Are you a mom thinking about starting your own business to bring in some extra income or replace your current job?

That’s great! Running your own business gives you the flexibility to set your own hours and choose the kind of work that you do—and don’t—want to do. This flexibility is a big part of why moms, including myself, are often so drawn to entrepreneurship to begin with.

What business can I do as a mother?

Whether you’re happily married, newly divorced, or just a single mom, if you’re interested in starting your own business, the good news is there are tons of options out there to choose from.

Below are many business ideas to consider, including a number of work-from-home ideas that can be done with little more than an internet connection:

- Business idea #1: Bookkeeping

- Business idea #2: Proofreading

- Business idea #3: Doula

- Business idea #4: Graphic design

- Business idea #5: Coding

- Business idea #6: Freelance writing

- Business idea #7: Project manager

- Business idea #8: Resale shop owner

- Business idea #9: Virtual Assistant

- Business idea #10: Blogging

- Business idea #11: YouTuber

- Business idea #12: Amazon pallet flipper

- Business idea #13: Dog groomer

Business idea #1: Bookkeeping

Earning potential: Average of $49,523 per year / $24 per hour*, though experienced bookkeepers with a mature client base can earn up to $72,500 per year or more.

What they do: At its simplest, bookkeeping involves keeping track of financial transactions for a business. The work can involve recording financial details, updating various financial statements, and reading over financial documents for accuracy.

If you like working with numbers and want the freedom to work from home, then freelance bookkeeping could be an excellent business idea for you.

*All salary averages in this article are based on the most recent data from Ziprecruiter.

How to become a freelance bookkeeper

All it takes to be a freelance bookkeeper is a computer, internet connection, bookkeeping software, and the skills to get the job done. With the right training, it’s possible to kick off your career in a matter of weeks.

Bookkeeper Launch — an online course launched by Ben Robinson, a certified public accountant, and our recommended bookkeeper training program — takes just 90 days to complete and teaches you everything you need to know about starting your own bookkeeping business, and earn into the six-figures.

Learn more about how to become a bookkeeper in this post. And how to start a bookkeeping business here.

Read our review for Bookkeeper Launch.

Business idea #2: Proofreading

Earning potential: Average of $46,466 per year / $22 per hour, while those with more experience can make $74,500 per year or more.

What they do: Proofreaders act as the final set of eyes to review a piece of content before it is published or otherwise pushed out into the world. Their job is to find and correct errors or inconsistencies in text.

Virtually any business that produces content can hire proofreaders. This includes:

- Book publishers

- Magazines

- Newspapers

- Websites

- Advertisers

- Television writers

- Grant writers

- Academics

- Business owners

- Speakers

Anywhere you see words out in the world, there’s a good chance that a proofreader was involved at some point in creating it.

Become a freelance proofreader

Proofreaders need to have an extremely strong handle on language, spelling, punctuation, and grammar. For that reason, many freelance proofreaders who are just starting out will complete some form of proofreading training to learn the tricks of the trade.

Business idea #3: Doula

Earning potential: Average of $50,685 per year / $24 per hour, though some with more experience and credentials can earn $68,500 per year or more.

What they do: Doulas play a critical role providing physical and emotional support to new parents before, during, and after childbirth.

A doula's role can vary significantly from professional to professional and also from client to client. These are some of the typical responsibilities a doula could have:

- Educating parents about childbirth

- Making parents more comfortable during labor

- Providing physical care during and after delivery

- Ensuring the mother has a positive birth experience

- After birth, ensuring that a mother is properly healing and adjusting to motherhood

- Educating the mother on issues of breastfeeding and childcare

Become a freelance doula

You can get doula training and earn a certification from organizations like:

- Doulas of North America International (DONA)

- Childbirth and Postpartum Professional Association (CAPPA)

- Childbirth International

- International Childbirth Education Association (ICEA)

Then you can begin to advertise your services so you can build a clientele base. Check with your certifying organization for programs to help you find clients and get established.

How to become a certified doula

Business idea #4: Graphic design

Earning potential: Average of $55,650 per year / $27 per hour, though experienced graphic designers can earn $90,500 per year or more.

What they do: Graphic designers perform a variety of tasks depending on what their clients need. This can include designing anything from logos and websites to business cards, books, magazines, newspapers, ads, images, product packaging, and literally everything in between.

Become a freelance graphic designer

Becoming a successful graphic designer requires more than just solid art skills. You must also have a solid grasp on design best practices, the specific computer programs used for design, and the business acumen required to handle, manage, and communicate with clients.

While some graphic designers learn these skills by completing a degree in graphic design, it has become increasingly common for graphic designers to be self-taught through online courses.

Coursera, for example, offers a number of great graphic design courses that can help you learn what you need to do the job well. Classes and certifications cost $59 per month with a Coursera Plus subscription.

Business idea #5: Coding

Earning potential: Average of $57,055 per year / $27 per hour, though experienced coders can earn $91,500 per year or more.

What they do: Coders perform the important task of designing, writing, and testing computer code for various applications, from web development to app development, software development, and everything in between.

Demand for coders is increasing as more businesses find themselves needing websites or apps to interact with their customers. And because all you need is a computer and know-how to do the job, it’s possible to do this job from anywhere, including your home.

Become a freelance coder

Many coders will enter the field after completing a college degree, but this isn’t always required. More important than holding a specific degree is being able to demonstrate your proficiency in the specific language needed by an employer or client.

Depending on the job, coders might need to know one or multiple programming languages. The most popular include Python, R, Javascript, C, C++, and PHP.

Before enrolling in a degree program, you might want to consider a self-paced, online course like those offered by Coursera, which are usually very affordable and high-quality.

How to become a coder (high paying and you can work from home)

Business idea #6: Freelance writing

Earning potential: Average of $60,985 per year / $29 per hour, though experienced writers can earn $156,000 per year or more.

What they do: Freelance writers create content for multiple projects, including:

- Websites

- Marketing or advertising efforts

- Books

- Blogs

- Podcasts

- Whitepapers

But this is just a short list of the options freelance writers can pursue. You can make money as a freelance writer either by contracting with clients (there are literally thousands of businesses that rely on freelance writers to create the content for their websites) or by launching and monetizing your own website and blog (more on that next). Many full-time blog owners earn in the six-figures, or even millions of dollars per year.

Become a freelance writer

All you need to launch your freelance writing business is a computer and access to the internet. Well, that, strong writing skills, and a little bit of business know-how.

Freelance writers monetizing their own websites will often start off making small amounts of money until their site truly starts taking off, but once it is rolling, the money can likewise be substantial.

Business idea #7: Project management

Earning potential: Average of $98,788 per year / $47 per hour, though experienced project managers can earn $157,500 per year or more.

What they do: When a business has a complex project to complete, they turn to project managers to get the job done. Project managers perform a variety of tasks designed to usher a project from planning all the way through to completion. This can include:

- Scheduling

- Budgeting

- Assigning tasks

- Managing personnel

- Removing roadblocks

- Communicating with project leaders and teams

Most project managers work as employees of large organizations, but it is possible to work as a freelance project manager as well, especially for smaller businesses.

Become a freelance project manager

Many project managers will earn a degree in project management, with master’s degrees being very common amongst more senior-level PMs.

That being said, for those who are first starting out, certificate programs can be a great way of testing the waters and seeing if the work is right for you. They can also be a great way of learning enough of the basics to get an entry-level project management job.

Google offers certificate programs that you might want to consider if you think project management could be for you.

Google's project management program:

- No experience or degree required

- Job ready in 6 months or less

- Flexible schedule with 100% of courses completed online

- Certificate upon completion

- Financial aid available for those who qualify

If you think of yourself as a natural problem-solver, consider going for Google's Project Management certificate. Free 7-day trial >>

Business idea #8: Resale shop owner

Earning potential: Average of $67,469 per year / $32 per hour, though some experienced resellers can earn $230,500 per year or more.

What they do: Resellers find and purchase items at a low price and sell them to make a profit.

When it first launched in 1995, eBay was a platform for people to make a few extra dollars on the side selling items they no longer wanted. But in recent years, online resale shops have become a gold mine for savvy sellers looking to launch lucrative businesses selling new and used goods.

Become a resale shop owner

The fastest way to get your feet wet in the world of online resale is to start by selling your own items online. Once you’ve become familiar with the process and see what people are buying, you can start sourcing items through thrifting or wholesaling.

Successful resale businesses understand which items to sell on which platforms and how to set prices to increase profitability. Different resale shops have different commission models.

Popular resale sites where you can make money

Here are some of the most popular sites for selling items:

Poshmark

Poshmark is like a social media site for resale. You can like and share listings to help them gain more traction, and people can follow your account to shop for new items you add. Poshmark began as a site strictly for clothing and accessories but has since expanded to include jewelry, children’s toys, art, and home goods.

For sales under $15, Poshmark takes a flat commission of $2.95. For items $15 and up, Poshmark has a 20% commision rate. Read our full Poshmark review here >>

Mercari

Mercari has a similar structure to Poshmark. Sellers can list items for free on Mercari — everything from clothing to electronics — and the site takes a 10% fee on each item when it sells. See our Mercari review here >>

thredUP

Unlike other resale sites, thredUP does not have individual seller profiles. Sellers submit their items to thredUP in free Clean Out Kits, then thredUP decides the value of the items and pays out commissions on a sliding scale of 5-80% (commission percentage increases with the value of the item).

thredUP only accepts about 50% of the items submitted and donates anything unusable, though sellers can choose to have their unsellable items returned for a $10.99 fee. Check out our review of thredUP here >>

eBay

It’s free to post items for sale on eBay — unless you start listing more than 250 items per month. High-quantity sellers pay a $0.35 insertion fee per listing. In either case, if your items sell, they’ll be subject to a fee between 12-15%, depending on the type of item, plus $0.30 per order.

Business idea #9: Virtual assistant

Earning potential: Average of $70,393 per year / $34 per hour, though some experienced virtual assistants can earn $171,000 per year or more.

What they do: Virtual assistants handle tasks like:

- Scheduling meetings

- Responding to emails

- Managing social media accounts

- Drafting presentations

- Supporting the day-to-day operations of a company or individual.

Become a virtual assistant

If you can type and have basic computer skills, you can start your own business as a virtual assistant.

As more companies shift to a remote model, more of these positions should become available. If you start your own business as a virtual assistant, you can pick up multiple clients and market any unique skills you have (like marketing, copywriting, or graphic design).

Learn how to become a virtual assistant and market yourself and get started on a lucrative new career.

Business idea #10: Blogging

Earning potential: Average of $73,199 per year / $35 per hour, though some experienced bloggers can earn $122,500 per year or more.

What they do: Bloggers create and manage a blog about a subject they are passionate about such as:

- Personal finance

- Health and lifestyle

- Fashion

- Celebrity news

- DIY and crafts

- Food

Blogging is a flexible career, and studies find that most moms prefer to have the flexibility to work at home at least part of the time. I get why! When you’re your own boss, own your time, decide how much money you can earn (opposed to a boss telling you what your salary is), you are in control. That is power. Control. Freedom. Joy.

Become a blogger

Starting a blog is easy.

First, find a URL, also called a blog address or domain name, and buy it. (My URL is Wealthysinglemommy.com).

In the past, I had good experience with the hosting service BlueHost that will help you buy your domain name quickly and cheaply (a few years ago when my site was getting really big and I needed high-end security and tech support, I upgraded to WPEngine as a host. WPEngine is amazing but costs about $3,000+ per year. Start small and cheap and upgrade as you grow).

Find partnerships either directly through the company sites, or through networks like:

To build a successful affiliate blog requires focusing on search engine optimization, or SEO. Spend some time with SEO expert Neil Patel‘s blog and videos to get the basics as well as deeper insight into this critical and frankly complicated and competitive industry.

Bloggers and social media influencer income ranges from $0 to millions of dollars. I recently attended a blogger conference where a few of my colleagues shared their experience in building sites that they all recently sold for between $6 million and $7 million.

What they shared is not highly technical, or complicated. It is what many of us can do, but they were diligent and ran their sites like businesses. It took them years — between six and 11 years, in these cases, but it is possible.

Business idea #11: YouTuber

Earning potential: Average of $65,999 per year / $32 per hour, though some experienced YouTubers can earn $81,100 per year or more.

What they do: Like a blogger, a YouTuber can take on many forms — from posting funny videos about your kids, to teaching your audience how to do a certain professional or creative skill, to social activism.

Become a YouTuber

It's free to set up a YouTube account. It's actually included if you already have a Google account. You have a Google account if you have a Gmail email address. Once you set up your account, you can create a YouTube channel.

YouTubing is very competitive, but those who stick it out long-term and invest time and money in their platform can earn six figures or more through advertising, affiliate revenue, selling a product or course of their own — or a combination.

Many YouTubers take the audio from their videos and turn those into podcast episodes, and repurpose their material on a blog and social media accounts like TikTok and Instagram.

Business idea #12: Flipping pallets on Amazon

Earning potential: Average of $67,469 per year / $32 per hour, though some experienced flippers can earn $230,500 per year or more.

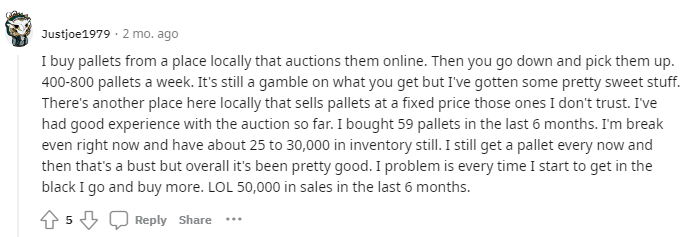

In six months, one Redditor made $50,000 in sales from buying 59 pallets:

What they do: Pallet flipping is a lucrative way to make money on Amazon returns. When buyers return an item to Amazon, many sellers don’t pay to have Amazon ship merchandise back to them. As a result, Amazon has a large stock of returned items they are willing to sell for a steep discount.

A pallet can be a large box of returned goods or an actual wooden pallet (platform with shrink-wrapped, stacked goods). These pallets can be filled with anything, from electronics to clothing and jewelry.

You can buy them from Amazon Liquidation Auctions through its partner, B-Stock, liquidators like BULQ, Liquidation.com, or local liquidators in your area. Then, resell the items through eBay, Facebook Marketplace, Mercari, and other selling platforms.

Other ways to find pallets:

- Facebook – Search Facebook for liquidator groups and become a member to find out when they offer pallet sales

- Seller/reseller forums – Forums on sites like Reddit, Warrior Forum, and eCommerceBytes can offer helpful information on where you can buy a pallet

- Online searches – Use your preferred search engine to look for “buy Amazon return pallets near me”

Can you make money flipping pallets on Amazon?

Yes, you can make money flipping pallets on Amazon. However, there is some risk involved. When you buy a pallet, you won't know what’s in it until you open it. For example, these resellers spent $500 at a liquidator and ended up with items that they could sell at over $1,400:

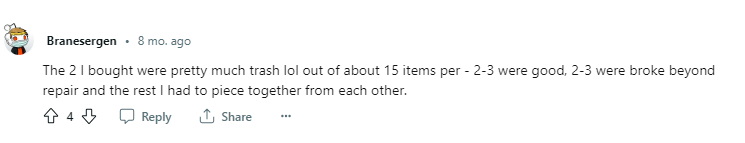

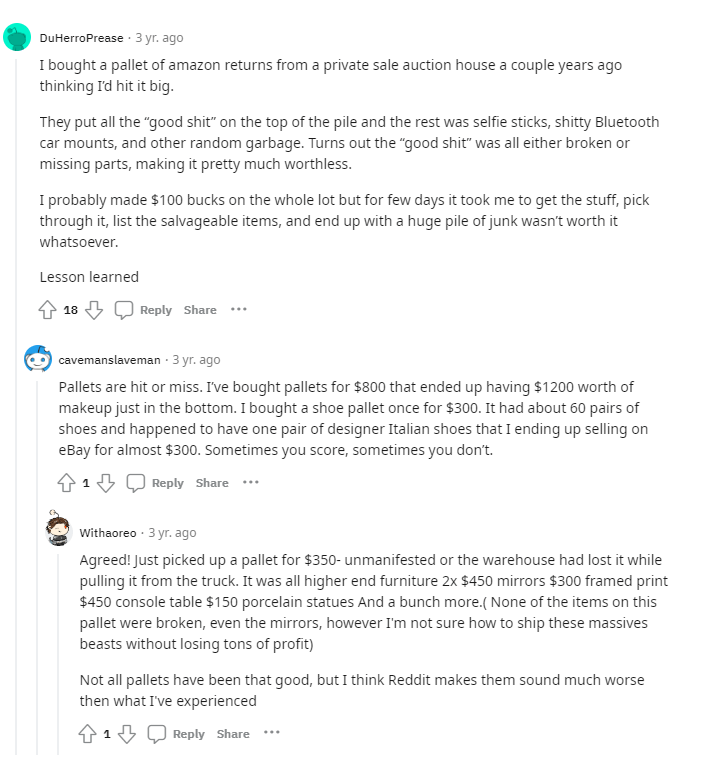

However it doesn't always work out. These Redditors share the not-so-good experiences:

If you’re buying direct from Amazon, they offer an estimated value on the pallet and accept bids from the public.

Here are some tips for making it a profitable business:

- Do your research, buy only from Amazon or a reputable liquidator

- Refurbish or fix your goods to make them look like new to get better profits

- If the original box is missing, buy a replacement or use a box branded to your business

- Factor in any selling and shipping fees to price your goods competitively

- Join a reseller support group or connect on seller forums to ask questions

- Bundle similar products

- Have a designated area where you can store, refurbish, and ship the merchandise

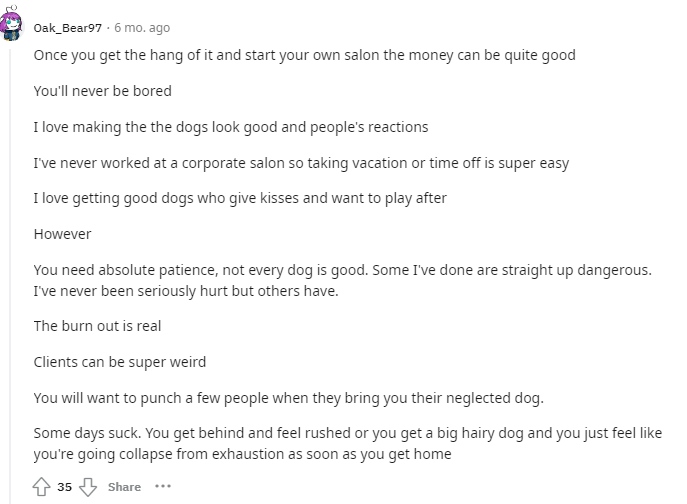

Business idea #13: Dog groomer

Earning potential: Average of $47,659 per year / $23 per hour, though some experienced groomers can earn $72,000 per year or more

What they do: Dog groomers bathe, brush, and trim nails and fur to maintain a dog's appearance. They may also provide special services such as creative grooming, which involves dying fur or painting nails with animal-safe products.

There is a great demand for dog groomers, and many who are in the profession express a great love for dogs and a high level of satisfaction about the work. However, dog grooming can be physically demanding, and you need a lot of patience to deal with different temperaments of dogs (and their humans)!

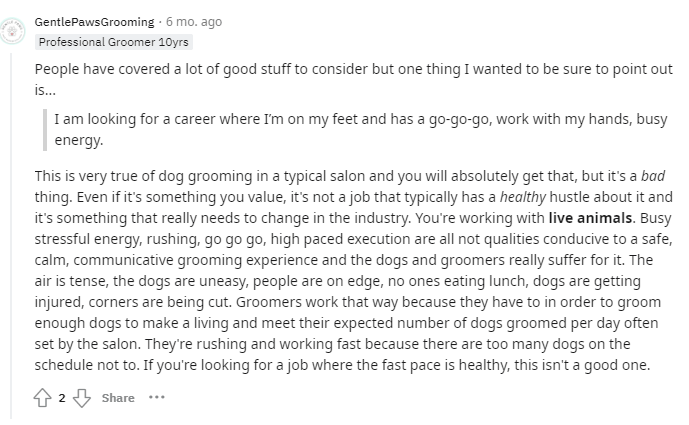

These Reddit users share their experiences, both good and bad:

Your level of experience will make a difference in your earnings. This is a career where your salary can grow from year to year as you build your skills, services and client list. Once you have the basic skills under your belt, you can think about how you want to continue:

- Home-based: You will perform dog grooming services at your home

- Mobile: You will travel to clients to perform dog grooming services

- Storefront: You will groom dogs in a corporate setting (you can open your own shop)

Become a dog groomer

To become a dog groomer, you need to take classes to learn grooming skills and practice those skills in real life.

You can:

- Take classes online or in a classroom setting from dog grooming schools like the Paragon School of Pet Grooming or Nash Academy of Animal Arts

- Start as a bather working for a business, and learn skills on the job

- Volunteer for a business that shows and breeds dogs to learn the basics

While there is no required license for the profession, having formal training and certifications will increase your credibility and earning potential. It's also good idea to attend dog grooming conferences to learn about the industry and stay on top of tools, techniques and trends.

11 local and online jobs that don’t require a background check

Bottom line: What is the best business for a woman to start?

There truly is no one-size-fits-all approach to deciding which business to start. Choosing the right business for yourself is all about figuring out what you love to do and how you can make money doing it.

There are three key questions to ask yourself when you’re thinking about starting a business:

- Am I passionate about it?

- Do I have the skills or knowledge to run it?

- Can I make money doing it?

If you answered yes to all three, you’ve found your match. But whatever business you decide to start, you can’t run it successfully without a top-notch website. A website is the primary way you can communicate the value of your business and build trust with the people who will become your customers.

Looking for more ways to earn extra income? Here are 86 side hustles.

7 recession-proof businesses to start now to earn more money

Whether you’re happily married, newly divorced, or just a single mom, if you’re interested in starting your own business, the good news is there are tons of options out there to choose from, many you can do with little more than an internet connection.

One of the great things about being a working mom today is the fact that so many jobs can be done from the comfort of your own home. This gives you the freedom to stay on top of mom-life while still making money.

There are four steps to get started: 1. Decide what kind of work you want to do. 2. Forming an LLC. 3. Buy a domain name and launch a website. 4. Start building a client base.