Here’s the thing with life insurance for single moms: Women often mistakenly believe that life insurance is not for them since they might not have an income today, or their income is too low to afford it.

If this is you, Mama, you’re not alone …

A Genworth survey found that 69% of single-parent families with kids at home are without life insurance, compared with 45% of married-parent families.

The reality is that most moms need life insurance until their kids graduate college.

Here are a few situations in which you should purchase a life insurance policy:

- You should buy life insurance when you have a first or another baby.

- You should buy life insurance when you get a divorce.

- If you have a business, pet or philanthropic cause you want to leave money to, an investment in life insurance can benefit more than just a biological family.

Everyday life helps parents find the best life insurance for their needs. A+ rated by the Better Business Bureau and a human agent to help. Get a quote in 3 minutes (and you don't have to give your contact info) >>

Why do single moms need life insurance?

In general, you need life insurance if other people depend on you:

- You are a parent to minor children

- Your spouse depends on you

- Your aging parent or disabled sibling depends on you

Women need life insurance more than men do, yet they are less likely to be covered.

67% percent of women surveyed in 2019 by agency Haven Life said they had life insurance, compared to 79% of men.

Of those who had an individual life insurance policy, the women had an average coverage amount of $231,342, compared to $423,102 for men surveyed.

Why the difference? The survey also asked whose death would have the greatest impact on the family — the primary earner or the primary caregiver. Women, who were more likely to be caregivers to children, and more likely to earn less than men, agreed with their male counterparts in the survey: Both genders say the death of a family’s primary earner would have the greatest negative impact on the family.

So why should women and moms prioritize health insurance, no matter their family status, or earning? Read on!

You need life insurance for your family

I know, we all think we are invincible, but the fact is there is always a possibility of something happening at any time. I’ve seen first-hand how families have struggled because they were not prepared for the unexpected.

Chances are, your children are financially dependent on you. If something were to happen once Social Security kicks in, your family would still need more financial support. Life insurance provides that.

Women live longer than men

This is old news: Women outlive men. This is true in every country in the world. In the United States, male life expectancy was 73.4 years, and 80.1 years for females — a difference of 6.7 years.

Men — including those with young children living at home — die earlier than women. The reasons: more dangerous jobs, higher suicide rates (the reasons are many and complex), higher propensity for risk-taking, that leads to aggressive driving and traffic fatalities, violence, and homicide.

Biology means men are more susceptible to fatal disease, while also less likely than women to seek out medical care.

Women are more likely to be the primary caregiver to children

When fathers die, their wives, partners and exes are then left fully responsible for the care of any children or other dependents.

Because of divorce and separation, more than 25% of fathers live away from their children’s primary residence, according to recent U.S. Census data. In military families, fathers are more likely than mothers to be deployed. Fathers are more likely to be incarcerated than mothers.

In all of the scenarios, mothers are not only the primary caregiver to the children, statistically, they are also the primary financial provider, too.

Even in cases where child support is mandated by courts, less than 40% is actually received by the custodial parent, and the average sum last year was less than $400.

In other words, while we may be working on more equality between moms and dads (both in terms of financial and logistical care of kids), today the fact remains: If you are a mom, you are likely to be primarily, if not solely, responsible for your kids.

A full financial plan includes life insurance.

Women are more likely to be the caregiver to aging or sick loved ones

Historically, and around the world, women have taken on the role of caregiver of aging and ill adults in the family.

The number of men taking on this role in the United States has risen dramatically in recent years, but the fact remains: Women still care for the dependent more than men.

Women may soon be more likely to be the breadwinner in married families

While women are the breadwinners by a landslide in single-parent families, this may soon also be the norm in families with partnered parents.

A full quarter of wives in heterosexual marriages make more than their husbands. This figure has been on the rise for decades — and is expected to continue to climb as women gain more power in the workforce and government, and men continue to struggle with unemployment at a higher rate.

Many employers offer life insurance policies as part of a benefits package and may even cover some or all of the cost. However, most employee-sponsored life insurance plans are capped, typically at one to two times your annual salary.

If you had an employee-sponsored life insurance plan before you became a single parent, remember to switch out your beneficiary if you no longer want the money to go to your ex.

We'll discuss later why you shouldn't name your children as beneficiaries (and what to do instead).

Life insurance is less expensive for women

Because women statistically live longer and are less likely to die than men, life insurance coverage is cheaper for us because insurance companies can spread out payment over a longer period of time. That means fewer excuses not to buy it!

The truth is, life insurance is often very affordable. For example, if you are a 40-year-old, non-smoking female and in good health, you could obtain coverage for less than $20 per month. You can always increase your coverage later, but it’s best to lock in a rate while you are young because it does get more expensive as you age. Get a quote now >>

Still not sure if you need life insurance?

You think your life insurance policy through work is enough

This is a common perception, and it may be true depending on your situation, but it’s important you understand the limitations of an employer life insurance policy:

- They are contingent on your employment with the company (no job = no insurance!).

- You can’t lock in a rate with these policies, so the price is going to go up as you age, so you may be paying more in the long-run.

- Finally, they usually only cover 1-2x your salary. How long will that last for your family? Is it enough?

You don’t totally understand how life insurance works and who gets the money

Life insurance can be really confusing and there are a lot of misperceptions. While it can cover burial expenses, as a mom, this is only part of what you need to be thinking about.

You also need to consider how your family will survive without your income. I know it isn’t pleasant to think about, and that may be a reason why you have put it off, but you really shouldn’t.

You’re uncomfortable paying for life insurance you may never need

I’ve heard this one before as well, and although we never want to waste money, this is one time I hope you waste money (nothing ever happens to you).

However, on the off chance something does happen, you need to be prepared. The consequences can be disastrous financially if you’re not prepared.

You let your life insurance policy lapse

If you did, your coverage will be or has been canceled and you have to start the whole application process over — and prices are likely to jump.

Life insurance FAQs

New to life insurance? Here’s what else you need to know:

- What does life insurance cover?

- How much life insurance should a single momhave?

- How much does life insurance cost?

- What type of life insurance should you get?

What does life insurance cover?

Just like most term life insurance policies, life insurance will help your family financially when you die. It is intended to provide help to your loved ones when they can’t rely on your salary or income any longer.

The payout can be used to pay for your kids’ child care, college, daily care, to pay off any of your debts (including mortgage), or support their lives financially.

How much life insurance should a single mom have?

Here is a quick-and-dirty formula: for most moms, multiply your income x3 to arrive at the amount of term life insurance you need.

For example, if you are a 40-year-old woman earning $50,000 per year at your job, buy a term policy with a $750,000 payout. Of course, there are many variables, including how much you have left on your mortgage, whether you want to fund your kids’ college, the age of your kids (the younger they are, the more insurance you may want to buy), whether you are responsible (or want to take responsibility for) an aged or disabled loved one.

A life insurance agent can help you find the right answer and the right policy. Use a life insurance calculator to understand how much life insurance you need, and qualify for. Items to consider:

- Your income — you likely want your kids or other heirs to enjoy a certain lifestyle by way of your life insurance.

- What do you want to pay for? If you want to make sure your kids' college tuition is paid in full, then consider that expense. If you want to pay for college and grad school and a down payment on a house and their wedding, then that is another sum.

- Cost to pay off debt. This may include credit card and personal debt that will need to be settled before your estate pays out your beneficiaries. If your debt is significant, factor that in first.

- How much can you afford? While you likely cannot afford not to buy life insurance, buying too much that you cannot afford only makes the life you are living today that much tougher.

As a general rule, you want to buy enough to pay off debt and support your dependents until they are through college.

One good measure is to multiply your current income by 10 (so if you earn $80,000 per year, you would need to buy $800,000 worth of life insurance). And, if you have debt, add what you owe to this number. Boom! You have your life insurance number.

For example:

$200,000 outstanding mortgage

+$800,000 ($80,000 salary x 10 years)

_____________________________

$1,000,0000

In the above family, a $1 million term life insurance policy is a good rule of thumb, but you might want to confirm this with life insurance companies you are considering.

Your plan should pay off your debts and replace your income for the years your children are still in school. It’s as easy as that.

How much does life insurance for single moms cost?

You may assume that you can’t afford life insurance, or that a policy is a line item that you can afford to slash from a tight budget.

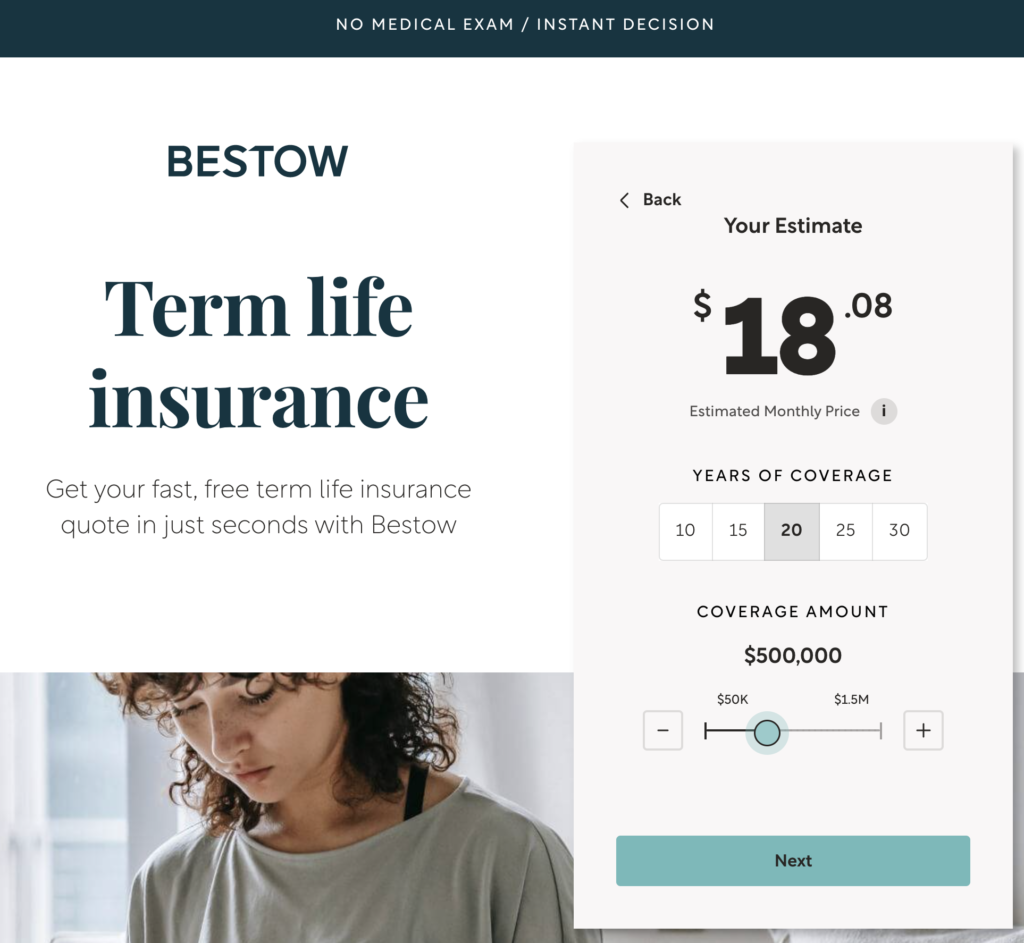

A recent life insurance calculator input showed that a 33-year-old woman in average health can buy $500,000 worth of 20-year term insurance for $18 per month. That same woman qualifies for a $1 million term policy for $30 per month:

Keep in mind most people really only need life insurance for the years they have dependents, but that is a personal decision and may include adult children or siblings with disabilities, a spouse who is dependent on your income, and other scenarios. So, you may not need a full 30-year traditional term policy, but a shorter one.

Rest assured that life insurance for single moms is affordable.

What type of life insurance should a single mom get?

Life insurance comes in two main varieties—permanent life insurance and term life insurance.

Many people prefer term life insurance because it is simple, easy to understand, and serves a single purpose: protecting their loved ones should the policyholder die.

Term life policies also tend to be much more affordable compared to whole life policies.

Whole life insurance policies, on the other hand, are more complicated than term life policies.

You may decide that instead of a whole life policy, you prefer to have the flexibility of a money market account for your cash, or that you can earn a higher interest rate in a CD or in an index fund. While many people enjoy the lifetime duration of a whole life policy, that feature also makes it more expensive than a term life policy.

Long story short: Term life is the easiest, most affordable way to buy life insurance. You can start the process online now >>

Permanent life insurance

Permanent life insurance is any policy that lasts for your whole life, while term life insurance only lasts for a specific period of time (the term). As long as you make your monthly payments, a permanent life insurance policy is permanent, meaning that whenever you die, your death benefit will be paid to your beneficiary.

Permanent life insurance typically comes with a cash value that grows as you pay your monthly premiums, earning interest, and creating a savings account you can tap while you are still alive.

Because of these added benefits, permanent life insurance is often much more expensive compared to a term life policy with a similar payout.

Permanent life insurance can come in a number of varieties: whole life, universal life, variable life, and variable-universal life:

- Whole life is another name for permanent life insurance.

- Universal life consists of a death benefit which is paid out upon your death, as well as a cash component that you can tap while you’re alive

- Variable life carries a cash value that can be invested in a fund managed by the life insurance company

- Variable-universal life insurance allows you to both invest the cash balance of your policy, and adjust the death benefit over time.

Term life insurance

Quick order of business: We advocate for term life insurance — which is the quickest life insurance to buy online, easiest to understand, and addresses most people’s needs to protect their loved ones in the event they die.

Term life insurance has two elements:

- The term — or amount of time — that you will be covered. For example, if you buy a 15-year policy, you are covered from the time of signing, and for the next 15 years (assuming you pay your premiums on time). Terms are typically 5, 10, or 30 years.

- Amount — or sum of money your loved ones will be paid should you pass. Typical sums are $100,000, $500,000 and $1 million.

A big benefit of term life insurance is that you can buy it easily, quickly and affordably online.

By contrast, whole life insurance has a cash value component, which grows at a low, but tax-deferred rate — and which you can borrow money against. Whole life insurance can be a good option, but can be complicated and more difficult to get a whole life insurance quote or policy online.

Is life insurance taxed?

No. This is a common question, and the answer is that life insurance is not taxable. What your beneficiaries receive is what they receive!

Is it worth paying for life insurance?

Statistically, you are unlikely to need life insurance, especially while your kids are young, before they graduate college. The value of life insurance really comes in the peace of mind it offers. For a few dollars each month, you can buy a basic term life insurance policy so you can sleep better and be less stressed about what would happen to your kids if you die.

Can you have multiple life insurance policies?

You can buy as many life insurance policies as you like. It is legal and possible to buy your own life insurance policy in addition to one you have through your work, or buy additional life insurance once you have a baby or go through divorce, for example.

Can you get life insurance on anyone?

You can also buy life insurance policies on other people — your kids’ dad, your ex-husband, your parents, etc. However, this process is trickier — you need to get the other person’s permission to buy life insurance on them, and you must be able to show proof that you will be impacted financially if they die.

Taking care of elderly parents? 5 tips for the sandwich generation

Who should you put as a beneficiary for life insurance?

In purchasing a life insurance policy, you must name a beneficiary, the person who will receive your death benefit in the event that you die.

Most often, married individuals choose their spouse as the beneficiary of their life insurance policy. This isn’t your only option, though: Anyone can be listed as a beneficiary.

Instead, create and name an estate, trust, and guardianship plan, which will receive the death benefit and use the proceeds to care for your child. This estate should designate guardians who will raise your child in the event of your death, and a conservator, who will manage the finances of your estate — including ongoing care of your child.

If you name your children as beneficiaries directly, your estate will wind up in probate court. Life insurance companies can't pay a death benefit directly to anyone under 18. In Alabama, that age is 19, and in Nebraska, it’s 21.

If you establish a trust, you can name the trust as your primary beneficiary, and the insurance company will deposit the money into the trust. You’ll appoint someone as a trustee to ensure the money in the trust is used according to your directions.

Bottom line: Best life insurance and life insurance company for single moms

If you are a single mom without life insurance, term life insurance is the best option to protect your children in the event that you die. That's because term life insurance:

- Provides coverage only for as long as you need it — until your children can financially support themselves (approximately after they graduate from college)

- Costs less than a whole life insurance policy

- Is a less complicated form of coverage that maintains the same premium throughout the life of the policy

When it comes to choosing an insurance provider, the best companies — in our opinion — have:

- Affordable term life insurance policies

- Quick online quotes

- No medical exams

- Solid reputations with positive consumer reviews

We recommend comparison shopping some companies in this space, including some we've reviewed:

Here is a quick-and-dirty formula: for most moms, multiply your income x3 to arrive at the amount of term life insurance you need.

I like this article a lot. Thank you, Emma, for bringing awareness to this issue.

Don’t do term insurance if you can afford not too. I am a life insurance agent with New York Life Insurance. We are the oldest, biggest, and richest life insurance agency in the country. Term insurance is fine for a single parent SO LONG AS the parent converts to cash value life insurance within the first few years. Term insurance is temporary insurance. As Emma said, its only meant to last for 10-30 years. But after that, it becomes exorbitantly high! For young single parents, this is a problem.

Cash value life insurance is better. (1) Over time you own the policy – just like after you finish paying your mortgage you own your home. (2) You can borrow from the policy. So if you get in a financial bind or you need to pay expenses for your child, like education, extra-curricular, etc., you can get a loan on your policy and just repay it later.

Another great idea is to get a policy on your kids. Definitely NOT because we believe they will go before us – no parent wants that. But because kid policies have a long time to accrue cash value. So by time they turn 18, 25, or 30, they already have a policy that can be given to them with huge cash value.

I’m a single mom to a 6-year old. When I got mine and my child’s policies, I felt a huge sense of relief because I knew I had provided for my baby and if I go early she’ll be taken care of. Please, just do it. Get the policy. Many whole life policies are extremely affordable – some as low as $40 or $50/month – but it all depends on the parent’s health.

Hope this helps.

Sorry for my misspellings – I left my glasses at home today!!!

Good article. However Haven Life is not the best avenue to go. They represent ONE company. Depending on ONES health profile who knows what rates Haven Life will offer, or if they can even offer coverage.

Smart people work with agencies who represent multiple companies. Bad advice being given from author to just “work” with Haven Life.

Tom –

At least be like Karen and admit that you’re an agent.

I am a single mom with a disability. We live mostly on my SSDI check and live simply. No one will sell me life insurance worth more than $50,000. It’s not that some of us are “stupid” it’s that $650.00 a month income only goes so far…

That really is a challenge. Have you heard of other disabled moms who have found a way through this?

Great advice !

OR be like the single mom who is dating an acquaintance of mine, and recently told (not asked) him to put her on HIS life insurance policy “to take care of us if something happens to you.” They’ve been DATING maybe a couple years, and this guy has his own grown kids to think about. Mind you the single mom owns nothing, lives at home with her own mama at 44 years old (with her drug-addled 20 year old ex-con son) because she can’t pay her own bills from her low paying jobs where she barely stays for a few months.

Forget the man’s kids, in favor of her own, not to mention the man has no legal commitment to her. She’s a single mom, by gosh, her kids needs come before his kids needs, as usual.

OH, and later she told him she wants to marry him, “So I can quit my job to stay home and take care of you.” – referring to the boyfriend. She doesn’t have young kids, and he’s been divorced for years and taken care of himself. Hmmmm. Sounds more like she wants to sit on her ass at home (a home at the beach she also wants him to pay for.) while he works to keep her in the style he’s providing, because gawd knows she doesn’t pay her own bills.

Impress me single moms. Pay for your own life insurance, and other bills.

This is pretty vitriolic Darth. I dont doubt there are some free loaders out there but that is certainly not the majority. I work very hard at a professional full time job am a single mum and I pay my own life insurance. Think it’s always prudent not to generalise especially when you are on a site dedicated to the group you are stereotyping !

Absolutely! I have life insurance, and I keep an updated will with trusts set up. I also have all the ‘legals’ in place for my children’s care and support as their father isn’t in the picture at all. Huge load off my shoulders knowing they’ll be good (at least financially!)

Yes, removing the guilt/stress is a great reason to buy life insurance!!