Owe the IRS?

You’re not alone.

In fiscal year 2024, individual taxpayers will owe an estimated $525 billion in tax debt.1 Based on the most recent tax data from the IRS, more than 10 million taxpayers owe back taxes.2

If you have unsettled tax debt with the Internal Revenue Service and you are unable to resolve the debt yourself, there are quality professional services that can help you arrange a settlement and payment plan — for a fee.

This post has general information about managing tax debt, including reviews 14 of tax relief companies for 2024. We evaluated companies based on:

- Better Business Bureau and Trustpilot ratings

- Guarantee policies

- Ease of communication — do they assign a specific professional to your case, one who returns your calls and emails, or better yet, for whom you have a direct number?

- Age of company

- General sense of transparency and honesty

None of these companies have transparent standard fees. You have to schedule a consultation to get a quote based on your unique tax situation:

- What to do if you’re in tax debt

- Best tax debt relief company: Instant Tax Solutions

- Reviews of other tax debt relief companies

- Alternative to working with a tax debt relief company

What to do if you’re in tax debt

Start by contacting the IRS to see if you qualify for an Offer in Compromise (Form 656-B), which allows you to settle your tax debt for less than what you owe.

You’re eligible to apply for an Offer in Compromise if you:

- Filed all required tax returns

- Made all estimated payments

- Are not in an open bankruptcy proceeding

- Were granted an extension for a current year return (if applying for the current year)

- Have employees and made tax deposits for the current and past two quarters before applying

You can also try submitting an Installment Agreement Request (Form 9465) with your tax return to see if you can pay your taxes in installments.

If you are not able to qualify for either of these options on your own, Logan Allec, a CPA and owner of personal finance blog Money Done Right, says tax relief companies can help you reduce your debt, often by more than you would be able to without representation.

Of course, there are fees involved.

For an Offer in Compromise, Allec says you should expect to pay at least $3,000 to $5,000 working with a tax relief company.

“That said, this fee can be significantly higher if the client’s debt is above average (multiple six or even seven figures) and if the IRS has assigned a revenue officer to the taxpayer’s case,” Allec says.

He says many tax relief companies aim for approximately 10% of the debt as a ballpark for pricing settlements.

Allec recommends people in tax debt shop around for a tax relief company to get the best price and to make sure the company is fair and ethical.

“Don’t use a tax relief company if the person you speak to there doesn’t spend much time learning about the details of your situation and just wants to sell you an Offer in Compromise that they have no idea if you qualify for,” Allec says.

He says you may also be able to negotiate what you pay a tax relief company, since most people giving quotes are likely working off a fee schedule that has a range of acceptable fees.

“The salesperson may be told by management, ‘Shoot to close at 10% of the debt, but you can go as low as 8% if necessary,'” Allec says.

Cases can be completed in as little as a few days for a straightforward repayment plan or more than a year for a severe tax situation that requires an appeal on an IRS case rejection.

The Federal Trade Commission offers these tips for hiring a reputable third-party tax-relief company to resolve your tax debt3:

- Be wary of promises to completely eliminate penalties and interest from the IRS

- If you’re required to make an upfront payment, review the company’s refund policy before signing

- Check to see if a default billing rate applies if you decide to cancel, as it could significantly reduce your refund (This is a flat fee that applies to the work of all the employees at the company, not just the ones representing you)

- Avoid companies that charge a monthly maintenance fee

The FTC also recommends:

- Contacting the Taxpayer Advocate Service: This is an independent organization within the IRS that can help resolve tax problems or if you’re facing collection actions from the IRS

- Working with a Low Income Taxpayer Clinic: If you have a low income and are facing a tax dispute, the clinic may be able to guide your next steps

Keep reading for the best tax relief companies to settle your tax debt:

Best tax debt relief company: Instant Tax Solutions

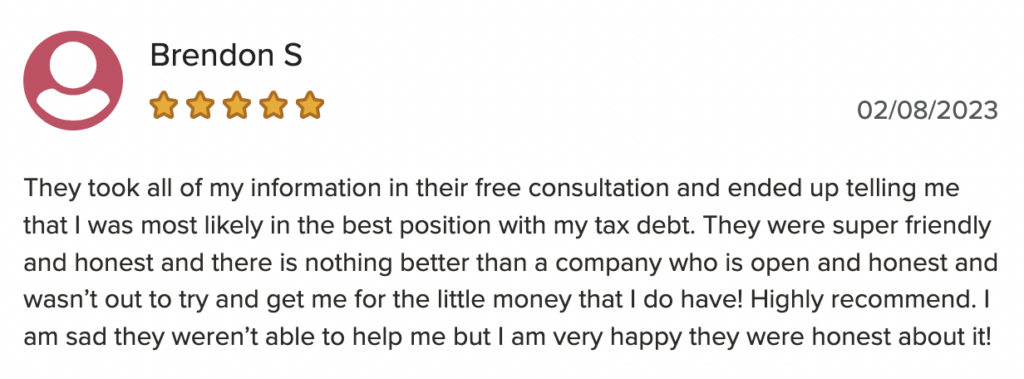

After reviewing a number of tax debt relief companies, our No. 1 recommendation is Instant Tax Solutions because:

- High ratings from both the Better Business Bureau and Truspilot

- Free consultation

- Flat fee structure — what you’re quoted is what you pay

- 30-day money-back guarantee, no questions asked

- Honest and upfront advice about your tax situation

- Direct line to the tax professional working on your case

Instant Tax Solutions was co-founded in 2008 by Ian Woodman and Byron Pedersen and has grown from a home-based business to a nationally recognized tax debt resolution company that does business in all 50 states.

Instant Tax Solutions is staffed by tax attorneys, certified public accountants and enrolled agents, and clients receive a direct line to the professional handling their case.

Instant Tax Solutions does not claim to eliminate all penalties and interest from the IRS. Instead, it promises to fight for the best resolution for your case by negotiating with the IRS on your behalf to remove all the penalties that it can.

Instant Tax also offers a no questions asked, 30-Day, 100% satisfaction guarantee. If for any reason within the first 30 days you aren’t satisfied with the service, you will receive a complete refund, no questions asked.

| Pros | Cons |

| – Free consultation – Flat-rate fee structure that’s determined on a case-by-case basis – Licensed in all 50 states – 24/7 live customer support – 30-day money-back guarantee – Direct line to the tax professional assigned to your case – A+ Better Business Bureau rating – 5-star Trustpilot rating | No specific pricing information on website |

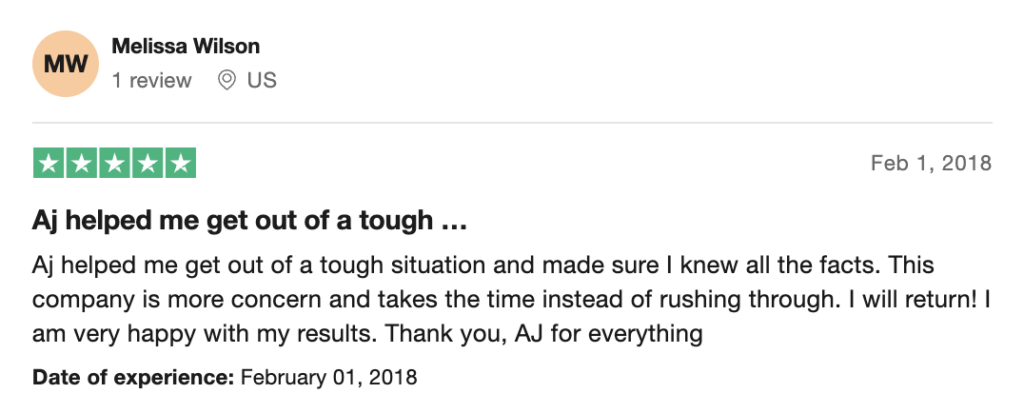

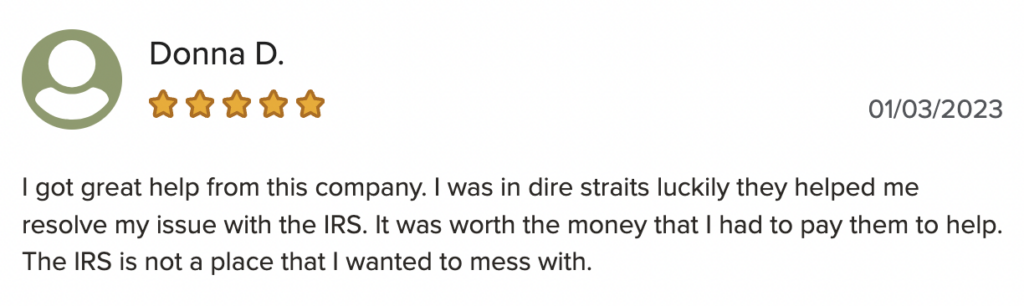

Customer reviews:

Read on to find out about other BBB best tax relief companies that you can hire to help you with your tax debt. All companies on this list have an A+ rating:

2. ALG Tax Solutions

ALG Tax Solutions is part of the ALG Group and offers tax relief assistance in all 50 U.S. states.

ALG also offers an interesting feature on its website — an IRS letter decoder. All you have to do is enter the number in the upper right corner of the IRS letter you received, and the IRS letter decoder will tell you what the letter means, its level of severity and how to resolve the issues presented. You can also schedule a free consultation to have your case reviewed by a tax professional.

| Pros | Cons |

| – Free consultation – Nationwide IRS assistance – Online IRS letter decoder – Online tax case review scheduler – A+ Better Business Bureau rating – 4.7-star Trustpilot rating | – No pricing or money-back guarantee information on its website – Most recent Trustpilot review is from 2019, and there are no written reviews on the BBB site |

Customer reviews:

The most recent review on ALG’s Trustpilot page is from March 2019:

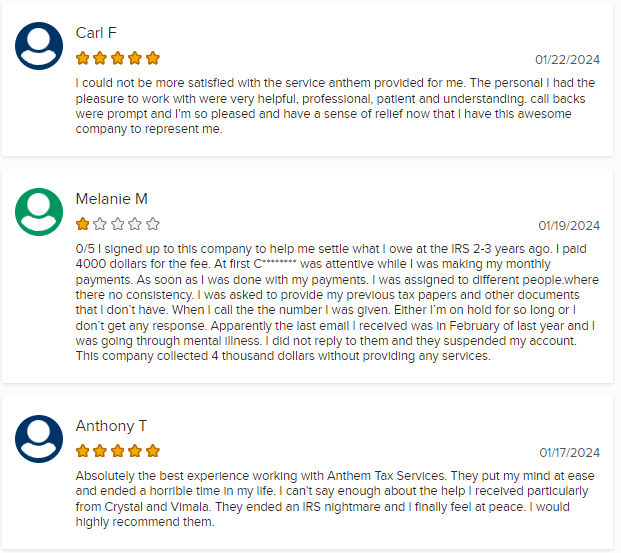

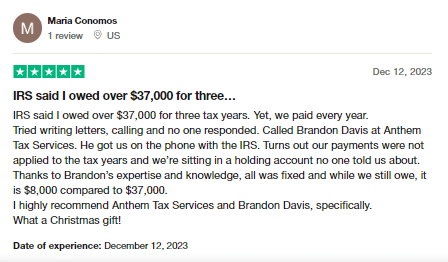

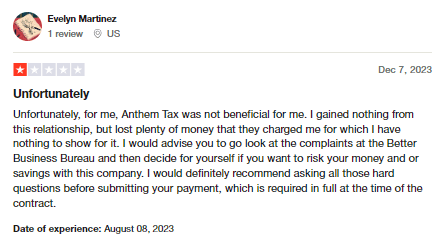

3. Anthem Tax Services

Anthem Tax Services provides tax debt relief by experienced licensed tax professionals. The company is licensed in all 50 U.S. states to represent clients in tax litigation.

Anthem also guarantees you will get your money back if it can’t save you money on your taxes or negotiate an adjustment to your payments.

| Pros | Cons |

| – Licensed tax professionals represent clients in all 50 states – Recognized for one of the quickest turnaround times in the industry – Money-back guarantee – A+ Better Business Bureau rating – 4.6-star Trustpilot rating | Pricing is not transparent. You must schedule a consultation to find out about fees. |

Customer reviews:

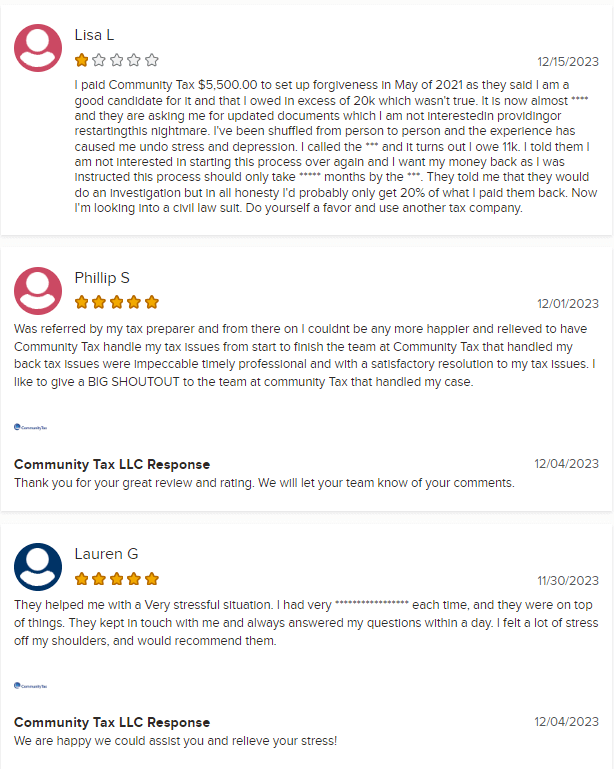

4. Community Tax

Founded in 2010, Community Tax is staffed by more than 50 tax professionals, including attorneys, practitioners, enrolled agents, and certified public accountants.

The company provides a variety of services, including back tax relief and audit defense, to clients in all 50 states.

| Pros | Cons |

| – Services available in all 50 U.S. states – Free consultation – 14-day 100% money-back guarantee – A+ Better Business Bureau rating – 4.4-star rating from Trustpilot | – Limited money-back guarantee – Pricing is not transparent on the website |

Customer reviews:

5. Enterprise Consultants Group LLC

Enterprise Consultants Group was founded in 2008 and is staffed by enrolled agents, consultants and tax attorneys.

Once Enterprise’s tax professionals have resolved your IRS tax issues, they also will educate you on the best tax plan for the future.

| Pros | Cons |

| – Services provided in all 50 states – 100% free consultation – Transparent flat-rate quote – A+ Better Business Bureau rating | Claims to only take clients they can help but offers no money-back guarantee |

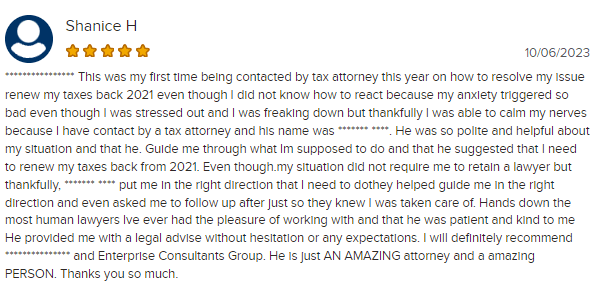

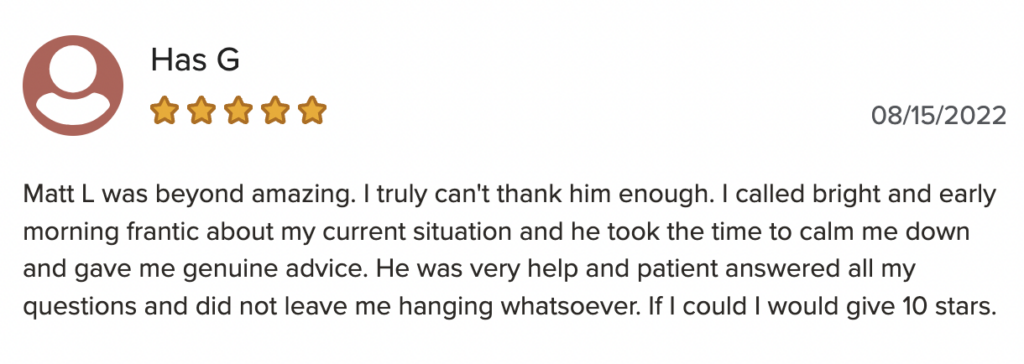

Customer reviews:

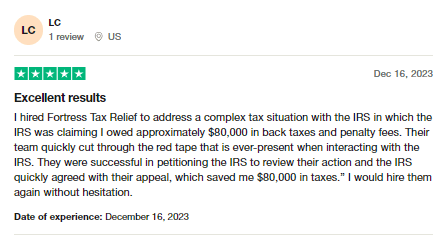

6. Fortress Tax Relief

Fortress Tax Relief is a mid-size firm that has been in business since 2003. It represents clients in all 50 states who are in need of tax relief services. Fortress only has experienced tax attorneys on staff.

Prospective clients with over $10,000 in tax debt will complete an initial consultation with an attorney. If within 24 hours of the consultation you decide against representation, you will receive a full refund.

| Pros | Cons |

| – Free consultation – All cases handled by experienced tax attorneys – A+ Better Business Bureau rating – Flat-fee pricing model | – Requires a minimum tax debt to qualify – Limited money-back guarantee – One review on Trustpilot |

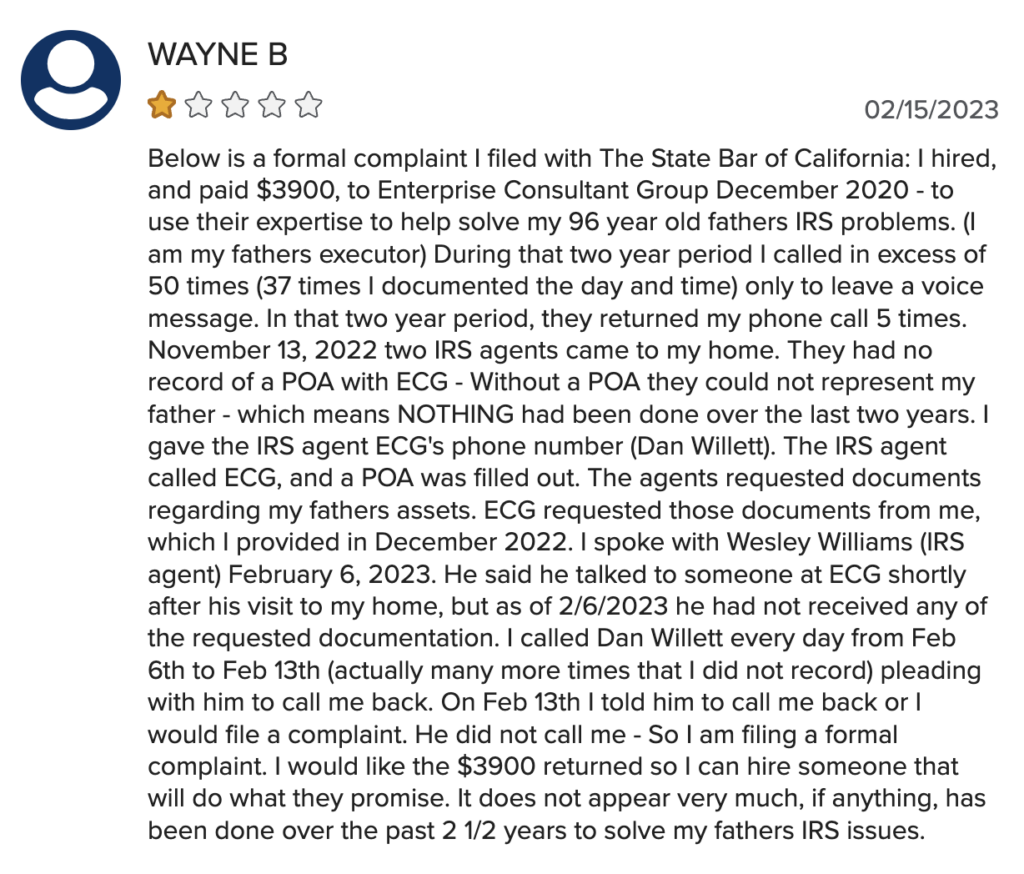

Customer reviews:

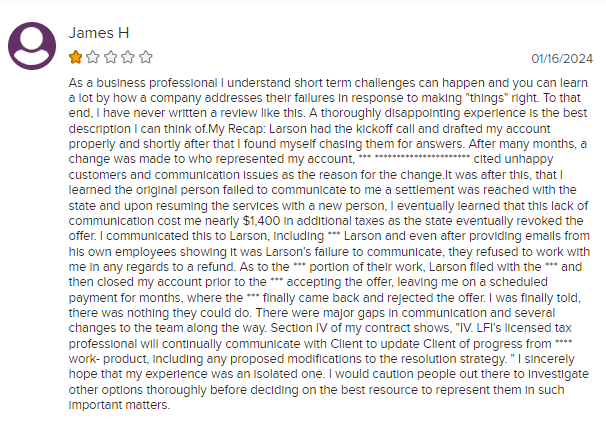

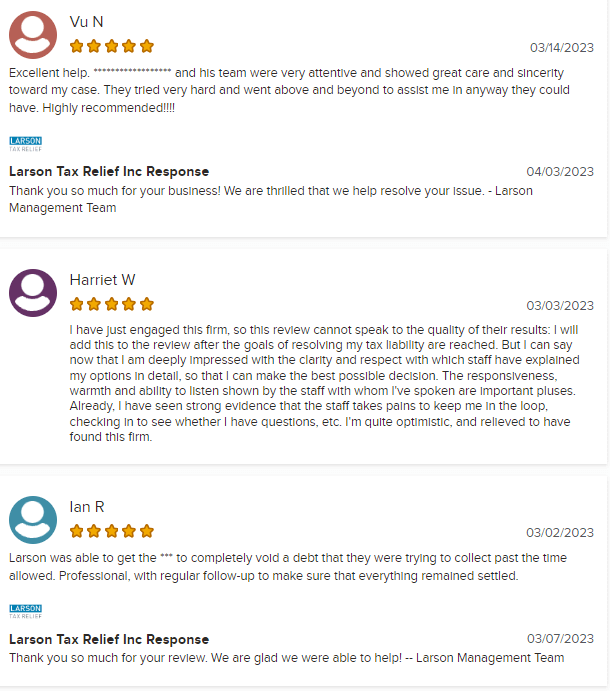

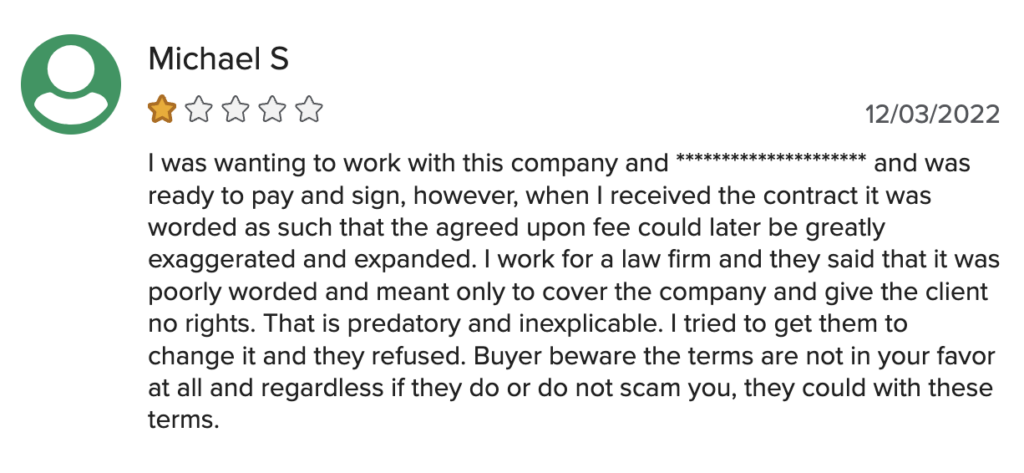

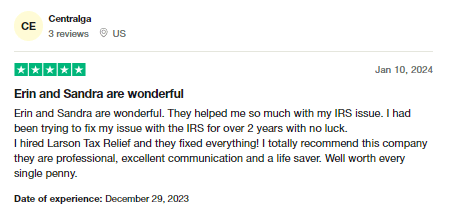

7. Larson Tax Relief

Larson Tax Relief, run by brothers Jack and Ron Larson, has been in business for 19 years and has 15 enrolled agents on staff. Larson serves clients in all 50 states and also won the BBB’s Torch Award for Ethics in 2022.

| Pros | Cons |

| – 15-day money-back guarantee – A+ Better Business Bureau Rating – Serves clients in all 50 states – 4.8-star Trustpilot rating | Limited money-back guarantee |

Customer reviews:

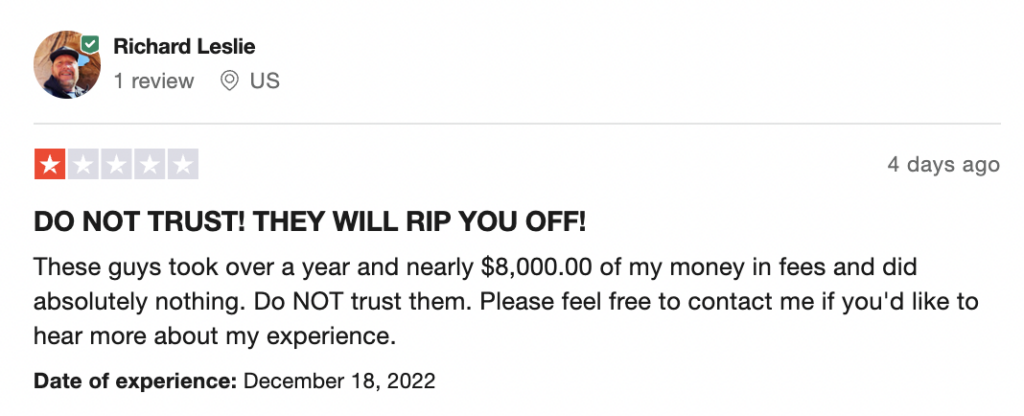

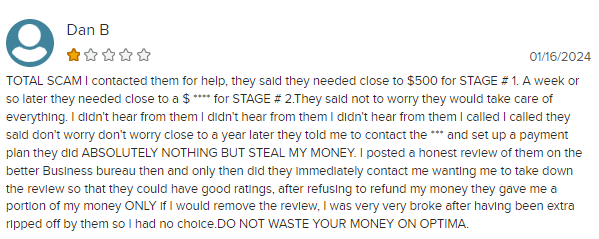

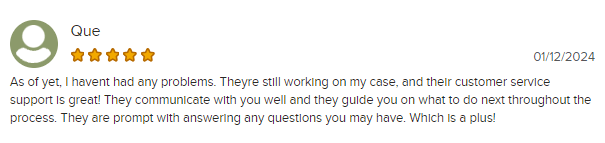

8. Optima Tax Relief

Optima Tax Relief was founded in 2011 and is staffed with tax attorneys and enrolled agents who are licensed to practice in all 50 states. They were the winners of the Better Business Bureau Torch Award for Ethics in 2021.

Optima has a Client Bill of Rights published on its website, which details what you can expect if you hire their professionals to help you resolve your tax debt. Optima also has an app on Google Play or the App Store, which will analyze any IRS notices you receive.

| Pros | Cons |

| – Refund of fee for investigation phase allowed within the first 15 days – App for analyzing IRS notices – A+ Better Business Bureau rating – 4.1-star Trustpilot rating | – Limited money-back guarantee – No pricing information listed on website |

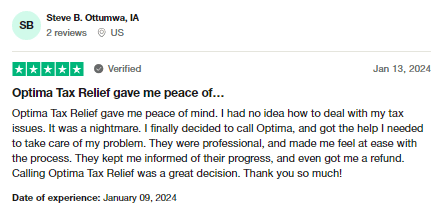

Customer reviews:

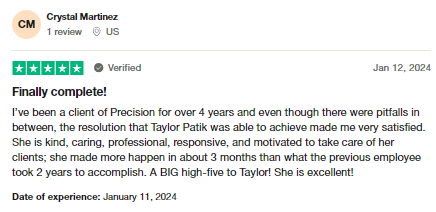

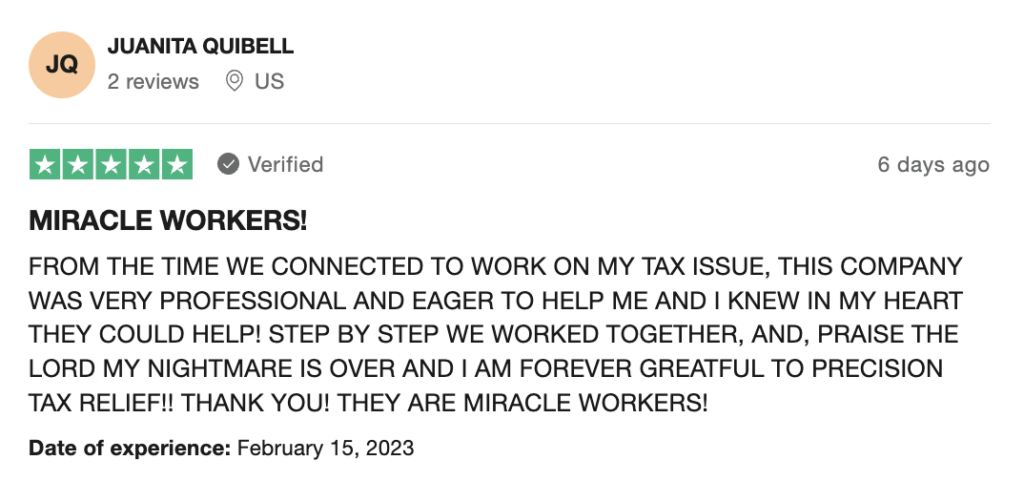

9. Precision Tax Relief

Precision Tax Relief has been in business since 1967. It has an A+ rating with the Better Business Bureau and also won the Better Business Bureau’s Torch Award for Ethics in 2019.

All tax relief cases are assigned to licensed tax professionals, including IRS-enrolled agents, certified public accountants and an experienced tax attorney. Additionally, the company offers a 30-day money-back guarantee.

| Pros | Cons |

| – More than 55 years of experience – Free consultation – Flat-fee pricing – Flexible payment options – A+ Better Business Bureau rating – 4.9-star Trustpilot rating – 30-day money-back guarantee | Does not offer tax audit representation |

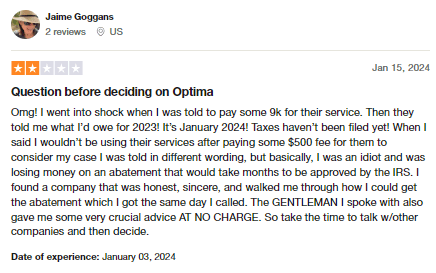

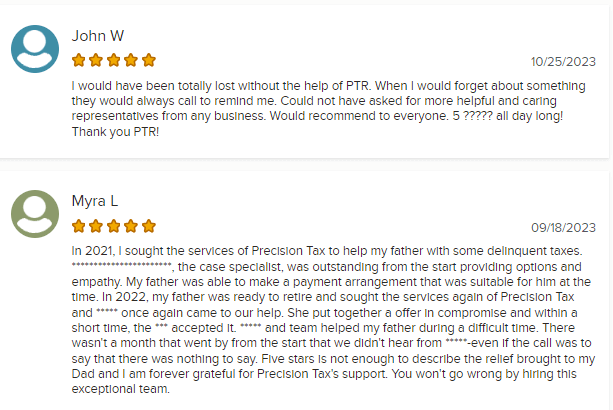

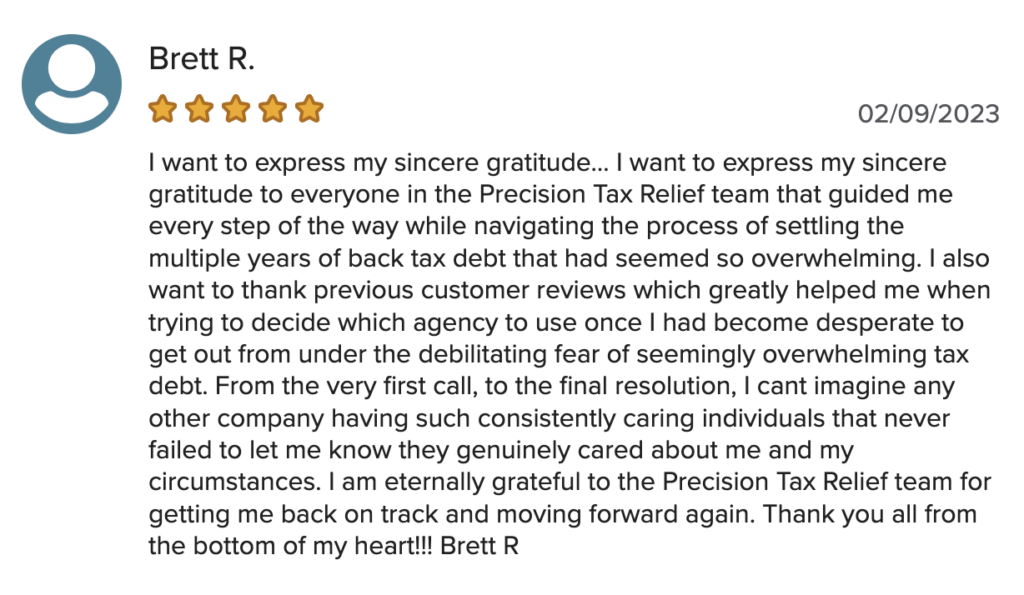

Customer reviews:

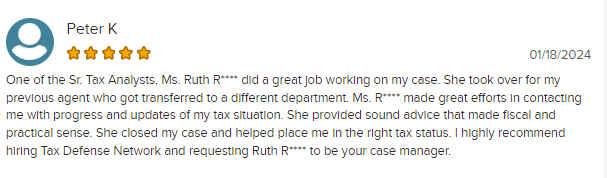

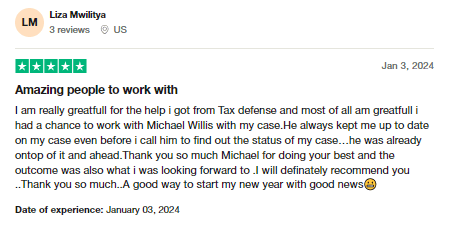

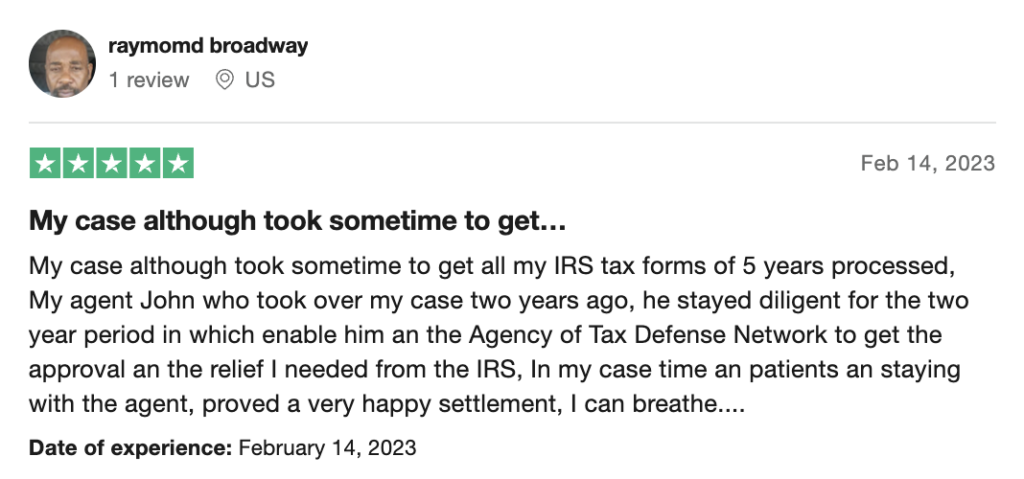

10. Tax Defense Network

Tax Defense Network, which was established in 2007, is an operation owned by MoneySolver, a student loan and tax resolution services company.

Tax Defense offers tax services for individuals and small business owners and employs hundreds of licensed tax professionals across the nation, including enrolled agents, tax analysts, certified public accountants, accredited tax advisors, and tax attorneys.

| Pros | Cons |

| – Free consultation – A+ Better Business Bureau rating – 4.4-star Trustpilot rating – Dedicated case advisor – Financing options | No transparent pricing or money-back guarantee information on website Upon calling, they wouldn’t disclose their money-back policy unless I provided personal information |

Customer reviews:

11. Tax Hardship Center

The Tax Hardship Center has been serving clients nationwide for two decades. They offer a variety of tax relief services and promise to work to ensure the best possible outcome for their clients.

| Pros | Cons |

| – Serves all 50 states – Free consultation – Promises fair and transparent pricing – A+ Better Business Bureau rating – 4.7-star Trustpilot rating – 14-day money-back guarantee | – No specific pricing information on the website – Most recent Trustpilot review is from 2021 |

Customer reviews:

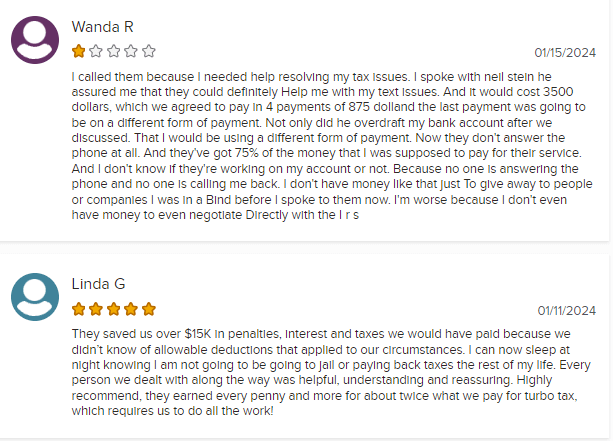

12. Tax Relief Advocates

Tax Relief Advocates was founded in 2017 by registered tax preparer George Nunez. They use a three-step resolution approach to tackle consumer tax issues: consultation, research, and resolution.

| Pros | Cons |

| – A+ Better Business Bureau rating – Staffed by licensed tax resolution professionals and attorneys | No transparency about fees or money-back guarantee on website |

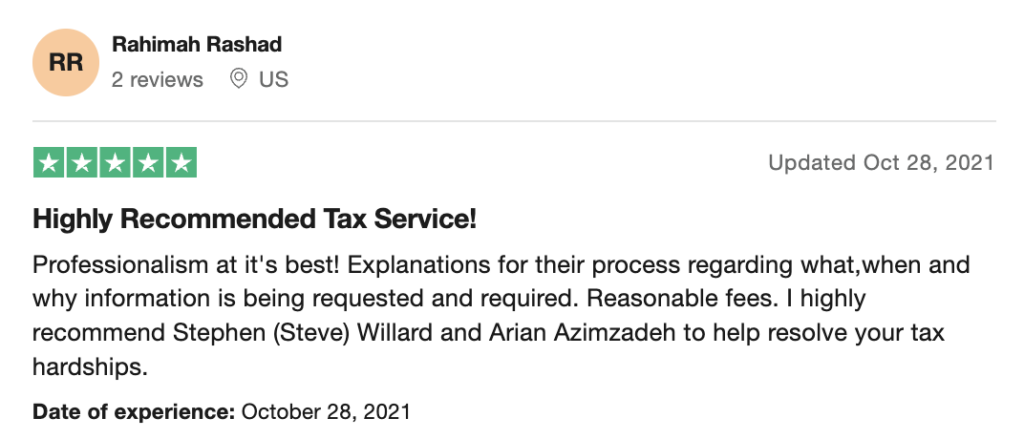

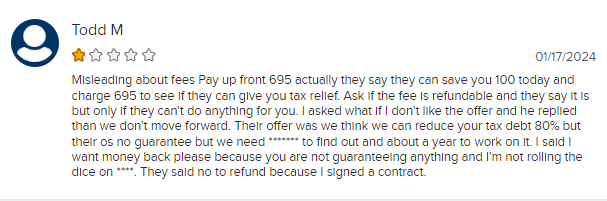

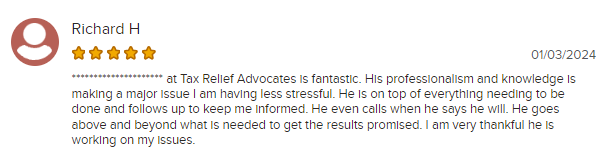

Customer reviews:

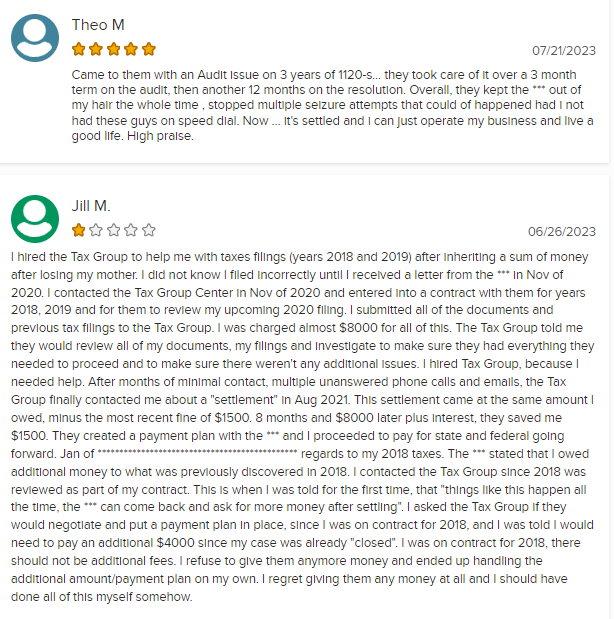

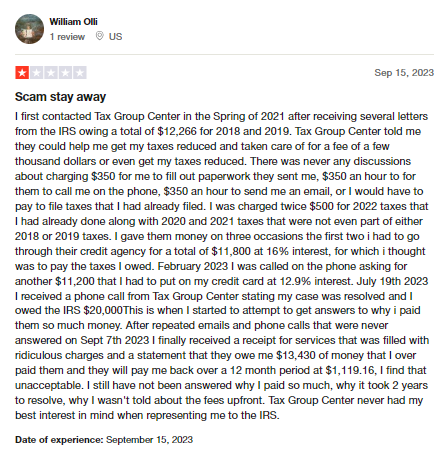

13. Tax Group Center

The professionals at Tax Group Center have over 30 years of experience, and their offices are open 24/7. They offer a free consultation to determine your needs and won’t take on your case unless they know they can reach a satisfactory resolution for you.

| Pros | Cons |

| – Free evaluation of your tax situation – Provides services in all 50 states – A+ Better Business Bureau rating – Staffed with attorneys, CPAs and enrolled agents – 100% price protection policy | – No specific pricing information on website – No money-back guarantee listed on website – 2.9 Trustpilot rating |

Customer reviews:

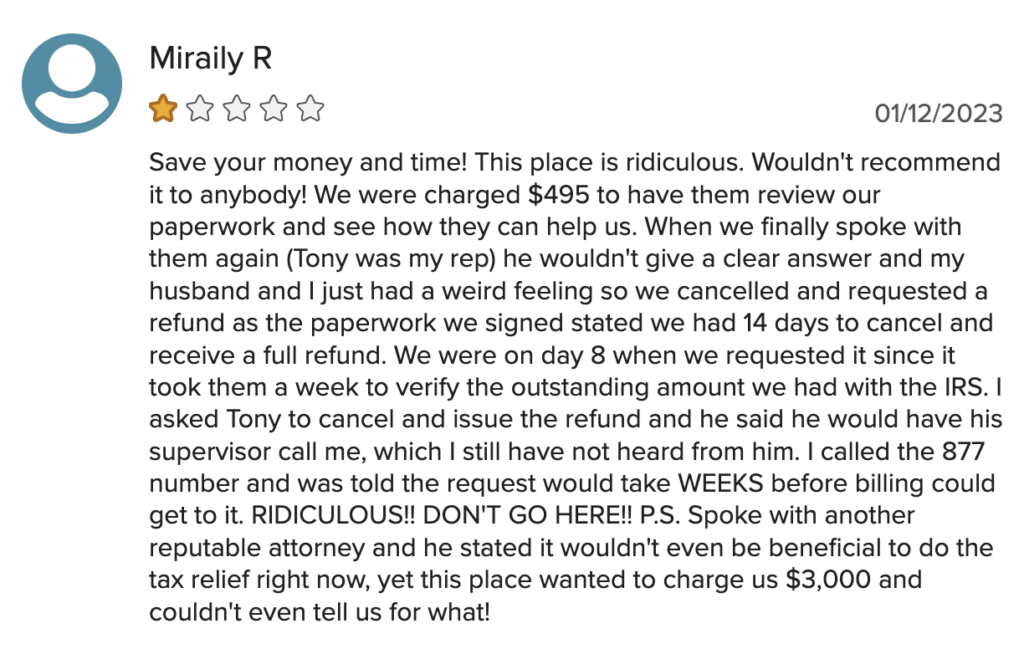

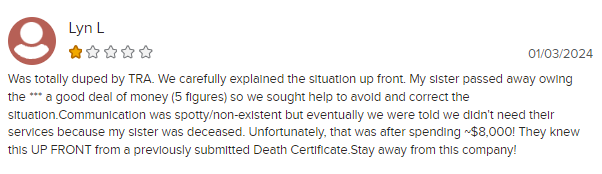

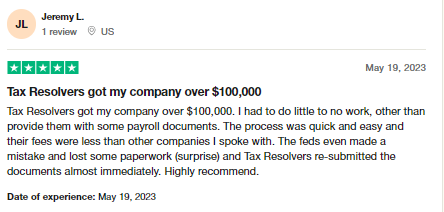

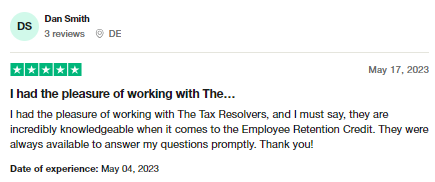

14. The Tax Resolvers

The Tax Resolvers has been in business for 15 years. As part of its core values, the company promises to deliver personalized service and individual attention to each case.

| Pros | Cons |

| – Free consultation – A+ Better Business Bureau rating – 4.8-star Trustpilot rating | – No specific pricing offered or a money-back guarantee – One poor review on the company BBB profile |

Customer reviews:

***Note: This is the only review posted on the Tax Resolvers’ BBB page.

Alternative to a tax debt relief company: IRS Fresh Start Program

A tax debt relief company can help you get accepted into the IRS Fresh Start Program, or you can do the legwork yourself.

Does the IRS really have a Fresh Start program?

The Internal Revenue Service implemented its Fresh Start program in 2011 to help individuals and small businesses struggling with tax debt to settle their tax liabilities. The program expanded access to streamlined installment agreements and expanded and streamlined the Offer in Compromise program.

Some tax relief debt companies still refer to IRS installment plans or the Offer in Compromise as the IRS Fresh Start Program. However, the Fresh Start program itself no longer exists.

How does the IRS Fresh Start program work?

While there is no longer an IRS Fresh Start program, some of the programs/initiatives it expanded are still available:

- Extended installment agreement: You can qualify for this payment plan if you owe the IRS $50,000 or less and you can pay back the debt within six years. No additional penalties or interest apply once you are approved for this plan.

- Offer in compromise: To qualify for this payment plan, all other payment options must have been exhausted. Once you’ve proven you cannot pay your debt through an installment agreement or a lump-sum payment, you make a reasonable offer to pay off your tax debt for less than you owe, and if the IRS accepts your offer, you can settle your debt.

- Tax lien withdrawal: This payment plan involves paying the entire amount you owe through a direct debit.

Who qualifies for the IRS Fresh Start Program?

Both individual taxpayers and small businesses who can prove through documentation that they would experience significant financial hardship when paying their tax balance can qualify for programs that were expanded under the Fresh Start Program.

How much will the IRS usually settle for?

The IRS will usually settle for an amount that it determines you can easily pay. It determines this amount by considering your assets, income, savings, debts and other expenses.

FAQs about tax debt relief companies

Here are answers to some of the most commonly asked questions about tax debt relief companies:

Who qualifies for tax relief?

Start by contacting the IRS to see if you qualify for an Offer in Compromise (OIC), which allows you to settle your tax debt for less than what you owe.

You’re eligible to apply for an Offer in Compromise if you:

- Filed all required tax returns and made all required estimated payments

- Aren’t in an open bankruptcy proceeding

- Have a valid extension for a current year return (if applying for the current year)

- Are an employer and made tax deposits for the current and past 2 quarters before you apply

You can also try submitting an Installment Agreement Request (Form 9465) with your tax return to see if you can pay your taxes in installments.

How much does it cost to use a tax relief company?

While every case is different, Alec says you can expect to pay about 10% of the total tax debt to a tax relief company.

What is the best company to help with back taxes?

The best company to help with back taxes is the one that can successfully take on your case and get a resolution that you will be satisfied with for a price you can afford.

These are some of the best tax relief companies to help with back taxes, based on the number of positive reviews they have on the Better Business Bureau and Trustpilot sites:

- Instant Tax Solutions

- ALG Tax Solutions

- Precision Tax Relief

- Fortress Tax Relief

Research tax relief companies >>

Bottom line: Is a tax relief company worth it?

Allec says because it can be difficult to prove to the IRS that you can’t afford to pay and will not be able to pay what you owe, having a professional in your corner can help.

He gives this example:

A taxpayer may be able to negotiate on his own with the IRS and settle their taxes for $50,000 less than they owe.

On the other hand, a professional might charge $10,000 but know how to work the IRS so that the same taxpayer can pay $100,000 less than he owes.

“If a tax professional can do that, their fee was obviously worth it,” Allec says.

These are some other reasons he says it’s worth hiring a tax professional:

1. You’ve been assigned a revenue officer.

Allec says a revenue officer — someone from the IRS specifically dedicated to tracking your case — is typically assigned when you owe more than $250,000.

2. You have years of unfiled tax returns.

If you haven’t filed taxes in a long time — say, five years or more — you may not necessarily want to file all those returns.

“You could be making your problem worse by doing so,” Allec says.

He recommends those people work with a reputable tax relief company to determine which years it would be in their best interest to file and to resolve that debt accordingly.

Also, check out these resources for free help with tax preparation.

3. You’re busy.

If you don’t trust yourself to stay on top of IRS deadlines because you’re too busy with career, family, or other commitments, Allec says you should consider paying a professional tax relief company to stay on top of your case for you.

Trying to get your finances back on track? Check out these posts:

- 52-Week Money Challenge for 2024

- 9 ways single moms can make money and build wealth in 2024

- Need money now? 15 ways to get free money instantly

- 20+ ways to get free money in 2024 to help pay bills

- 42 recession-proof jobs to keep cash flowing during economic downturn

- 7 recession-proof businesses to start now to earn more money

- Best money saving tips for single moms

- 10 quick job certifications that pay well

SOURCES

- “How much revenue has the U.S. government collected this year?” December 31, 2023. Fiscal Data, U.S. Department of the Treasury https://fiscaldata.treasury.gov/americas-finance-guide/government-revenue/

- “SOI Tax Stats – Delinquent Collection Activities – IRS Data Book Table 25” April 14, 2023. The Internal Revenue Service https://www.irs.gov/statistics/soi-tax-stats-delinquent-collection-activities-irs-data-book-table-25

- “Trouble Paying Your Taxes? April 2023. Federal Trade Commission Consumer Advice https://consumer.ftc.gov/articles/tax-relief-companies

While every case is different, based on reviews from customers who used tax relief companies on this list, you can expect to pay between $1,000 and $10,000 to work with a tax relief company.

The best company to help with back taxes is the one that can successfully take on your case and get a resolution that you will be satisfied with for a price you can afford.

If you have a complex tax case that could result in you owing the IRS thousands to millions of dollars, hiring an experienced tax relief professional can help you save money.