Do you need to boost your credit scores — fast? While some diligently work on improving their credit score for a year or more to make a big move like buying a car or a home or refinancing their debt, life might throw you a curveball — and you may need to boost your credit score quickly.

Experian Boost™* is an online tool that claims to help users increase their FICO®** Score by an average of 13 points — though they do post a disclaimer that your score may not change at all.

Experian Boost is unique in that it considers utility and telecom bills like your electric, cable and phone bills when calculating your credit scores.

Experian Boost is 100% free, does not hurt your credit scores, and takes just 5 minutes to complete. In this review, I'll talk about my own experience using Experian Boost and help you decide if you should use it to improve your credit score:

Get your free credit report and increase your FICO® Score immediately with Experian Boost >>

Is Experian Boost safe to use?

Yes, Experian Boost is a legitimate feature through Experian.

Tom Koesternen, Chartered Financial Analyst (CFA) and consultant for TheGuaranteedLoans, says Experian Boost is safe and useful for people who need help improving their creditworthiness — especially if they need help getting a personal loan.

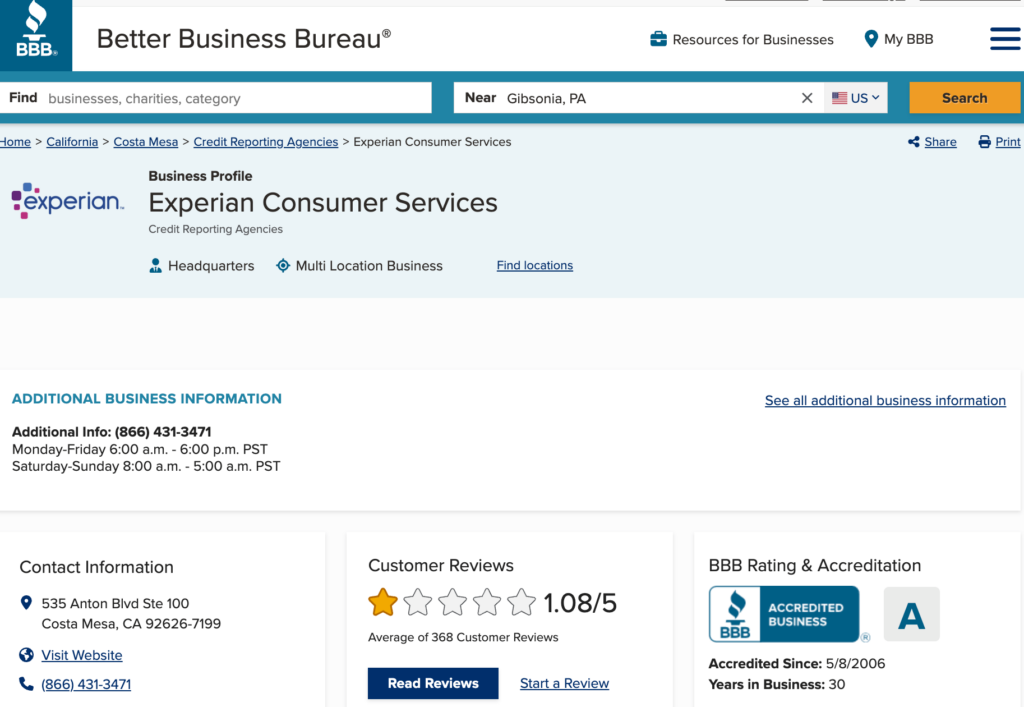

Experian is one of the three leading credit reporting bureaus, overseen by lots of federal regulation, and has an A+ Better Business Bureau rating. Experian also has the most up-to-date and powerful 256-bit SSL data encryption on the market.

Nothing is perfect, but Experian Boost is indeed a safe product.

Is Experian Boost really free?

Experian Boost is 100% free. That said, Experian does have some credit monitoring and repair products that cost money, which you can expect you will be pitched. But you do not need to pay in any way to use or benefit from Experian Boost.

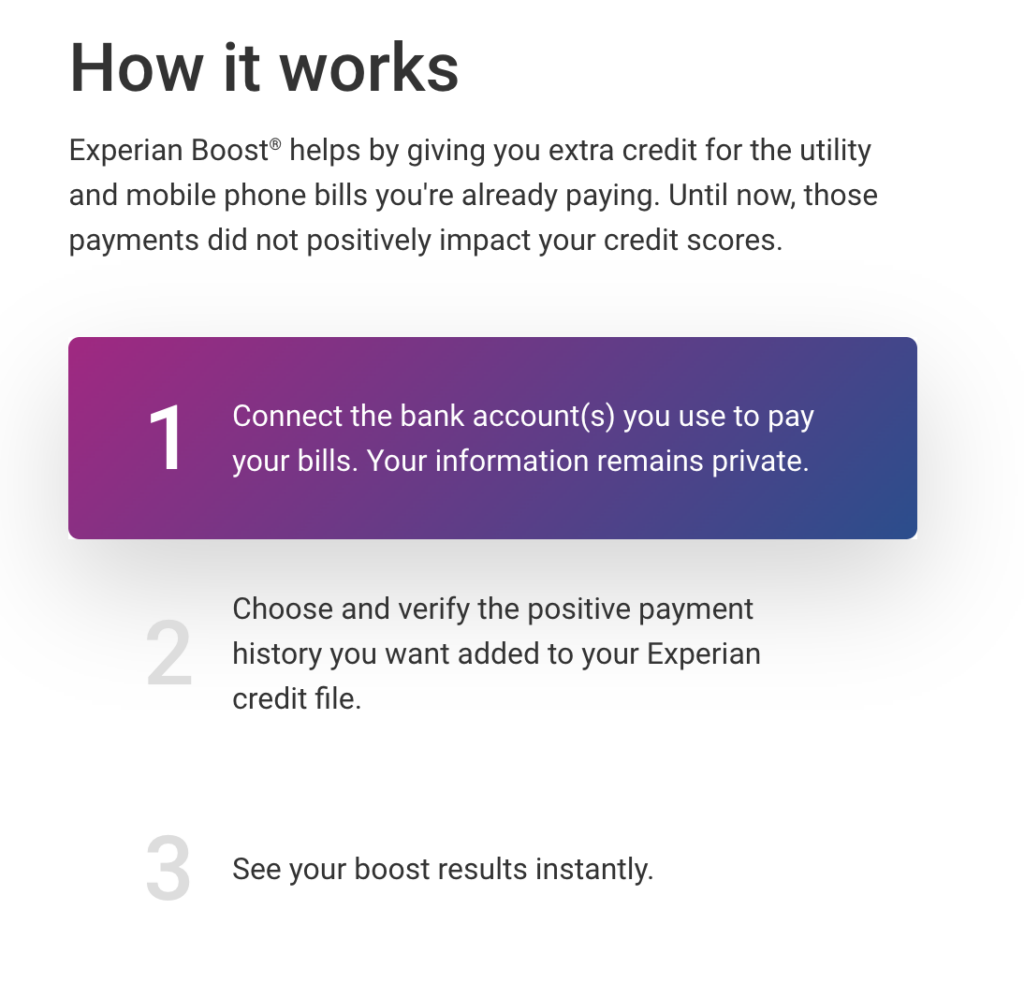

How does Experian Boost work?

Experian Boost factors your on-time utility bill payments into your credit score to give you a little boost. If you are someone who regularly pays your phone, electric or cable bill on time, Experian Boost may be worth trying.

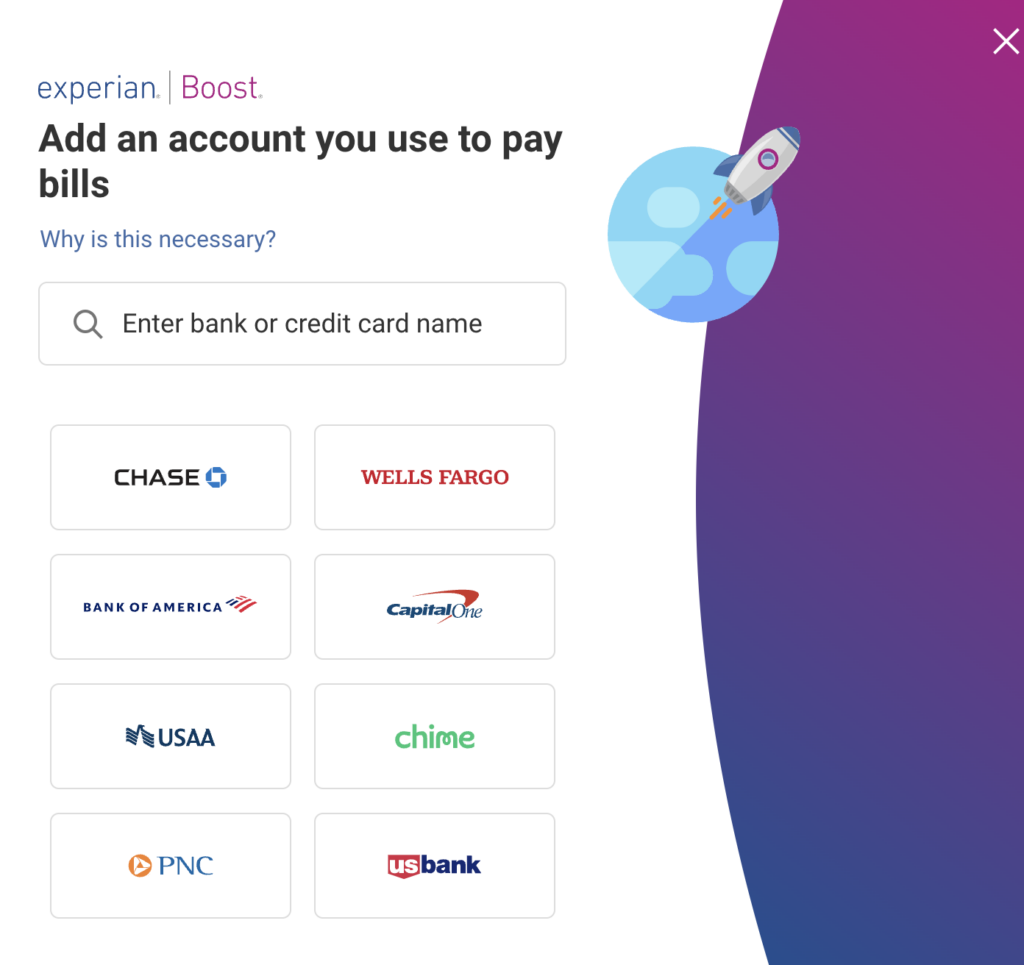

It’s a simple and quick process to create an account and link your bank accounts with Experian Boost — the whole process took me just a few minutes.

Once you create an account, you'll be prompted to enter your bank's login information, and Experian will do the heavy lifting to review your credit history.

Here is how Experian Boost works, step-by-step:

2. Connect your bank accounts. This allows Experian Boost to comb your expenses for timely payments.

3. Click the button to verify that you want your bills to be included in your Experian credit report, and let Experian Boost work its magic on your FICO® Score.

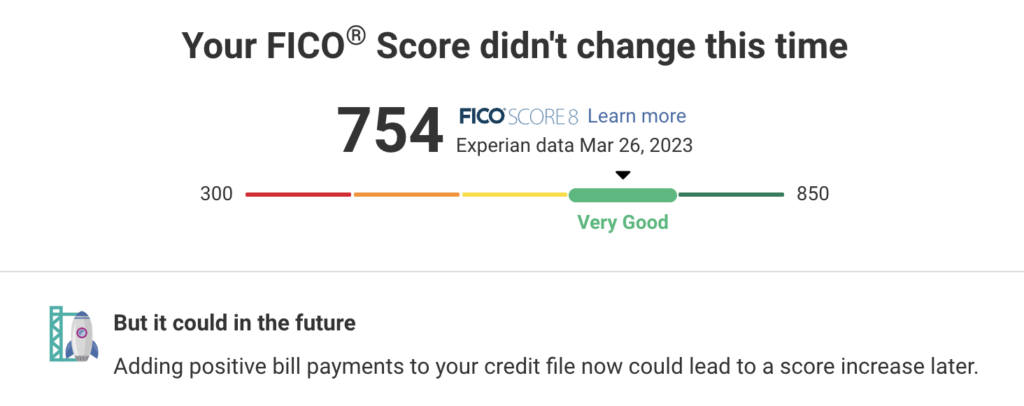

4. Watch your FICO® Score improve (though this doesn't always happen — mine stayed the same)

5. Once you are plugged into Experian Boost, the service will continue to monitor your credit scores and report for free, as well as a factor in your positive utility payment — which will benefit your credit scores long term.

Based on your credit history and bill payment records, Experian Boost can increase your FICO® Score immediately. Those whose scores are boosted see a 13-point increase on average, according to Experian1.

Any Experian Boost improvements are not applied to Transunion or Equifax credit scores.

How much will Experian Boost improve my credit?

According to Experian, 61% of Experian Boost users increased their FICO® Score, by an average of 13 points per user.

Of Boost users with a FICO® Score under 579, 86% increased their FICO® Score after completing the process, raising their scores 21 points on average.

10% of consumers who had insufficient credit history became scoreable.

Experian Boost impacts your credit score on the FICO® Score 8 model. FICO® Score 8 is most often used as a basis for lenders approving loans and credit cards, landlords looking for responsible renters, and signing up for utilities like gas and electricity.

Experian Boost reviews

Leighann’s experience with Experian Boost

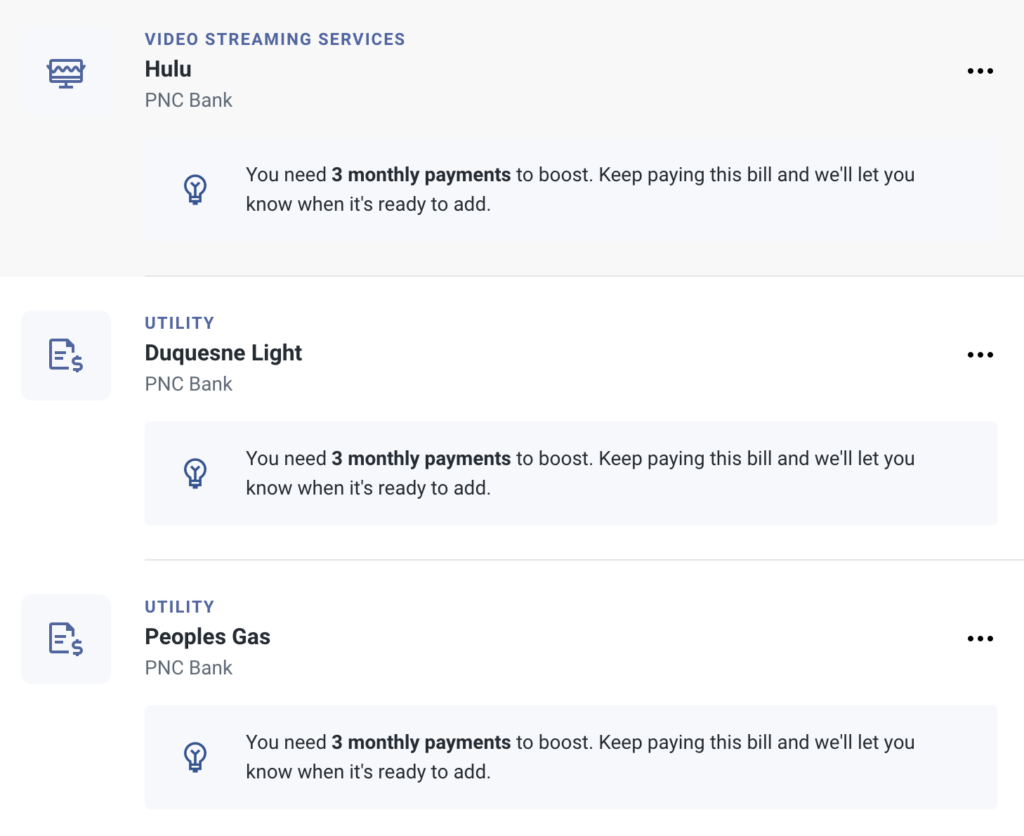

After I signed up for Experian Boost and added my bank account, I got a message from Experian that I didn’t have enough history of monthly payments to boost.

This was confusing to me, since all of the bills they cited as being too “new” I’ve been paying for years (my utility bills specifically for nearly 8 years).

I’m not sure if this error has to do with a communication error between my bank (PNC) and Experian, or if it’s an error in the Boost system.

I tried adding one of my credit card accounts and was notified I was eligible to boost a single bill (my cable bill).

When I clicked Boost, I received this message that said my score didn’t change this time but might as more bills become eligible to boost:

Regardless of this little glitch, I would definitely try to use Experian Boost again in the future and think it’s worth trying to boost your score by a few points. It is free, after all.

These are my ratings:

- User interface: 3.5

- Value: 5

- Customer service: 4.4

Experian Boost BBB reviews

Experian Boost is a product of Experian Consumer Services. The business, BBB-accredited since 2006, has an A+ rating with a 1.08/5 rating based on more than 360 reviews.

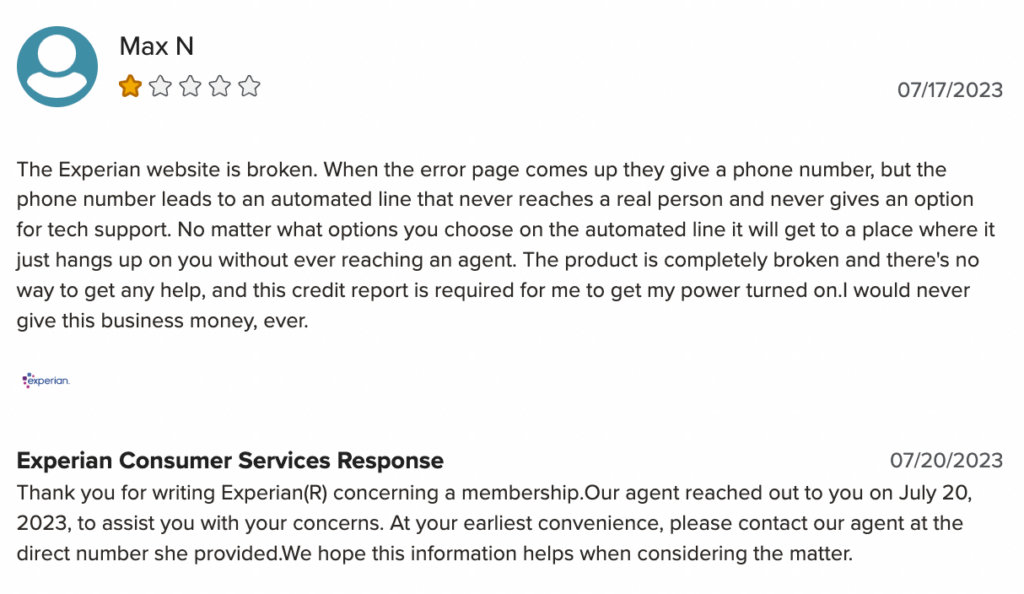

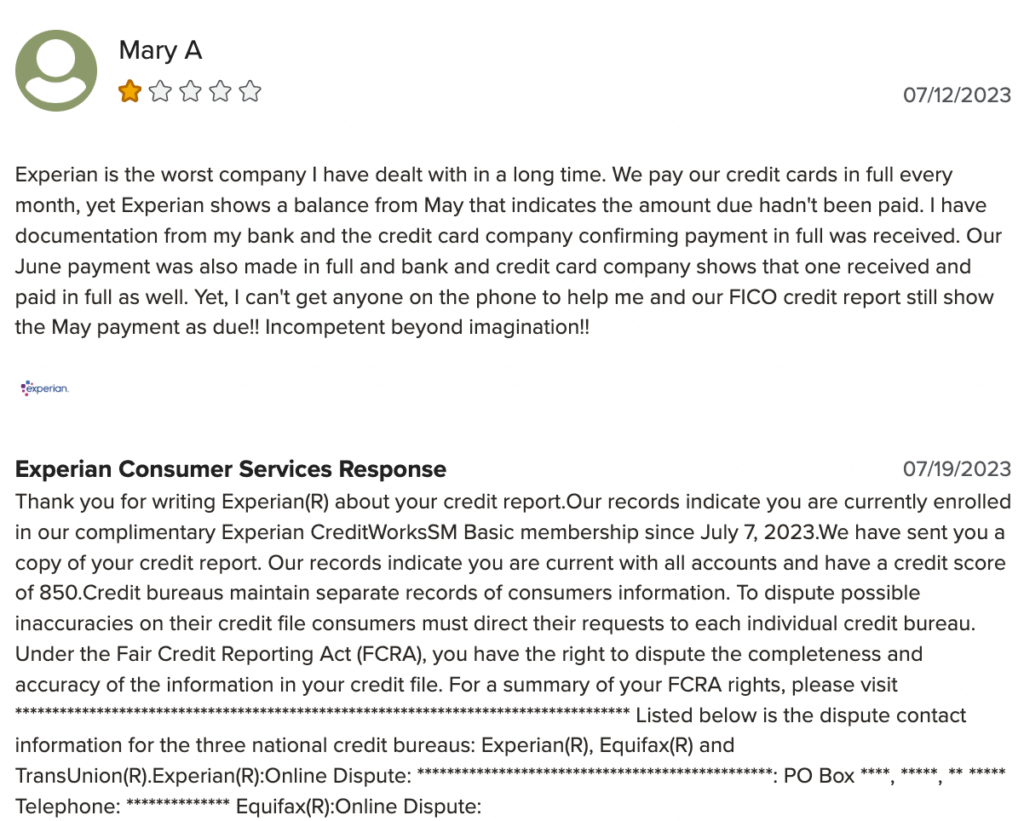

Recent reviews are mostly one star, with the most complaints centered around a lack of customer service and out-of-date credit reports:

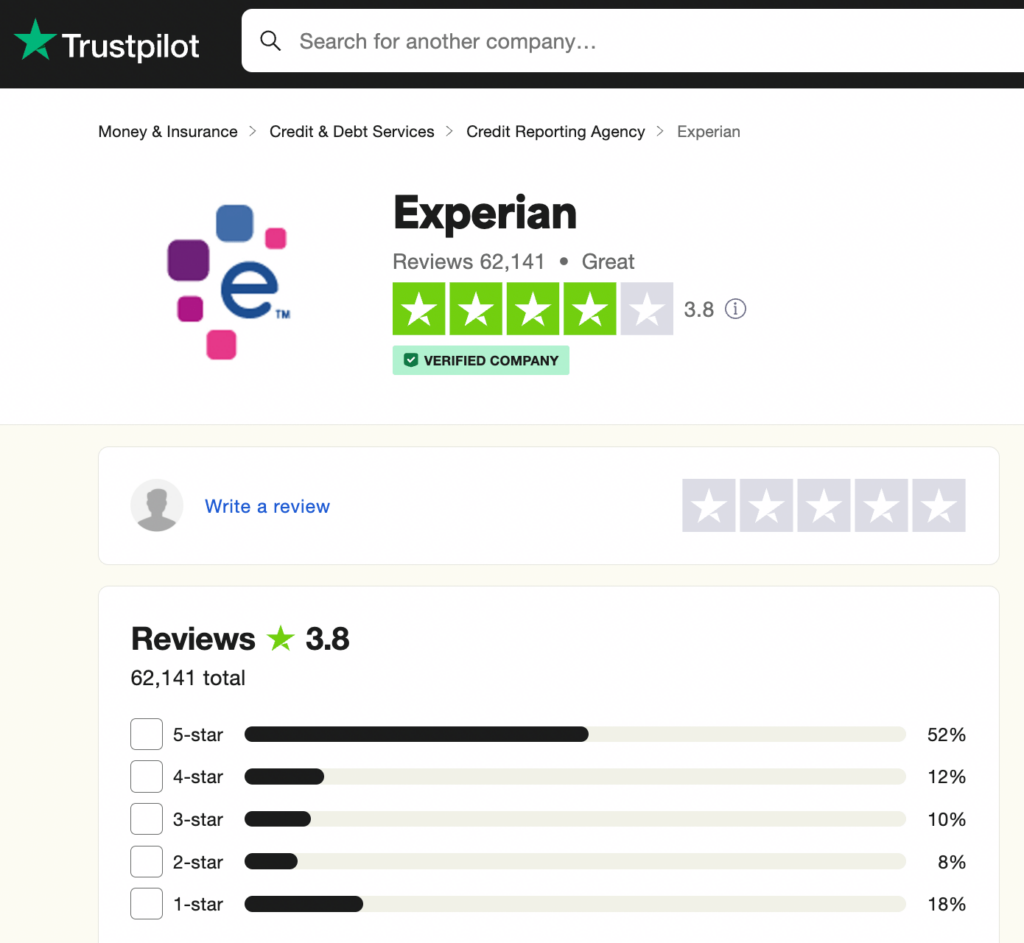

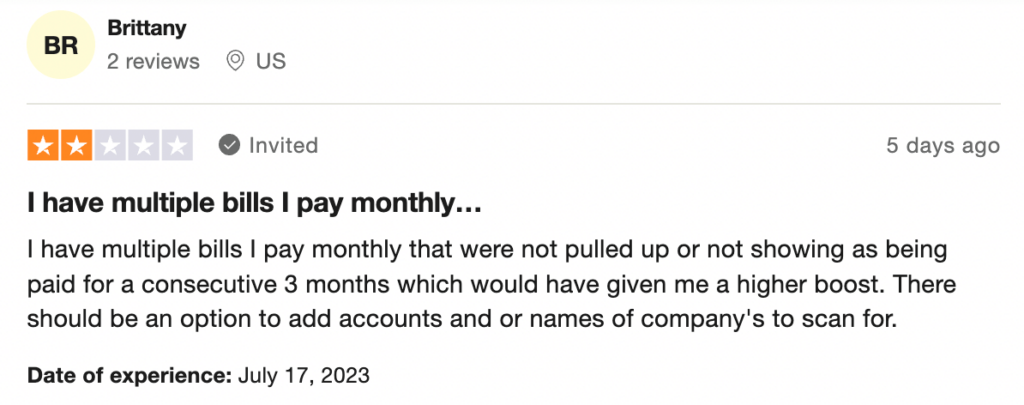

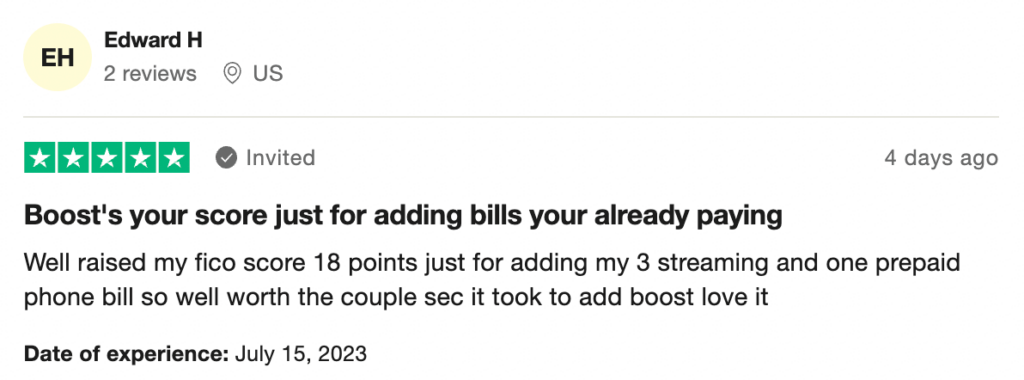

Experian Boost Trustpilot reviews

On Trustpilot, Experian has a 3.8 rating based on more than 62,000 reviews:

Most reviews are positive, with a rating of three or more stars. Many of the reviews reference Experian Boost:

Experian Boost reviews from Reddit

Lots of people come to Reddit asking for experiences using Experian Boost:

Most Redditors claim Experian is more likely to work/be worth it if you have a lower score. Many others accuse Experian of mining data from its users.

Pros and cons of Experian Boost

CFA Tom Koesternen says Experian Boost has some upsides and downsides:

Pros:

- Easy to use

- Quick way to bump up your Experian credit score

- Free product that includes positive utility payments that credit reports usually ignore

- Doesn’t factor in late payments

- Excellent for people who are new to credit and need to build a history

Cons:

- Only impacts Experian data, not Equifax or Transunion

- Only works if you have at least one credit line

- Must pay your bills electronically, not by check or cash

- Will not boost your score more than double-digits and may not boost it at all

- Only works with bank accounts and utility bills in your name

- Potential for score decrease or no improvement in score

- Not all lenders accept FICO® Score 8

- May not recognize or detect all of your utility bills

Other ways to build credit

Experian Boost is a quick fix for upping your credit score. It may be helpful if you are in a situation where you need extra points right away, but there is no substitute for building your credit by:

- Making payments on time

- Getting a secured credit card

- Becoming an authorized card user of a person with good credit

- Not opening new accounts quickly

- Not using all of the available balance on your credit cards

There are other tools that promise to quickly improve your credit score like eCredable Lift. Experian Boost is free, while eCredable Lift products start at $9.99 per month.

Experian Boost works instantly, while eCredable List raises your score the next day. However, eCredable Lift can raise your Fico Score 8 and VantageScore 3.0. Experian Boost only impacts FICO Score 8.

If you’re trying to decide whether to use Experian Boost or use other methods to build credit, consider this:

- Experian Boost can raise FICO Score 8, so it is helpful if you want to buy a car or get a credit card or unsecured loan, but not for securing a mortgage

- If you don’t have at least one credit line, it won’t help you

- It has the most impact when you have little to no credit or a very poor to fair credit scores

On average, Experian Boost can up your score by 13 points. If your credit score is fairly high, this may not increase your creditworthiness.

Experian Boost Reviews FAQ

Does Experian Boost hurt your credit score?

No. Experian Boost does not negatively impact your credit score or report. However, it likely won’t improve your score if you already have a credit history and make frequent credit card payments.

Do lenders recognize Experian Boost?

Not all lenders recognize Experian Boost. Experian Boost reports to FICO Score 8. Lenders who use this score model are mainly credit card issuers but also include auto finance companies and consumer loan businesses.

How often does Experian Boost update?

When you first use Experian Boost and connect your bank and credit card accounts, it will update your Experian credit scores immediately. After that, it will update your Experian score every 30 days.

Can I download an Experian Boost app?

While Experian doesn’t have a specific Boost app, you can run Experian Boost on the Experian app, available for iOS and Android devices.

What bills qualify for Experian Boost?

According to Experian, these are the bills that qualify for Experian Boost:

- Mobile and landline phone

- Internet

- Cable and satellite

- Gas and electricity

- Residential rent with online payments

- Video streaming services

- Water

- Power and solar

- Trash

You can choose which bills you’d like to include in your Experian Boost credit history

Bottom line: Is Experian Boost worth it?

While I personally experienced some glitches using Experian Boost, the app is worth trying simply because it doesn't take a lot of time and it's completely free.

Experian Boost can instantly boost your FICO® Score — though as I've mentioned, not everyone will qualify for a boost at all times.

Plus, Experian is a reputable company that has some very cool features, including immediate, free credit scores and reports.

While a small credit score increase will not change your life, it is a nice step toward bigger financial goals, like buying your first home, getting out of debt, or qualifying for better interest rates on your next car. The use of positive bill payment can help single moms improve their finances.

Get your free credit report and increase your FICO® Score immediately with Experian Boost >>

*Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost.

**Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more.

While Experian Boost can help raise your credit score fast, you also should explore fixes that will help you improve your score over time.

SOURCES

- “How does Experian Boost work?” September 19, 2022. Experian. https://www.experian.com/blogs/ask-experian/what-is-experian-boost

Yes, Experian Boost is a legitimate feature through Experian.

Experian Boost is 100% free.

According to Experian, 61% of Experian Boost users increased their FICO® Score, by an average of 13 points per user.

No. Experian Boost does not negatively impact your credit score or report.

Not all lenders recognize Experian Boost. Experian Boost reports to FICO Score 8. Lenders who use this score model are mainly credit card issuers but also include auto finance companies and consumer loan businesses.