy online signup process and no medical exam for policies up to $3 million.

These claims are accurate. However, if you have any medical conditions or you’re overweight — like me — you may not be able to get coverage through Ladder.

While Ladder is one of the newer life insurance brands, its coverage is backed by long-established and reputable life insurance providers.

Get your own quote now from Ladder >>

Or, keep reading for our full Ladder Life insurance review:

What we found when reviewing Ladder Life

- Ladder is a legit life insurance company

- Ladder is not for everyone

- No medical exams

- Flexible policies

How we evaluated and rated Ladder

How much does life insurance from Ladder cost?

How does Ladder Life insurance work?

My Ladder Life insurance experience

What we found in our review of Ladder Life: 4 things to know

These are the main things you need to know if you’re considering Ladder Life insurance coverage, based on our deep research and personal interaction with the product:

1. Ladder is a legit life insurance company

Ladder Life insurance policies are issued by A+ Better Business Bureau-rated insurance providers, who have been paying out claims for decades:

- Fidelity Security Life Insurance Company, A.M. Best rated A

- Allianz Life Insurance Company of New York, A.M. Best rated A+

- Allianz Life Insurance Company of North America, A.M. Best rated A+

2. Ladder is not for everyone

Ladder only issues new policies to people who are between the ages of 20 and 60 in relatively good health (your age is determined by your nearest birthday). You may be denied coverage if you:

- Have a high BMI

- Suffer from chronic medical conditions

- Have financial issues (for instance, if you are unemployed)

Ladder will not cover you past 70 years of age. If you are 55 years old, for example, the longest term you can get is 15 years.

Ladder Life insurance only covers U.S. citizens or lawful permanent residents who have lived in the United States for more than 2 years.

A representative from Ladder said the company has no set criteria to determine a person’s eligibility, and each application is considered on a case-by-case basis. However, after inputting my height and weight in the initial form, I was instantly directed on the next page to check out another life insurance company, TruStage, one of Ladder’s partner insurers.

This wasn’t an outright denial but rather a suggestion that Ladder likely wouldn’t be able to cover me if I submitted my questionnaire.

3. No medical exams

Ladder does not require a medical exam for policies less than $3 million. The company uses a pre-screening questionnaire to weed out unqualified candidates, so you don’t have to waste your time going to a health check only to be denied coverage. That said, not everyone will pass this stage and be offered a policy.

4. Flexible policies

A unique feature, Ladder gives people the option to change their coverage level overtime as their financial needs change. They call this “laddering up” or “laddering down,” which can be requested at any time from your online account, no extra fees involved.

Ladder promotes this feature as being as easy as a few clicks on your smartphone. However, the process is really more manual and old-fashioned than that.

If you request to ladder up your coverage, it will likely take time for the underwriting team to process your application, since they treat the request like a new application. If you are not instantly approved, it could take anywhere from two weeks to two months to hear back about a decision.

This new policy will be based on information you submitted in your initial application, though Ladder’s underwriting team may follow up with questions about your previously submitted or current health/financial information. You may not be approved for the increased coverage.

However, if you choose to ladder down your coverage, there is no waiting period, and the change is effective immediately.

Note that changing your coverage options will increase or decrease how much money you pay for your policy.

How we evaluated and rated Ladder

We evaluated Ladder in comparison to other online life insurance companies based on:

- Coverage – Amount of coverage available, variety of coverage options

- Ease of application – Online questionnaire, medical exams, overall user experience

- Price – Cost of coverage

- Customer service – BBB reviews/my personal experience with customer service

- Customer reviews – Customer ratings across major review sites

These are our ratings:

Our Ladder Life ratings:

-

Coverage

-

Ease of application

-

Price

-

Customer service

-

Customer reviews

What others say about Ladder

Online Ladder Life insurance reviews are overwhelmingly positive:

BBB rating and reviews

Ladder itself does not have a Better Business Bureau profile. However, its policies are issued by three insurers that all have an A+ BBB rating:

- Fidelity Security Life Insurance Company

- Allianz Life Insurance Company of New York

- Allianz Life Insurance Company of North America

None of the reviews on these pages specifically mention Ladder.

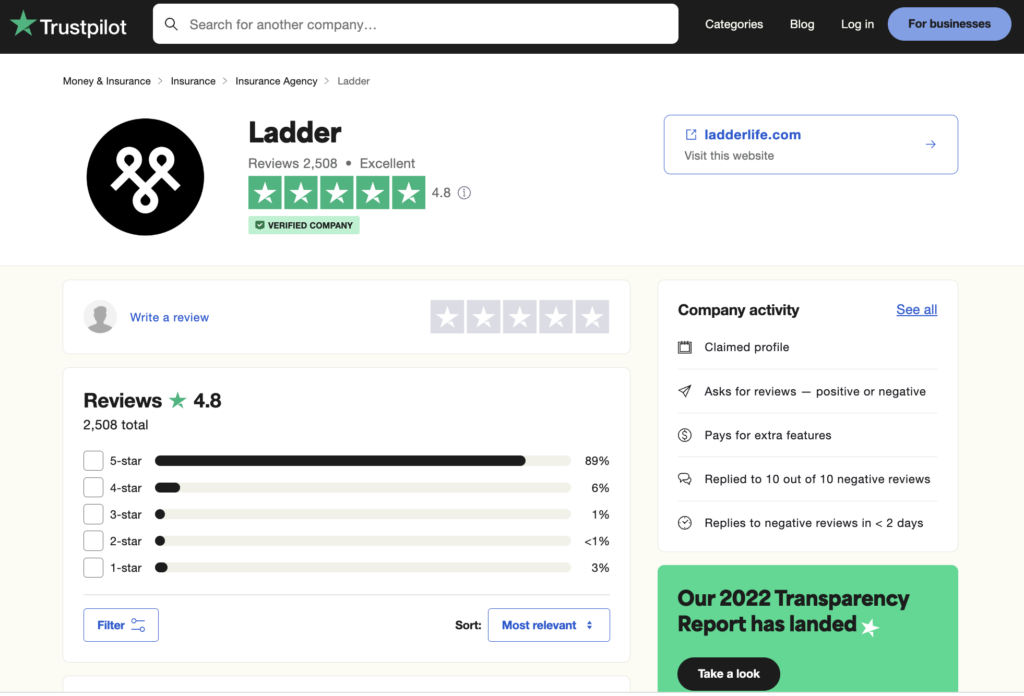

Trustpilot rating and reviews

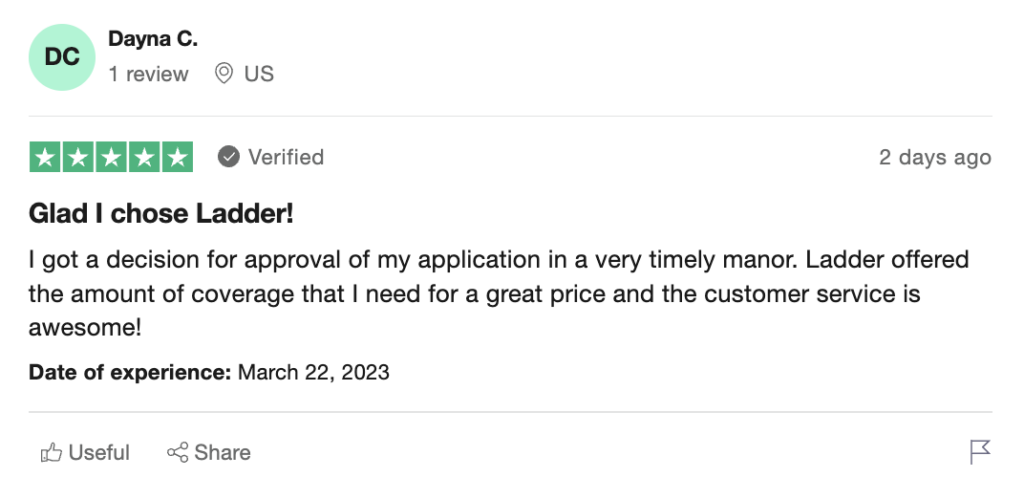

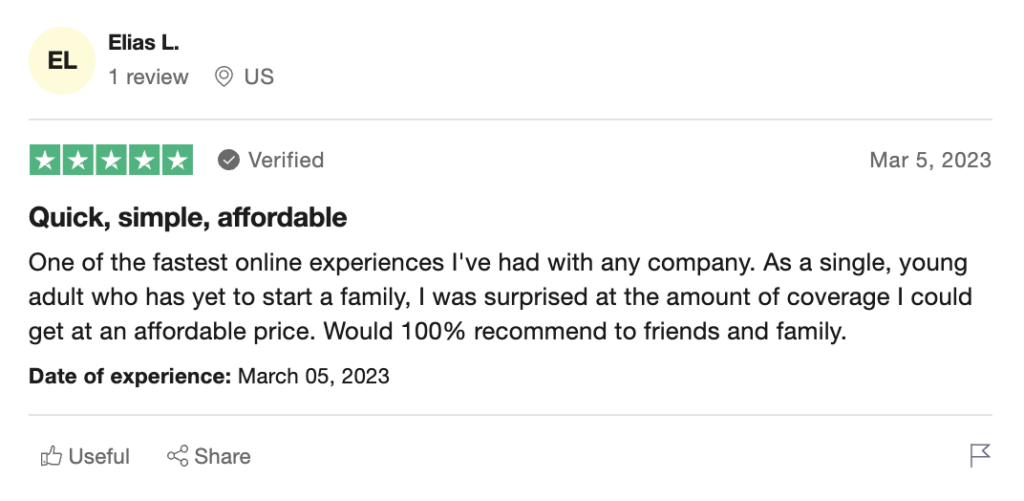

Ladder has 4.8 out of 5 stars on Trustpilot based on more than 2,500 reviews, most of which are 5 stars.

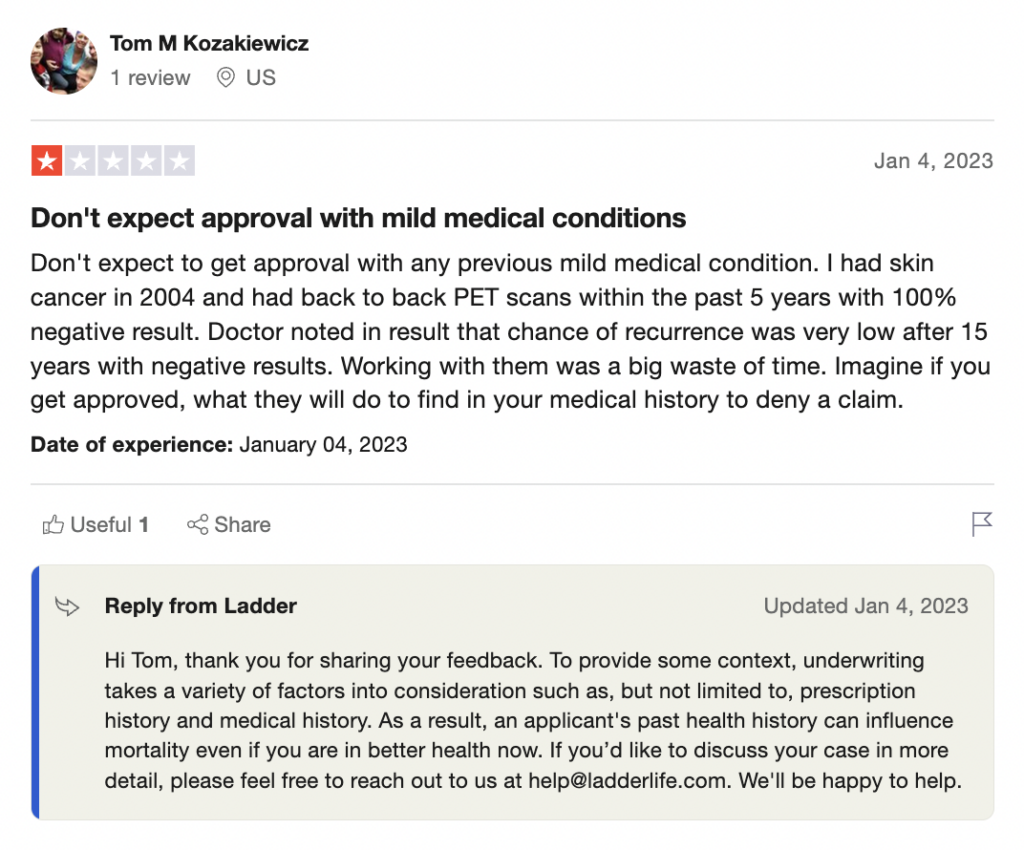

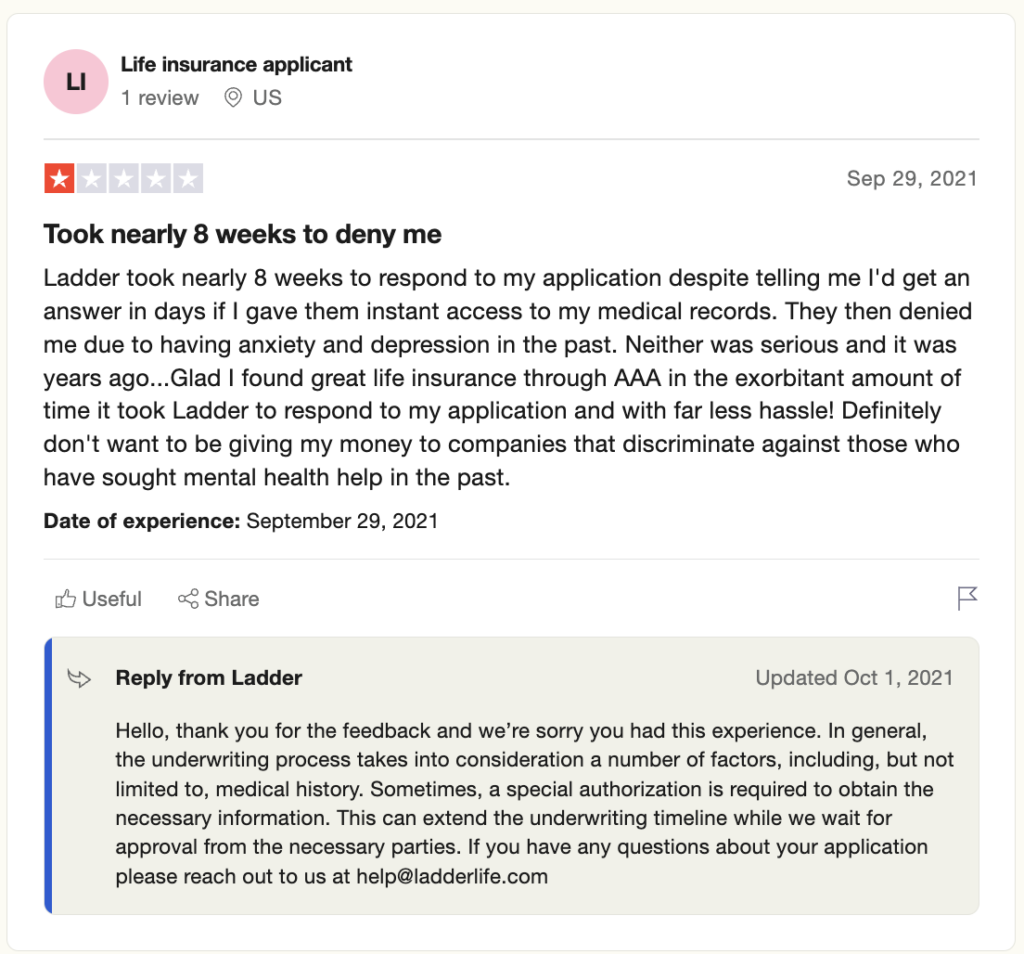

Reviewers note the ease of application and low policy pricing. The rare negative reviews are typically from people who were denied coverage based on a medical condition:

What Redditors think about Ladder

There is a Ladder_Life_Insurance subreddit that appears to be run by Ladder, since most of the content is informative and advertises the benefits of signing up for Ladder.

Other Reddit threads are individual users scoping out life insurance policies, though few users have responded:

Ladder Life + Marijuana Use

byu/rideonup inLifeInsurance

How many are using Life Insurance Ladders to save money?

byu/DoctorLinus inFinancialPlanning

Common complaints

Most complaints about Ladder are from people who were denied coverage. Others note that it may take a long time to get a coverage decision if you aren’t instantly approved — one person claimed to have waited 8 weeks before being denied.

How much does life insurance from Ladder cost?

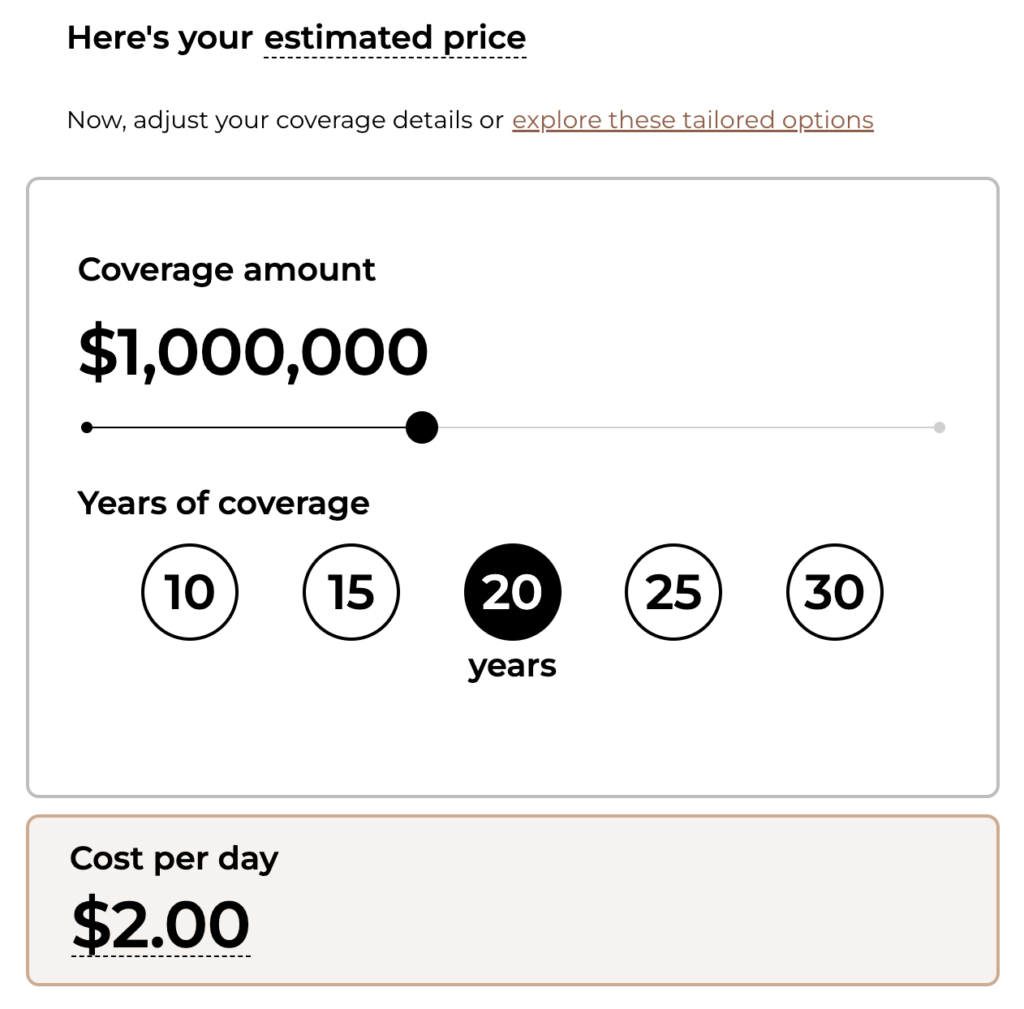

Ladder life insurance premiums start at just $5 per month, with coverage ranging from $100,000 to $8 million.

As a real-life example, I sought policy estimates for a 50-year-old male with the following stats:

- 6’ tall

- 250 pounds

- Used tobacco/nicotine products weekly in the last 12 months

- Income of $100,000

- 2 children

- Remaining mortgage balance of $100,000

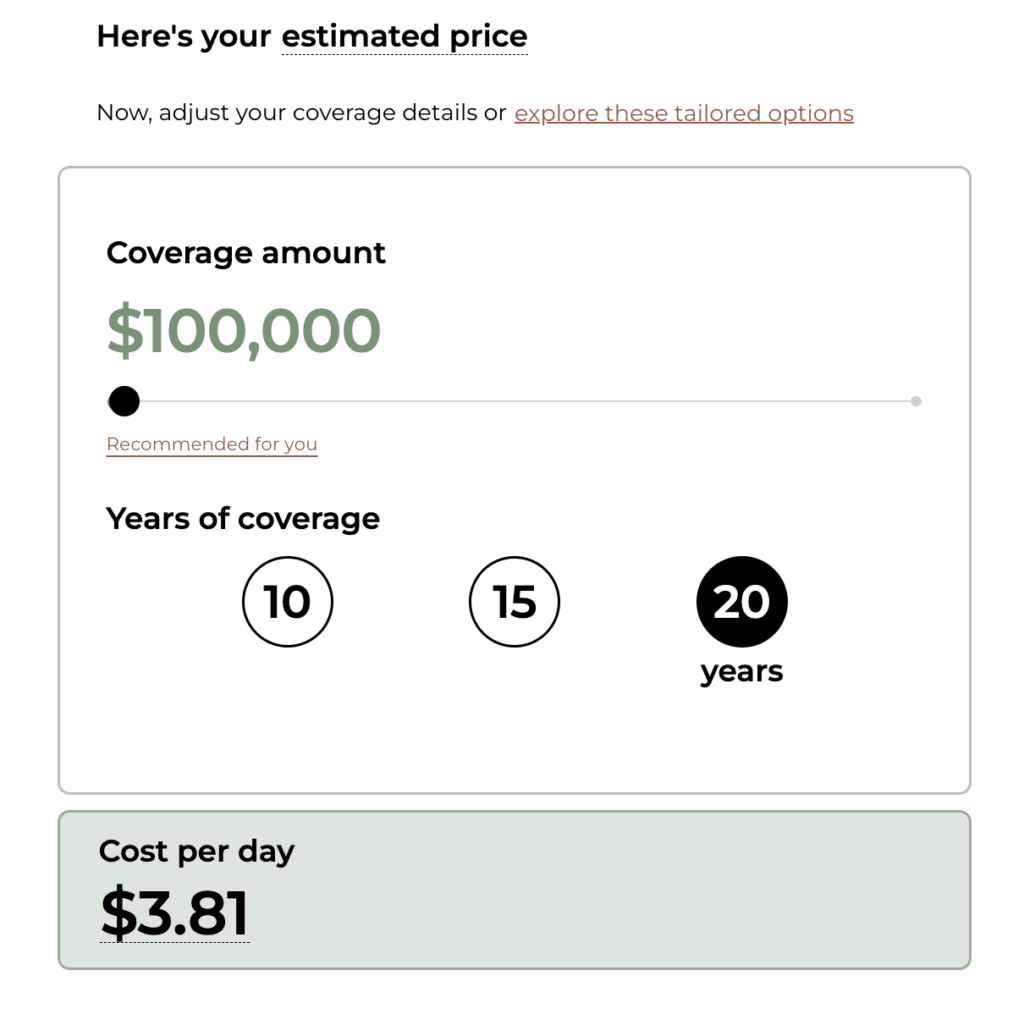

Based on $100,000 of coverage (which is the only amount this man was recommended), this is his estimated price if approved for a policy:

- 10 years – $2.62/day

- 15 years – $3.13/day

- *20 years – $3.81/day

*This is the longest policy he would be able to purchase through Ladder since they don’t issue coverage past 70 years.

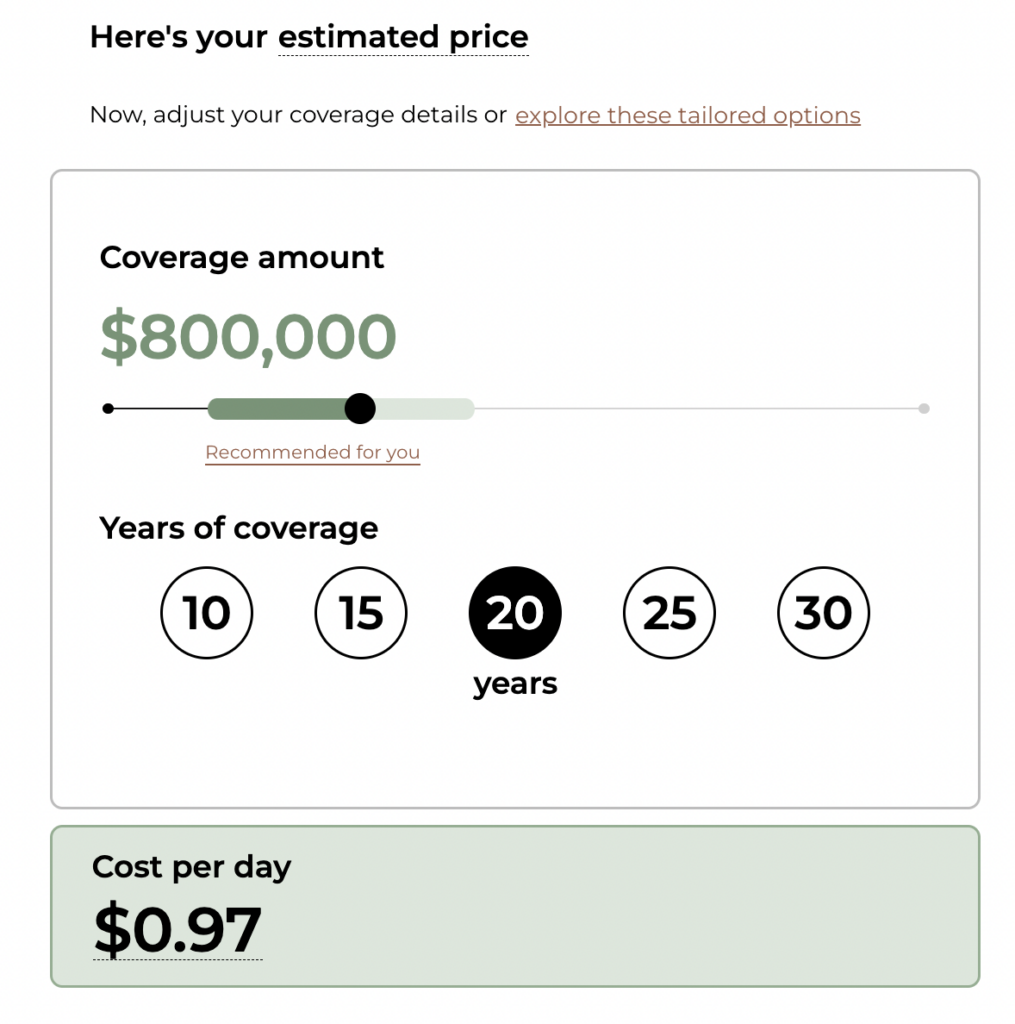

As a cost comparison, I requested an estimate for a 30-year-old woman with the following stats:

- 5’5” tall

- 150 pounds

- Non-smoker

- Income of $40,000/year

- No children

- No mortgage balance

This woman’s suggested coverage range was between $400,000 and $1.2 million. However, for the purpose of direct comparison, I set her coverage at $100,000:

- 10 years – $0.34/day

- 15 years – $0.37/day

- 20 years – $0.40/day

- 25 years – $0.51/day

- 30 years – $0.52/day

Get a quote from Ladder now >>

How does Ladder Life insurance work?

Ladder uses a simple online application process to determine eligibility for life insurance coverage. Based on your answers to their questionnaire, you’ll either be:

- Instantly denied or approved

- Notified if you qualify after a thorough underwriting process, which may take anywhere from two weeks to two months

Ladder’s questionnaire asks information about:

- Medical history

- Income/financial status

- Beneficiaries

- Other life insurance policies you have in place

- How much coverage you need and for how long

If you are approved for coverage, Ladder will pay out your coverage amount — known as a death benefit — to your beneficiaries in the event you die while covered.

Details about Ladder life insurance policies

If you’re considering a Ladder Life insurance policy, here’s what you need to know:

What kind of insurance is Ladder Life?

Ladder Life only offers term life insurance coverage, which means they cover you for a set period of time at a fixed rate, with a specific sum paid to your beneficiaries at the time of your death.

This differs from whole life insurance coverage, which provides permanent coverage that builds cash value over time. Forbes did a cost comparison of whole vs. term life insurance policies and found that whole life policies were about 5 to 7 times more expensive, depending on the person applying for coverage.

What policies does Ladder offer?

Ladder offers term life insurance coverage from $100,000 to $8 million for a period of 10,15, 20, 25, or 30 years.

Use Ladder’s life insurance calculator to determine how much life insurance you need.

Does Ladder offer riders?

Ladder does not offer riders — add-on provisions that provide additional insurance coverage — because they “believe that riders complicate life insurance and do not provide a significant benefit for their added cost.”

Examples of life insurance riders include guaranteed insurability, accidental death, waiver of premium, family income benefit, accelerated death benefit, child term, long-term care, and return of premium riders.

Self-employed? You need disability insurance

Does Ladder Life pay out?

Ladder policies are issued by insurers with long, proven histories of paying claims. As long as the death occurs within the policy term, your beneficiaries will be paid your death benefit at the time of your passing in one lump sum. If you die after the policy term, there will be no payout.

Ladder does not pay out claims for deaths by suicide within the first two years of coverage and in cases of fraud.

Pros and cons of Ladder

These are some of the benefits and drawbacks of Ladder Life insurance coverage:

Pros

- No medical exams for policies less than $3 million

- Policies up to $8 million

- Quick questionnaire that takes less than 20 minutes to complete

- Instant decisions if you don’t have major health concerns

- Locked-in pricing that doesn’t increase if your health status changes or as you age

- Ability to “ladder up” or “ladder down” coverage based on your needs

- App available for iOS devices

- Live chat customer service option (with actual human people) from 7 a.m. to 4 p.m. PT

- No cancellation fees

- $50 referral credit given for each friend you refer who receives a coverage offer (not available in Louisiana, Michigan, Mississippi, Montana, New Mexico, Washington or West Virginia)

Cons

- Does not cover people with certain health conditions, including obesity

- Approval may be delayed if your application needs further review — for instance, if you have medical conditions that don’t automatically disqualify you from coverage

- If you are older than 60, you cannot be covered, and you can only purchase coverage that lasts until age 70

- Only offers term life insurance

- No riders or supplementary coverage

- Live chat and customer service only available weekdays from 7 a.m. to 4 p.m. PT

Can’t afford health insurance? 5 health insurance options for single moms

My Ladder Life insurance experience

Before I started Ladder’s application process, I was pretty positive I would be denied coverage based on my high BMI and medical conditions — namely asthma, PCOS, and a condition called IIH. I have tried and failed to apply for life insurance coverage in the past through other online providers.

For reference, I am a 32-year-old, non-smoking woman. I want life insurance to replace my income for my husband and two children (4 and 9) in the event that I die before they are financially independent.

It’s frustrating not being able to provide that safety net for my family, but I know I’ll have a tough time getting life insurance from any provider until I lower my weight. I’m not sure if my medical conditions alone would disqualify me from coverage.

I’ve previously applied for coverage from Ethos Life Insurance and was instantly denied after going through the questionnaire, which included questions about my health history and financial status (income, debt, mortgages, etc.).

I applied for Ladder on my laptop computer, though they do have a mobile-friendly site and mobile app available for iOS if you prefer.

After inputting my age, weight, height, sex, and smoking status, I got a screen that suggested one of Ladder’s partner insurers, TruStage, might be a better fit for me. (Spoiler alert — it wasn’t. I was denied.)

I was curious if changing my weight on Ladder’s application would change my result, and when I did, I was allowed to continue through the rest of the questionnaire. (Note that I did this strictly for research purposes, with no intention of actually starting a policy. If you open a life insurance policy with false information, you can be charged with fraud or your loved ones may be denied a payout at the time of your death if the information you provided isn’t accurate.)

After I finished answering the questions, I wasn’t given an instant decision but was instead told that Ladder’s underwriters needed more time to review and verify my information, a process they said usually takes about two weeks but could take up to two months.

Ladder vs. other life insurance companies

While most life insurance coverage is relatively the same, Ladder stands out because of its:

- Low premiums

- Easy online application process

- No medical exam for policies less than $3 million

- Ability to increase and decrease coverage as your needs change

You can also check out our reviews of Bestow Life Insurance and Ethos Life Insurance, two other online insurance providers that offer term life insurance coverage with no medical exams.

Bottom line: Ladder is worth considering if you need to buy life insurance

If you are a relatively healthy adult between the ages of 20 to 60, Ladder is a solid life insurance option.

If you’re not sure how much life insurance you need or you want to learn more how to choose the best policy for your needs, check out our guide to life insurance for single parents.

No medical exam for policies up to $3 million.

Ladder policies are issued by insurers with long, proven histories of paying claims. As long as the death occurs within the policy term, your beneficiaries will be paid your death benefit at the time of your passing in one lump sum. If you die after the policy term, there will be no payout. Ladder does not pay out claims for deaths by suicide within the first two years of coverage and in cases of fraud.